Merger of banks

passes by 80%

Handling employees becomes the

next task for the isle institutions

|

Central Pacific, which promised no layoffs when it sweetened its offer for City Bank parent CB Bancshares Inc., plans to unveil voluntary separation packages tomorrow for employees of each bank who work in areas that need to be streamlined, according to people familiar with the situation.

That next step in this 18-month-old merger process became possible yesterday when 80.4 percent of the shares of City Bank's parent voted in favor of the merger and 81.3 percent of Central Pacific's shareholders did likewise. A vote of 75 percent of the outstanding shares was necessary for approval.

The merger of the two holding companies becomes official tomorrow, with the stocks of the banks to trade as one entity beginning Thursday. The banks will merge in the first quarter.

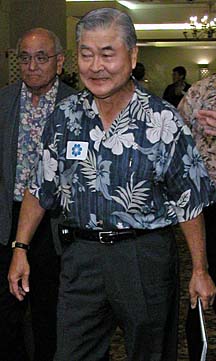

"This (merger) effort is not about building a big bank," said Clint Arnoldus, chairman, president and chief executive of Central Pacific. "This effort is simply about building a stronger platform to be able to take the great personalized service and community banking approach that each bank has had since their founding and be more effective in this state for our customers, for our shareholders and for our employees."

Arnoldus, who will retain only the CEO title for the new bank, is promising a seamless transition for customers. He said City Bank customers can continue to use their existing checks and will retain their account numbers.

For the roughly 1,000 combined employees, however, the integration promises not to be as easy, with some workers facing some tough decisions.

Central Pacific is not guaranteeing that reassigned employees will remain at the same classification or pay level, according to people familiar with the situation. The bank is giving eligible employees until Nov. 1 to decide whether they want to participate in the voluntary separation program, those people said.

Employees who opt for the separation package will get 26 weeks of their base salary and an additional benefit determined by years of service. Employees who have worked for either bank for four or fewer years also will get one week's pay multiplied by their years of service. Those with five to nine years will receive 1 1/2 weeks' pay per year of service. Employees with 10 to 19 years will get two weeks' pay per year of service, and those with 20 or more years will receive 2 1/2 weeks' pay per year of service. The maximum severance that an employee can receive is double that employee's annual compensation.

Employees participating in the program also will receive continued medical and dental coverage, ranging from nine to 18 months depending on years of service. Beneficiaries, such as spouses and children, will not be eligible for benefits.

In addition, participants in the program will receive $500 worth of job outplacement services.

Arnoldus declined after yesterday's shareholders meeting to acknowledge that such a plan was in place.

"If we should adopt such a program, certainly those results will become available later sometime after (tomorrow)," Arnoldus said. "We're looking at different options."

He also declined to reveal his target projections for the eventual number of employees who would remain with the combined bank, and would not elaborate if estimates that 10 bank branches will close still held true.

"We're working on our branch strategy as we speak, and we expect that sometime after the 15th of this month, we'll be able to come public with our plan," he said.

CB Bancshares President and CEO Ronald Migita, who will be chairman of the new bank, without executive powers, said the makeup of the new board of directors will be announced later this week.

Shareholders were quiet at their respective meetings yesterday at Dole Cannery, with no one asking a question at the Central Pacific gathering and only one shareholder asking a question -- about tax consequences -- at the CB Bancshares meeting.

Outside the meeting, shareholders were more forthcoming.

City Bank shareholder Marion Hufen said she was not in favor of the deal.

"I don't approve of it because if it's going to work for everybody concerned, it should be something everybody agreed to," she said. "There's been too much friction along the way."

Another shareholder, who owns stock in both banks, said he also was opposed to the deal. "They paid too much," said the shareholder, who declined to give his name.

City Bank shareholders will receive Central Pacific stock and cash worth between $95 and $96 for each of their shares. The final price will be determined after the close of trading today.

Central Pacific shareholder Benjamin Wong and his wife, Charlotte, both said they liked the idea of a larger bank.

"It will be much bigger and stronger," Benjamin said.

"And you won't have to worry about them going bankrupt if they're stronger," Charlotte added.

Another Central Pacific shareholder, Miles Suzuki, said he liked the blend of the two banks.

"The banks seem compatible," he said. "Central Pacific Bank seems like more of a commercial bank, and City Bank seems more local. Central Pacific also has an international relationship (after previously being aligned with Sumitomo Bank of Japan). I think it will be a good fit."