Housing and fuel costs

drive Hawaii inflation

Isle consumer prices rise

faster than the national average

with no slowdown in sight

Rising housing and fuel costs are eating into the incomes of Honolulu residents, according to data released yesterday by the U.S. Labor Department.

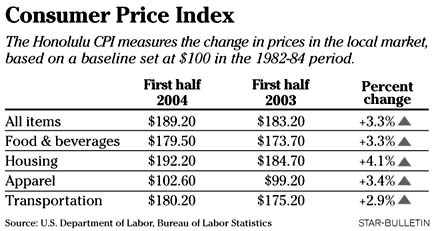

Led by surges in the costs of homes and gasoline, the consumer price average for the first six months of the year jumped 3.3 percent over the same period in 2003. The rise outpaced the overall national increase by about 1 percentage point.

Honolulu prices for the first half of 2004 grew 1.9 percent over the second half of 2003.

|

While the inflation increase is substantial and is likely to continue for several more years, some consumers are likely to feel the impact more than others, said Paul Brewbaker, Bank of Hawaii senior vice president and economist.

The average person is going to find housing, rent, energy and transportation costs more expensive. Union employees locked into pay increases based on a 1 percent inflationary rate will find that their pay won't stretch as far, he said.

However, because of Honolulu's tight job market, workers with specialized skills may see higher incomes.

"People with a skill set in high demand are likely to stay ahead of inflation," Brewbaker said. "For others, especially for those without strongly marketable skills, inflation is likely to eat away at their earnings."

From 1994 to June 2003, Honolulu's inflation rate hovered around 1 percent a year, he said.

While fuel costs are likely to stabilize at some point, inflation is not likely to dissipate as long as Honolulu's housing costs remain high, Brewbaker said.

The U.S. Labor Department releases consumer price information twice a year for Honolulu. The data are not seasonally adjusted.

Housing prices averaged over the first half of 2004 increased 4.1 percent from the same period last year, the biggest annual jump since the department began publishing the statistics 11 years ago.

Honolulu's housing index -- which includes changes in rent, utilities and other factors -- has been rising since the beginning of 2001. The index had been falling from 1997 through 1999.

Home prices in Honolulu are selling at near-record highs, with the median single-family home going for $480,000 last month, 23 percent higher than a year earlier. Condominiums are selling at similar markups, with the median price hitting $217,000 in July.

Average gasoline prices for the first half of the year jumped 10 percent over the first half of 2003, the department said.

Total transportation costs grew 2.9 percent.

Honolulu gasoline prices have topped the nation lately. A gallon of regular unleaded sold for an average of $2.249 yesterday, according to AAA, up from under $2 a year ago.

The price of clothing also showed a dramatic increase, up 3.4 percent over a year earlier and 4.9 percent from the second half of 2003.

The higher inflation rate hurts, but isn't a death blow, Brewbaker said.

"In the early 1980s, when inflation was in the 9 to 10 percent range, it was fatal for the economy," Brewbaker said.

www.dol.gov/