|

For love or money?

Corporate directors say

they don't serve for the pay

-- but it sure doesn't hurt

It's not about the money.

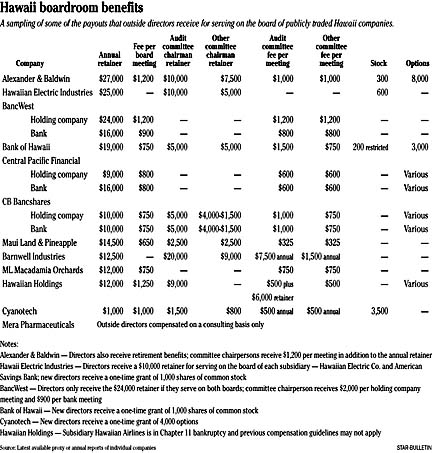

Despite annual compensation that in some cases can approach $75,000, nonexecutive directors at Hawaii's publicly traded companies say pay is far down their list of reasons for serving on a board.

|

Or, take the $25,000 annual retainer by Hawaiian Electric Industries Inc., which pays additional retainers of $10,000 each for sitting on the boards of subsidiaries Hawaiian Electric Co. and American Savings Bank, as well as 600 shares of common stock.

BancWest Corp., parent of First Hawaiian Bank, also is among the better financial providers with a $24,000 annual retainer and an attendance fee of $1,200 per meeting.

Two companies even pay hundreds of dollars for attending by telephone.

"I think the current responsibility directors take on when they sit on the board of a public company (wouldn't be attractive to anyone) unless there was some remuneration because the risk and responsibilities have become so great," said attorney Jeffrey Watanabe, whose combined annual compensation exceeds $100,000 for serving on the boards of A&B and Hawaiian Electric Industries.

Watanabe, a partner in the law firm of Watanabe Ing Kawashima & Komeiji LLP, sits on more than a dozen for-profit and nonprofit boards. He said the time he spends serving on public company boards ranges from 15 to 30 hours a month for meetings, reviewing materials and occasionally attending a two-day retreat. Those meetings can last as long as a half day to two full days with directors required to attend, in some cases, more than 20 general or committee meetings a year.

"Most of the people who sit on for-profit public boards are there because they've exhibited some kind of community leadership," said Watanabe, who also is an investor and board member of Star-Bulletin parent Oahu Publications Inc.

"But, almost by definition, the larger majority of them also sit on nonprofit boards, which are by and large no compensation. The two kind of go hand in hand. I don't know of any for-profit board members who do not provide a public service on nonprofit boards in their respective communities."

Watanabe said he wouldn't serve on the board of a for-profit company if he wasn't paid because of the responsibility involved. He said the landscape for directors has changed dramatically during the past few years because of the Sarbanes-Oxley corporate accountability law that was passed in response to the Enron and WorldCom scandals.

"In a way, it's now more difficult to get very qualified people to sit on a public company board because of new requirements and the imposition of responsibility," Watanabe said.

But Watanabe added that it's an honor to be asked because many of the companies, such as A&B subsidiary Matson Navigation Co. and electricity provider Hawaiian Electric, provide essential services to Hawaii.

"Having these companies well run and servicing the public well is a way of contributing to the community in which we live," Watanabe said.

At A&B, independent board members receive $64,000 to $75,000 a year in cash and stock, depending upon whether they chair a committee and how many meetings they attend. In addition, directors receive 8,000 stock options annually. Those options could end up being worth a lot or nothing depending upon how the company's stock performs.

A&B also provides its directors with life insurance; medical and dental benefits; reimbursement for estimated tax liability from A&B's insurance and health payments; a lump-sum payment upon retirement or at age 65; and post-retirement health care insurance.

|

Bank of Hawaii Corp. also isn't shy about rewarding its board members.

Each Bank of Hawaii director receives a $16,000 retainer and a quarterly payment of $750, plus $750 for each board meeting attended. n addition, nonexecutive directors who are members of the compensation committee or the executive committee receive $750 for each meeting attended while audit committee members get $1,500 a meeting.

Thus, an individual who attended all nine board meetings and participated at the audit committee's eight meetings over the past year would have earned $37,750, plus 200 shares of restricted stock and an option for 3,000 common shares.

But David Heenan, a trustee with the James Campbell Estate, said belonging to the boards at Bank of Hawaii, Maui Land & Pineapple Co. and privately held Aloha Airlines has nothing to do with the money.

"I think being on an outside board gives you a much broader perspective beyond the job or industry that you're primarily focusing on," Heenan said. "With a bank, for example, you get to see a broad section of business sectors across the entire spectrum in Hawaii and beyond, and get a better sense of what the national, regional and global economies are doing."

Not that Heenan doesn't benefit financially. He receives about $100,000 combined for serving on the boards and committees of Bank of Hawaii and Maui Land & Pineapple.

"I think in today's world, the financial benefits are either insignificant or modest for most people on boards," he said. "It may have been an attraction 10 years ago, and probably to some folks probably still is, but I think that the financial incentives are relatively insignificant today. It's a rare person I know that joins the board to enhance their income."

Shirley Daniel, who was elected to the Hawaiian Electric Industries board in 2002, said she looks at her role on the board as a two-way street.

"As an academic, I probably had somewhat different motivations than some people," said Daniel, a accounting professor at University of Hawaii.

"I hope it's a two-way street where my expertise as a professor can be something good for the company and, by same token, being involved in the corporate governance issues in a real firm in the private sector makes me a better professor," she said.

Christine Camp Friedman, a new director at Central Pacific Financial Corp., said the opportunity to be on the board was too good to pass up because of her background as a small-business advocate.

"Directors' fees were not a significant factor in my decision to accept CPB's invitation to serve on its board of directors, and I suspect the same goes for others who serve on public company boards in Hawaii," said Friedman, managing director of Avalon Development Co. LLC. "I viewed CPB's invitation as an honor and an opportunity. To help oversee the growth and operation of an excellent and dynamic organization was an opportunity I could not turn down."

Friedman will get an annual retainer of $25,000 for serving on the boards of both the holding company and Central Pacific Bank, as well as $600 for each committee meeting she attends.

Watanabe, the attorney, said public companies are increasingly placing more emphasis on stock compensation for independent directors rather than higher meeting fees.

"The more you can align the interests of the shareholders and the boards, the better off you are," Watanabe said. "I think in times when you have a lot of corporate scandals, the general public can view board membership very negatively."

Rick Humphreys, a former Hawaiian Airlines board member, also serves as the volunteer chairman of the investment committee for the state of Hawaii Employees' Retirement System. He said most people on boards have successful backgrounds as teachers, businessmen, doctors or lawyers and that compensation usually won't be a driving force.

"You want someone active in the community to be on your board," said Humphreys, the head of Hawaii Receivables Management, a financial services business. "The older members have the most wisdom and experience. But you also need fresh ideas and a new look at things that can enhance your business. So you do need to have turnover on the board."

Charles King, president of the King auto dealerships, said that as a small-businessman he's honored to be on the A&B board.

King, whose great-grandfather was H.P. Baldwin of A&B, said financial compensation is a piece of the equation for being on a board but it's "way down the list."

"It's hard to say (that being on the board) has helped me in the dealership business," King said.

"One of the things it does, being on Kauai, is it kind of connects me with the rest of the islands and, of course, the mainland. It broadens my horizons."

|