A&B beats estimates,

profit soars nearly 30%

Alexander & Baldwin Inc. raced past earnings estimates in the second quarter as a flurry of property sales and a strong performance by shipper Matson Navigation Co. boosted net income nearly 30 percent.

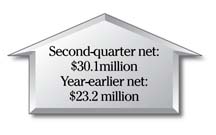

The company beat the consensus forecast of two analysts by 14 cents as it posted net income of $30.1 million, or 70 cents a share, compared with $23.2 million, or 56 cents a share, a year ago.

Earnings were given an extra boost because most of the property sales that A&B expected to close throughout the year closed during the first half. But Matson also was a major contributor as it chalked up volume increases, higher cargo yields and kept costs flat to achieve what the company said was a record profit margin for any recent second quarter.

Total revenues jumped 20 percent to $377.1 million from $314.2 million.

"They were absolutely outstanding numbers outside of the estimates," said analyst Nicholas Aberle, who covers the company for San Diego-based Caris & Co. and has a "buy" rating on the stock. "I think the most encouraging thing aside from the property sales segment of the business doing very well was that Matson showed a tremendous increase in profitability, hence accelerating the bottom line."

Allen Doane, president and chief executive of A&B, said the performance by Matson and the property sales unit in the second quarter continues the pattern that began in the first three months of the year. He singled out real estate sales from recently acquired properties, such as development parcels and house lots at the Wailea resort on Maui and from office condominiums in Honolulu, as well as lots in A&B's industrial parks.

Doane said, though, that for the remainder of the year Matson's rate of improvement will "moderate somewhat" because of cost increases.

"Overall, however, the outlook remains very good for A&B to report increased earnings this year," Doane said.

Matson, which will take delivery in the fall on its newest container ship, the MV Maunawili, saw its operating profit climb 35 percent to $31.4 million from $23.2 million while revenue rose 4 percent to $208.1 million from $199.3 million. During the quarter, Matson initiated a new roll-on/roll-off service from the Big Island to the West Coast that is expected to benefit cattle and nursery businesses by reducing transit times.

Increased customer volume boosted A&B's transportation logistics services as revenue jumped 63 percent to $93.5 million from $57.4 million and operating profit rose 86 percent to $2.6 million from $1.4 million.

The property sales unit was a star performer in the quarter as operating profit nearly doubled to $13.4 million from $6.9 million and revenue rose 7 percent to $28.3 million from $26.4 million.

"I think that the first two quarters of this year have really been magnified by a plethora of property sales lumped into the first half and I wouldn't expect to see those aggressive numbers thrown up in the second half of the year for property sales," Aberle said.

Sales during the second quarter included 13 Maui and Oahu commercial properties for $8.9 million, three residential development parcels for $13.8 million, one floor of an office condominium for $1 million, and five residential properties for $4.3 million.

A&B's property leasing revenue fell 1 percent to $20.4 million from $20.6 million and operating profit dropped 3 percent to $9.2 million as occupancy on the mainland fell 2 percentage points to 94 percent. Occupancy in Hawaii remained at 90 percent.

An expected poor sugar harvest and continuing low raw sugar prices hurt A&B's food products division as revenue fell 18 percent to $28.9 million from $35.1 million and operating profit slumped 87 percent to $300,000 from $2.3 million. "The rest of the year will be difficult for this segment," Doane said.

— ADVERTISEMENTS —

— ADVERTISEMENTS —