State to keep

extra $100MA larger-than-expected Hawaii

tax collection does not change

Lingle's tight budget plans

A booming local economy and a vigilant tax collector combined to pump $100 million more than expected into the state treasury in fiscal 2004 but did not thaw out Gov. Linda Lingle's budget freeze.

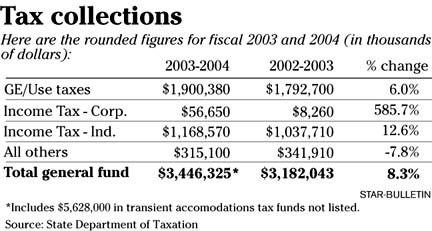

State revenues figures released yesterday show that the state collected 8.3 percent more in the fiscal year that ended June 30 compared with the year before. The state Council on Revenues had predicted an increase of 5.2 percent.

The extra $100 million brought the year-end increase tax take to $264 million.

Lingle's tight grip on the budget includes restrictions on new programs and new hires. The freeze also puts holds on state grants-in-aid and private programs, including cuts to the State Foundation on Culture and the Arts.

"It looks like we have a real good revenue picture," Lingle said yesterday.

"It has come in $100 million more than the council projected. That is real good, because we are projecting a $160 million deficit over the next two years," Lingle warned.

Legislative leaders, who are watching Lingle restrict money they had put in the budget for private programs, said she is going overboard with her conservative economic position.

"We had made sure we allocated enough money and had enough to balance at the end of each year," Senate President Robert Bunda said as he disputed Lingle's warning of an impending deficit.

Lingle argues that the state faces unanticipated increases in expenses because of increased debt service payments and larger-than-expected public employee retirement and medical expenses.

"She contends we have a deficit. We say it (budget expenditures) is already in our calculations," said Bunda (D, Wahiawa-Pupukea).

Sen. Brian Taniguchi, Ways and Means Committee chairman, who wrote much of the state budget, said the new economic figures should persuade Lingle to release money already appropriated."This is positive news, and it is more than we expected," Taniguchi (D, Moiliili-Manoa) said. "It speaks to the fact that she should release the funds."

The state figures show that revenues from all major tax sources increased during the last fiscal year.

General excise tax went up 6 percent for the year. Because the GET is the tax collected on all goods and services in Hawaii, it is the best indicator of the state's ability to increase revenues. Also, individual income tax collections increased 12.6 percent for the year.

Also, business tax collections were up $48.4 million.

Lingle said the state has been able to collect more taxes than in previous years because of a more aggressive Tax Department.

Lingle said the state usually has about $300 million in unpaid taxes every year and previously has been able to collect only $113 million, but the Tax Department collected $150 million in delinquent taxes last year.

She added that several tax deductions used to spur the economy after the Sept. 11, 2001, terrorist attacks have ended, including the home remodeling tax deduction.

"Also, there was the tightening of the Act 221 high-tech tax credit," Lingle said.

"All in all, it means the Tax Department is doing a great job, the economy is in recovery and we got the changes we needed to the tax code. It is not a time to go out and start spending new money," Lingle said.

State Tax Department

www.hawaii.gov/tax/tax.html