Isle bankruptcies

drop 20% to lowest

rate since ’96Growing employment and real

estate sales fuel a robust economy

State bankruptcies fell nearly 20 percent in the second quarter to their lowest level in nearly eight years as 3 percent unemployment in May and continued strength across all economic sectors shrank the number of filings by Hawaii businesses and individuals.

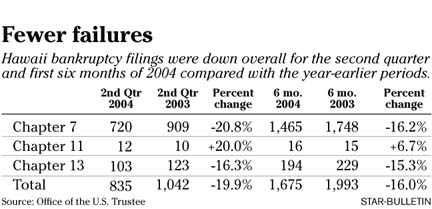

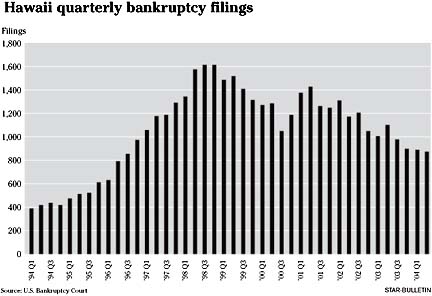

On a day in which the Federal Reserve raised interest rates for the first time in four years, preliminary bankruptcy numbers released by the U.S. Bankruptcy Court in Hawaii showed that chapters 7, 11 and 13 filings decreased for the 10th straight quarter over the year-earlier period. There were 835 total bankruptcy filings in the second quarter compared with 1,042 a year ago. The total represented the fewest filings since 810 were made in the third quarter of 1996.

For the first half of the year, total filings were down 16 percent to 1,675 from 1,993 at the same time in 2003. The numbers were as of yesterday's 4 p.m. Bankruptcy Court close, and could change slightly since filings for the quarter could be made electronically up until midnight."We're close to (the economy) being as good as it gets, if we're not there already," said Paul Brewbaker, chief economist for the Bank of Hawaii. "I have no doubt about that."

Hawaii bankruptcy filings, which hit an all-time high of 5,813 in 1998, have decreased in the last two years after spiking to 5,033 in 2001 following the Sept. 11 terrorist attacks. The filings have come down each quarter on a year-over-year basis beginning with the first quarter of 2002, and totaled 4,479 for that year and 3,791 in 2003. At the current pace, bankruptcy filings will drop again this year and end up around 3,350.

"The bankruptcy numbers are perfectly in line with everything we've seen: continued job growth, the lowest unemployment rate in the country, the prospect of record tourism numbers and summer record home sales," Brewbaker said. "There's been a general pattern of strength across the entire Hawaii economy -- across industries as well as across all the islands. I believe there will be more of the same."

The wealth effect from the rising real estate market has made people less likely to file for bankruptcy, said Jerrold Guben, a bankruptcy attorney for Reinwald O'Connor & Playdon."It may be that people at this point are not overextending themselves," Guben said. "When there were a lot of bankruptcies, the real estate market was softer, and the mortgage lenders were undersecured. If (the lenders) felt threatened, they would immediately file for a judicial foreclosure, and one response of the homeowner was to file for Chapter 13 to save their home.

"But today, with the appreciated market, people are making their payments and there are fewer judicial foreclosures. There is practically nothing. It's a change in the economy, and it's better for everybody -- lenders and borrowers."

Brewbaker said he does not see yesterday's quarter-point rise in the federal funds rate to 1.25 percent as slowing down Hawaii's economy.

"It's important not to interpret this widely expected policy shift as painting the seeds of destruction in the current economic expansion in Hawaii," Brewbaker said. "The Fed has gone out of its way to argue the same point in their statement that even after this action, the stance of monetary policy remains accommodative. They added a statement to reassure the financial markets that they would respond as needed to maintain price stability, but their other language clearly indicates that they do not believe recent inflation data are of extraordinary concern."

Brewbaker said home prices are closer to reaching a peak on the neighbor islands than on Oahu. He also said the prospects for continued job growth, income growth and home price gains remain strong.

Just like every cycle, though, Brewbaker said the day will come when the bankruptcy filings reverse their downward trend and start rising again.

"It comes around later and gets you, so that's an important concern to have in mind for the future," he said. "But it's probably several years in the future. A lot of what you observe in the declining bankruptcy numbers have to do with the turnaround in Hawaii's economy several years ago. My guess is that there's still some downward movement to go (in bankruptcy filings), but at some point it will reach an equilibrium consistent with the strong economy. We could be approaching that."

— ADVERTISEMENTS —

— ADVERTISEMENTS —