Big corporate changes are expected for Verizon Hawaii, with its $1.65 billion purchase by the Carlyle Group.

Isle ties vital to

Verizon buyerLocal investors join a D.C.-based

firm in the $1.65 billion phone

company deal

The private-equity Carlyle Group, which announced yesterday it was buying Verizon Hawaii for $1.65 billion, said it wants to return the telephone company to its local roots.

And to prove its commitment, the Washington, D.C.-based company has brought in BancWest Chairman and Chief Executive Walter Dods to lead a group of local investors.

"A big part of our plan is to return Verizon Hawaii to its roots as a local phone company, empowering local management," said William Kennard, Carlyle's managing director and a former Federal Communications Commission chairman. "It's sort of a version of 'Back to the Future,' if you will."

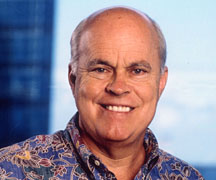

WALTER DODS

Walter Dods is one of the local investors joining the Carlyle Group's purchase of Verizon Hawaii.

Hawaii Power BrokerTitle: Chairman and chief executive of First Hawaiian Bank and parent BancWest Corp.

Milestone: Retiring as CEO this year after 36 years with the bank

Trustee: Estate of Samuel Mills Damon

Business directorships: BancWest, First Hawaiian Bank, Bank of the West, Alexander & Baldwin, Matson Navigation Co., First Insurance Company of Hawaii Ltd.

Age: 62

Dods, who will be retiring as chairman and CEO of First Hawaiian Bank and parent BancWest at the end of this year, stressed that his investment is personal and has nothing to do with the bank.

"I'm a strong believer in community involvement, and I've talked to the Carlyle Group (and Kennard) and he strongly agrees with the idea of bringing local community involvement back to Hawaii," Dods said. "I've signed up a group of local investors to be part of the transaction."

Dods declined to divulge any of their names.

But Kennard said the group of local business people Dods assembled represents a cross section of business, banking, various retail operations, real estate and hospitality.

"The notion here is that we're just not paying lip service to the desire to reconnect to the local community," Kennard said. "We want local business leaders investing alongside of us."

The Carlyle Group, which has more than $19 billion under management, already has a presence in Hawaii through Horizon Lines LLC, which it purchased from CSX Corp. for $300 million last year. Horizon is the second-biggest ocean shipping operator in the state behind Matson Navigation Co.

"We think that this is a great market, and we're excited about the prospect of investing more money here," Kennard said.

Kennard wouldn't break down the cash and debt structure of the deal with parent company Verizon Communications Inc., but a source familiar with the situation said that each local investor is putting in at least $1 million.

Kennard said the Carlyle Group is still evaluating the current management team and isn't ready yet to make any decisions. Verizon Hawaii is headed by Melvin Horikami, who took over as president for the retired Warren Haruki in September. Kennard wouldn't say whether Haruki was involved with the Carlyle purchase, but other sources said Haruki will play a role.

Kennard said all of Verizon Hawaii's employees will retain their jobs, and there eventually will be an increase in the work force as Carlyle brings back to Hawaii jobs that had been handled on the mainland by Verizon's parent.

Kennard said the former GTE Hawaiian Tel, which was renamed Verizon Hawaii in 2000 when GTE Corp. merged with Bell Atlantic, also will get a new name.

"We don't have a name we can disclose right now, but I can assure you it will be a name that conveys the local character of the company," Kennard said.

The transaction, which Kennard said had been eight months in the making, needs approval from the state Public Utilities Commission, the FCC and the U.S. Department of Justice. He said he was optimistic that Carlyle could receive PUC approval by the end of this year and that the deal could close early in the first quarter. Kennard said he hopes to file an application with the PUC within a month.

Kris Nakagawa, chief legal counsel for the PUC, said complex cases such as the Carlyle-Verizon Hawaii deal normally take six months to a year for the three-member commission to render a decision. He said there was no way now to offer a precise timetable since there are certain statutes and rules that Carlyle must follow. Nakagawa also said objections from other parties could extend the decision-making process.

The Carlyle Group said the deal includes Verizon Hawaii's local telephone operations, print directory, long-distance operations and Internet service provider business.

Verizon Wireless operations and assets in Hawaii are not included in the transaction. Verizon also will retain two units in the state that provide services for federal government customers: Verizon Federal Network Systems and Verizon Federal Inc.

Verizon Hawaii, which has about 1,700 employees, had sales last year of $610 million, operating income of $58 million and depreciation expense of $111 million. The company has 707,000 local phone lines.

"We will offer new services to our customers, including expanded broadband, and we expect to add many new jobs after the acquisition," Kennard said. "Importantly, rates will stay the same as we reposition the business as a true local company."

The key players in the phone deal

Verizon Hawaii

The local phone company is being bought by the Carlyle Group for $1.65 billion.

President: Melvin M. Horikami

Total employees: 1,700

2003 sales: $610 million

Corporate parent: Verizon Communications

Corporate headquarters: New York City

Carlyle Group

The global investment firm buys companies around the world, with a concentration in communications.

Offices: Headquarters in Washington, D.C., 23 offices in 14 countries

Assets: $19 billion under management

Portfolio companies: More than 150,000 employees and $31 million in revenues

Hawaii presence: Purchased shipper Horizon Lines LLC from CSX Corp. for $300 million last year.

Managing director: Former Federal Communications Commission Chairman William Kennard

Prominent advisers: Former President George H.W. Bush; former British Prime Minister John Major; former U.S. Secretary of State James A. Baker, III; former U.S. Secretary of Defense Frank C. Carlucci; former U.S. Speaker of the House and Ambassador to Japan Thomas S. Foley

Web site: www.carlyle.com

BACK TO TOP |

Skepticism lingers

over buyer’s intent

The Carlyle Group, one of the largest private-equity firms in the world, has 30 percent of its money invested in communications.

For some employees at Verizon Hawaii, that's reassuring.

But for other observers, there's nagging suspicion that the Washington, D.C.-based company may have purchased the local telephone company for a short-term gain.

Patrick Comack, a telecommunications analyst for Guzman & Co., of Coral Gables, Fla., said yesterday he thought the $1.65 billion purchase price was "reasonable" and estimated the Carlyle Group paid roughly $2,300 a line. He said that's less than the approximate $2,900 price tag that a rural line would fetch. Rural lines sell for more because there's less competition and they're not as exposed to competition from cable.

"They'll operate it and try to flip it to someone they know, or just run it for the cash," Comack said. "These guys usually aren't in these things for the long term. It's just an investment."

Not so, said William Kennard, managing director of the Carlyle Group.

Verizon timeline

Key dates in Verizon Hawaii history:» 1883: King Kalakaua grants Mutual Telephone Co. a charter to provide service in the islands.

» 1954: Mutual changes its name to Hawaiian Telephone Co.

» 1967: GTE Corp. acquires the company, which becomes GTE Hawaiian Tel.

» 2000: GTE merges with Bell Atlantic to form Verizon, spawning the Verizon Hawaii moniker.

» 2004: The Carlyle Group and a cadre of local investors plan to buy the local phone company; a new name is in the works.

"Because of the nature of this company, it's not likely to get flipped to another buyer for the sole reason that other phone companies would not be interested in buying Verizon Hawaii," Kennard said. "If SBC, BellSouth or one of the bigger mainland phone companies was interested in buying Verizon Hawaii, they would be buying it now. (Parent company) Verizon conducted an auction where it solicited interest in the company."

Kennard said the Carlyle Group has other options to reward investors without selling it to another party.

"Given the cash-flow characteristics of this company, the company could be refinanced over time or be taken public," he said.

Some of Verizon Hawaii's employees applauded the deal. A systems support manager, who asked to remain anonymous, said he thought the company made a good move.

"They bring a lot of expertise to the field of telecommunications," he said. "They offer solid financial footing for the company's future growth and for the future of the employees here.

"I think their long-term commitment is to make this a better company than this is right now."

Another employee in the same department said he was excited to get started.

"Previously, we lost a bunch of systems to the mainland, and it seems like they're all coming back," he said. "So rather than being fearful for my job, I think we're going to have a lot more than we can handle for awhile."

But 38-year veteran George Waialeale, an electronic installer, is not convinced.

"I don't believe they're committed to Hawaii," he said. "I believe they're here for the short term."

Waialeale referred to a May 12 talk that Ivan Seidenberg, chairman and chief executive of Verizon Communications, gave to the U.S. Senate committee on telecommunications.

"Seidenberg said that the only way telephone companies have made money is by selling themselves or by merging with larger telephone companies," Waialeale said. "If this is a statement from one of the largest telephone companies, how is a company like Carlyle going to make money if these guys can't make money?"

Waialeale said previous buyers of the company have made things worse.

"Our infrastructure has a lot of lead cable in it that's prone to water, and maintenance has fallen by the wayside," Waialeale said. "The employees are stretched thin. When I came in the company, we had 4,200 employees in the bargaining unit. Now, we have 1,300."

Keith Kamisugi, a spokesman for GTE and Verizon from 1997 to 2000, said he was sad to see Verizon leaving Hawaii because of the products and services it offered.

"On the other hand," he said, "this decision somewhat takes the phone company full circle back to the days of Hawaiian Telephone Co., a local company, run by local people, locally branded."