Among Marriott's Hawaii timeshare properties is Maui Ocean Club, with its "superpool."

Time to share

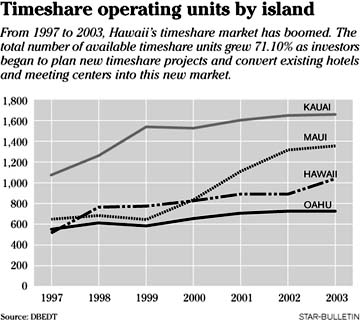

The number of timeshare units

in Hawaii has grown 71%

in the last six years

George and Lois Cavell visited Kauai in 1993 on their honeymoon. That was the beginning of their love affair with Hawaii timeshares.

At one time, the retired couple owned seven timeshare weeks on Kauai. They've since pared the number down to four, but that's only because they decided to buy a second home on the Garden Island.

"We were so in love with paradise, especially Kauai," George Cavell said. "Owning timeshares allowed us to feel more vested in the community. You feel like you own something, you are not just a visitor."

Folks like the Michigan-based Cavells form one of the fastest-growing markets in Hawaii's visitor industry. The transformation of the tourist industry from visitors as transients to visitors as stake holders is part of the larger evolution of Hawaii as a destination, said Paul Brewbaker, senior vice president and chief economist with Bank of Hawaii.

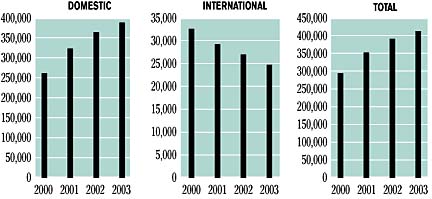

"This concept of the visitor as a stake holder is broader and deeper than what is going on in the resort areas. Increasingly these are our neighbors," Brewbaker said.From 1997 to 2003, the number of timeshare units in Hawaii has grown 71 percent, rising from 2,779 units to 4,755 units. During the same period, the number of timeshare visitors has also grown by 40.5 percent, rising from 293,316 to 412,187, according to the latest data available from the state's Department of Business, Economic Development & Tourism.

The growing demand for timeshare is a reflection of evolving preferences, Brewbaker said.

"The baby boomers are in their 50s and their lifestyle is different from when they were in their 20s and 30s and coming to Hawaii in the 1970s for spring break," Brewbaker said. "Now, it's not so important to tourism what happens in spring and summer as the winter."

There's no doubt that timeshare has become a significant market for Hawaii both in terms of the growing number of units and their impact on the state's economy, said Marsha Wienert, Gov. Linda Lingle's tourism liaison.

"It's the most resilient market," Wienert said.

Ko Olina Beach Club

Timeshare owners are far less likely to abort their travel plans than other tourists over issues such as SARS or terrorism, she said.Kauai's extensive timeshare market, which comprises nearly 25 percent of the island's total visitor units, helped insulate its visitor industry from the dramatic dips experienced by other islands in response to the Sept. 11 terrorist attacks, SARS and the War on Iraq, said Sue Kanoho, director of the Kauai Visitors Bureau.

Timeshare provides the economic consistency of year-round visitors and jobs, said Lynn McCrory, president of Pahio Resorts Inc., a timeshare company with five properties on Kauai, an island that boasts the largest number of operating timeshare units in Hawaii.

"Timeshare produces occupancy rates from 85 to 100 percent on a regular basis," McCrory said. "That's something traditional hotels can't touch."

Marriott's Hawaii timeshare properties include its Maui Ocean Club.

It's a numbers game that adds up for Hawaii developers as evidenced by the number of hotel to timeshare or partial timeshare conversions taking place. It's not feasible for most developers to build more hotel inventory, said David Carey, the president and chief financial officer for Outrigger Enterprises Inc.At one time, Outrigger had planned to build new hotel rooms as part of its $800 million Waikiki Beach Walk Project, which is slated to begin construction in 2005, but economic conditions caused the company to shelve the project for nearly a decade. A joint venture announced last week between Outrigger and kamaaina developer Richard Gushman has given new life to the project, but the company now plans to tear down six hotels and replace the room inventory with timeshares and condos.

That's not just happening in Waikiki. Marriott's Maui Ocean Club is electing to demolish some of its existing meeting space to make room for more timeshare, said Robert Calhoun, Marriott regional vice president of sales and marketing for Hawaii and Asia.

"It speaks to our strategic decisions of how to remain a profitable and visionary company," Calhoun said.Since Marriott entered the timeshare industry in 1984, it has achieved the nation's highest annualized timeshare sales, which topped out at $1.3 billion in 2003, he said.

Entering the timeshare market, which in the '80s had a dubious reputation at best, was a risky undertaking for Marriott. But the gamble paid off, Calhoun said.

"We literally became the overnight leader of the industry and I believe our entry paved the way for other branded corporations to follow," he said.

The aggressive growth of Hawaii's timeshare market has prompted several studies on the long-term impacts of timeshare on the visitor industry, said Terryl Vencl, director of Maui Visitor Bureau.

Although new timeshare developments have increased visitor inventory, in some cases timeshare conversions have dramatically shrunk the pool. If too many timeshare conversions take place, meeting planners and conventioneers could find it difficult to secure accommodations for larger groups, Vencl said.

"We still have a lot of available rooms and we are able to work with what we have, but I don't know about the future," she said.

Other industry professionals are buzzing about past studies that have suggested timeshare visitors spend less money during their trips than other travelers, Vencl said.

But for places like Maui, where the timeshare/hotel mix is still weighted more toward hotels, it's just too early to predict the impact of timeshare over the long haul, she said.

Pahio Resorts timeshare properties include Kauai Beach Villas.

Bali Hai Villas.

The Shearwater.

— ADVERTISEMENTS —

— ADVERTISEMENTS —