Isle condo

prices surgeAn Oahu inventory crunch sends

median prices up 24% over last

year and near the 1990 record

The condo is making a comeback.

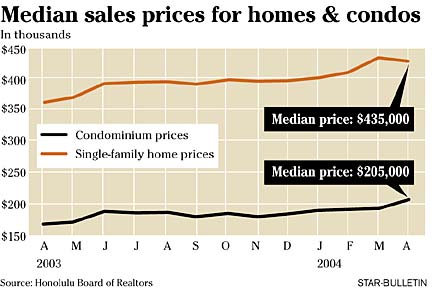

Oahu condominium median prices crossed the $200,000 threshold in April for the first time since the early 1990s, coming to within shouting distance of their 1990 record high as many home buyers give up on finding a single-family home that they can afford.

The median resale price of all the condominiums sold on Oahu increased 24.2 percent over April 2003 levels to $205,000 from $165,000 amid heavy sales turnover, according to data compiled by the Honolulu Board of Realtors. That also represented a sharp rise over March, when the figure was $190,000.

"Condominium prices are now approaching their $230,000 peak set during the summer of 1990," said Mary Begier, the board's president. She attributed the increase to the high price of single-family homes, which have risen out of the range of many buyers. The median for single-family homes in April held steady at $435,000, a 20 percent increase from $362,500 a year ago.Condo prices squirted higher thanks to the intensifying squeeze between supply and demand on Oahu. Even though condo inventory was at a record low -- just 1,034 units were put on the market in April -- a near-record 685 units were sold in the month, compared with 552 a year ago. The median number of days on the market dropped to 23, from 24 in March.

For single-family homes, 361 units were sold, compared with 320 in the previous April. It was one of the highest sales totals in several months, despite record-low inventory of just 784 units. The number of days on the market held steady at 26.

The April median price of a single-family home was down slightly from the record $439,000 set the previous month. However, that March record represented a steep $29,000 month-on-month increase and would have been hard to beat, said the board's research economist, Harvey Shapiro.

"The fact that we're still up in the $430,000 range means we're sustaining prices," he said. "That's certainly not a negative."

Though historically low interest rates are usually credited with fueling the Hawaii home-buying boom of recent years, the unprecedented shortage of homes on Oahu is so great now that some believe it might render the local market largely immune from rate increases.

The Federal Reserve Board voted to keep the benchmark U.S. interest rate at a 45-year low when it met on Tuesday. But the board, which next meets on June 30, hinted it might lift borrowing costs at a "measured" pace in the future to head off inflation.

"Even with the expected interest rate hike by the Federal Reserve, we anticipate the effect on Oahu's residential sales market will be minimal in the short term, especially given the extremely short supply of dwellings available for sale," Begier said.

Last November, single-family home prices powered past the previous record of $392,000 set in 1990 during the days of the Japanese bubble economy.

Meanwhile, condominium prices, which fell steeply from the bubble days to plumb depths around $120,000, also have grown steadily in the current market run-up, but have not come within sight of record territory until now.

"Generally, when a market gets pricey, sales activity reverts to the cheaper product, and that's probably what's happening here," said Bill Chee, president of Prudential Locations.

Chee warned that the historically tight inventory makes it more likely that sales of a few higher-priced condos may have lifted the median price higher. However, he added that if prices for both single-family homes and condos remain buoyant, that could influence more buyers to opt for less expensive West Oahu properties, thereby moderating future increases in sales prices.

Either way, prices should stay propped up for the foreseeable future since no significant new condo inventory is expected on the market until a couple of years from now, when a number of high-rise condo developments are due to be completed, he said.

"We really need inventory. There's no way we can catch up to market demand the way things are now," he said.

— ADVERTISEMENTS —

— ADVERTISEMENTS —