Oahu’s house median:

$439,000Tight supply results in the highest

prices for homes in several years

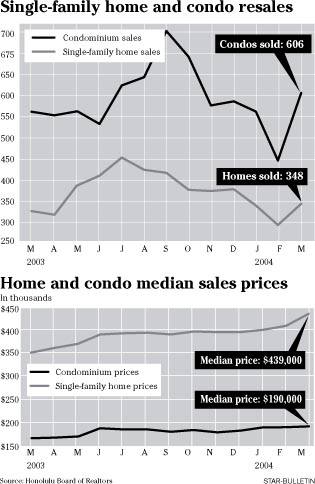

The median resale price of a single-family home on Oahu spurted to a record $439,000 in March as the island's depleting inventory of homes and condominiums plummeted to its lowest level since the board began keeping monthly records in 1986.

The $439,000 median -- the point at which half the prices are higher and half are lower -- marked a 25.4 percent jump over March 2003, the highest year-on-year increase in several years, according to data from the Honolulu Board of Realtors. The median condo price also jumped a hefty 12.4 percent from the previous March to $190,000.

"This is just more good news. There is a high interest in Hawaii and in buying a home in Hawaii, and I think that's a good thing," said Mary Worrall, owner and president of real estate firm Mary Worrall Associates Inc.

Underpinning the surging prices was a record-low inventory of just 800 single-family homes and 1,053 condos up for sale in March.

"Wow," said Bank of Hawaii Chief Economist Paul Brewbaker when informed of the numbers. "That's really something -- but not too surprising."

Brewbaker said the low interest rates that have fueled home-buying, coupled with the increasingly tight supply, will continue to buoy prices for the foreseeable future.

"There is still considerable upside. The fundamental conditions show no signs of going away," he said.

However, others are warning that the market is beginning to disengage from economic fundamentals and is looking increasingly like a bubble.

"There's a herd mentality taking over in which people think, 'Gee, it's only going to keep going up, so I have to buy,'" said Ricky Cassiday, an independent real-estate analyst. "I'd like to see a little more reality injected into the market."

Cassiday said he expects the galloping price growth to slow in the next few months, but added it could continue at a slower but steady pace for another year. If that happens, he warned that state and county governments will need to watch to ensure that prices do not rise out of the reach of lower-income families and first-time home buyers.

"We're not near the danger point yet, but it's good to start thinking early about those things," he said.

In October the state established the Hawaii HomeOwnership Center to assist prospective first-time buyers and provide information on financing options such as the City and County of Honolulu's down-payment loan program for qualifying lower-income households.

Center Executive Director Kendall Hirai said yesterday he is working with local and federal officials and local banks to devise new financing schemes such as those available in similarly priced California. Qualifying applicants there can get as much as $84,000 in upfront financing for a $400,000 home through outright grants or loans in which repayment is deferred for up to 30 years. Hirai said he hopes to see such options in place by the end of this year.

Brewbaker surprised many during a real estate industry forum about a year and a half ago by predicting that the median home sale price in Hawaii would reach $600,000. He said that prediction remains valid but warned that the high-flying market is nonetheless vulnerable. He said any sudden increases in U.S. job growth could cause interest rates to spike upward and stop price growth in its tracks.

"That could turn out the lights on the real estate market," he said.

— ADVERTISEMENTS —

— ADVERTISEMENTS —