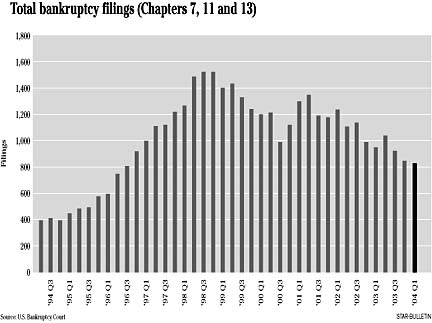

Isle bankruptcies decline

Rising real-estate values and low

interest rates in the state lead to a

12.6 percent drop in bankruptcy

filings, on top of a healthy 2003

Statewide bankruptcy filings tumbled 12.6 percent during the first quarter thanks in large part to Hawaii's rising real-estate values and the low-interest-rate environment.

A total of 833 local individuals and businesses filed for bankruptcy petition during the first three months this year, down from 953 in the first quarter of 2003, according to the Office of the U.S. Trustee, which oversees bankruptcy cases in Hawaii.

The decline is on top of a healthy 2003, when statewide bankruptcies dropped 17.8 percent.

With median home prices at record highs and interest rates at near historic lows, fewer local consumers are forced to go to the bankruptcy court to stave off creditors.

"The ability of people to refinance and make money off of their real estate has been a driving force in the decrease," said Gayle Lau, assistant U.S. trustee.

That point is underscored by the number of individual wage earners filing for Chapter 13 bankruptcy.

Chapter 13 bankruptcy, which typically is filed by local consumers who are trying to protect their homes from foreclosure, dropped 18.7 percent to 91 during the first quarter of 2004 from the year-earlier 112.

Chapter 7 liquidations are down 11 percent to 738 from first-quarter 2003's 832, while business bankruptcies in the form of Chapter 11 reorganizations dropped to four from the year-earlier period's nine.

Lau said that Hawaii's trend runs counter to the national trend, which is showing a rise in bankruptcy filings, especially in areas hard hit by the loss of industrial-sector jobs.

He added that bankruptcies are down in areas like Hawaii and Southern California where real-estate values have risen.

— ADVERTISEMENTS —

— ADVERTISEMENTS —