City Bank execs

report big bonusesThe top two chiefs at the bank's

parent company made more than

$500,000 in a record earnings year

The top two executives for City Bank's parent each received a combined salary and bonus exceeding a half-million dollars last year as the bank defended a hostile takeover attempt by rival Central Pacific Financial Corp.

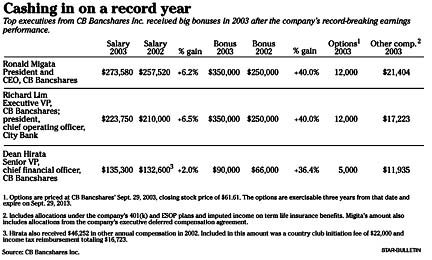

Ronald Migita, president and chief executive of CB Bancshares Inc., received $623,580 while Richard Lim, executive vice president of the parent company and president and chief operating officer of the bank, earned $573,750, according to the company's proxy filing yesterday with the Securities and Exchange Commission. Both of them received $350,000 bonuses as part of their compensation.

"The bonus increase was all performance based," CB Bancshares spokesman Wayne Miyao said. "It was based on the excellent year we had in 2003 and not related to the proposed merger."

In 2003, CB Bancshares posted record earnings of $20.7 million, a 53.9 percent increase over $13.5 million a year earlier.

Last year's net income also included $6.6 million, or $4.4 million after taxes, in expenses associated with the defense of Central Pacific's merger proposal.

Dean Hirata, senior vice president and chief financial officer of CB Bancshares, received a combined $225,300 in salary and bonus compensation.

In another development, Miyao said yesterday that the bank has received a letter from a major investor who is threatening to withhold his votes at the company's April 29 shareholders meeting.

Bruce Sherman, CEO of Naples, Fla.-based Private Capital Management LP, said in the March 24 letter that Private Capital's fiduciary responsibility to its clients "mandates that we remind you (CB Bancshares) of your fiduciary duty to your shareholders to act in their best interest and at a minimum negotiate with Central Pacific."

Sherman, who earlier this week made similar remarks, controls 9.6 percent of CB Bancshares' stock for his clients as well as more than 9 percent of Central Pacific stock. He claimed in his letter that "the ever deepening entrenchment and breach of duties displayed by the board of CB Bancshares in response to Central Pacific's merger offer are among the most disturbing violations of fundamental corporate integrity witnessed by PCM in all of our years of investing on our clients' behalf."

Miyao said he couldn't disclose whether CB Bancshares' board had met on Central Pacific's new $400 million offer or when a decision would be forthcoming. Central Pacific has given CB Bancshares until April 15 to begin negotiations on the cash-and-stock proposal, which is worth $87.26 for each share of CB Bancshares' stock.

CB Bancshares' stock, which closed yesterday at $65.87, has fallen nearly $3 since the sweetened bid was made March 15. Central Pacific made its first of three offers public 11 months ago.

"We believe that as a shareholder (Sherman is) entitled to his opinion and entitled to vote whichever way he wants to," Miyao said, adding that bank executives will share the letter with the board of directors.

CB Bancshares also disclosed yesterday that the three people who are being nominated for three-year board terms at the April 29 shareholders meeting are current directors of the bank company.

They are Tomio Fuchu, director of Dart Coffee Inc.; Duane Kurisu, a partner in Kurisu & Fergus and a minority Star-Bulletin owner; and Mike Sayama, vice president of customer relations of Hawaii Medical Service Association.

— ADVERTISEMENTS —

— ADVERTISEMENTS —