DENNIS ODA / DODA@STARBULLETIN.COM

Clint Bidwell, founder of C.M. Bidwell & Associates Ltd., sits on a desk in his Nuuanu office with his three-person staff. Standing, from left, are Debbie Chun, Paulo Ramirez and Niall Kilcommons. The company has been one of the top investment performers in the country despite a low-key operation.

The Nuuanu money manager has

guided an ERS account of $46 million

to the best return in its U.S. peer group

Nestled in the Nuuanu hills, about a mile off of the bustling Pali Highway, Clint Bidwell settles comfortably behind his oak rolltop desk to pore over financial data.

His office and adjacent historic home sit on a 20,969-square-foot lot. The house was built in 1900 by Lucy Peabody, maid of honor to Queen Emma.

Bidwell, with $140 million under management, has just three employees. Computer data bases he uses for his quantitative behavioral-model research comprise the rest of his braintrust.

Despite being 5,000 miles from Wall Street, Bidwell's company, C.M. Bidwell & Associates Ltd., has turned in a financial performance that would be the envy of any investment firm.

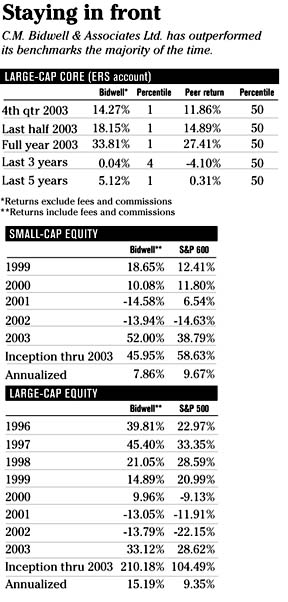

The 62-year-old former University of Hawaii finance professor, who manages about $46 million in a large-cap core portfolio for the Hawaii Employees' Retirement System pension fund, posted the best return in his U.S. peer group of large-cap core investment managers for the last quarter, the six months ending Dec. 31, the last year and the last five years.

Bidwell's portfolio also finished in the fourth percentile (first is the best) for the last three years. The large-cap core portfolio is the only basket of stocks that Bidwell manages for the ERS.

"We look at predicting what analysts are going to do before they do it," Bidwell said about his proprietary investment method. "We try to find companies that, after we buy them, analysts will raise their earnings estimates and/or recommend the stock for purchase. Raising earnings estimates and buy recommendations tend to drive stock prices."

>> Silver anniversary: C.M. Bidwell & Associates Ltd. opened 25 years ago this month.

>> Under management: The company manages $140 million for 60 accounts, including its largest client, the state of Hawaii Employees' Retirement System.

>> Quotable: "I believe that most managers don't (beat the market). I believe that most of it is a peacock dance. I believe that most of it is a bunch of guys with suits, fancy cars, living in (upscale) Scarsdale (N.Y.), who don't have a clue." -- Clint Bidwell.

Bidwell, who has worked as a researcher for firms on Wall Street, as well as in Los Angeles, developed a mathematical behavioral model in the early 1970s when he was a professor at the University of North Carolina in Chapel Hill, N.C. His doctoral thesis, which he earlier penned at the University of Southern California, was an evaluation of institutional research recommendations.

He came to the University of Hawaii in 1977, and in March 1979 -- 25 years ago this month -- started an advisory business as an adjunct to being a professor. Bidwell taught for 10 years at UH, but resigned as a tenured professor when his growing business and teaching responsibilities became too much to handle simultaneously.

Bidwell's investment style calls for him to be fully invested at all times and to not overweight or underweight any particular sectors. He doesn't time the market and he doesn't meet with company executives.

"For me to compete with Wall Street, or with firms like Fidelity, I'd have to have maybe 60 smart analysts, all of whom are highly educated and have years of experience," Bidwell said. "We can't do that, so a small firm competes by a niche having to do with the power of computer data bases, and the power to extract inefficiencies in a different way."

Rick Humphreys, chairman of the investment committee for the ERS, said Bidwell has "got his little black box and his own private way of investing."

Bidwell said he wishes it were as simple as digging into a little black box.

"The work we do involves simulation testing, working with a model we started in the early 1970s and improving it, thinking about it, analyzing it, massaging it and trying to make sure we stay up with the market," he said. "I'd like to tell you I have a black box that's going to work between now and the next 30 years, but that's not true."

Bidwell screens 8,000 companies on an ongoing basis. His active management style results in him turning over an average of about one stock a week in his portfolios, which usually contain about 40 stocks each. He said his investing style generates more fees and commissions than he'd like, but it produces better results.

"We've tried to create models where the turnover is less ... but our performance is not as good," he said. "If the turnover goes down, so does the performance. And I think clients are more concerned about performance than anything else."

Kimo Blaisdell, chief investment officer for the $8.5 billion ERS pension fund, certainly has no complaints.

"For a small firm located in Hawaii, he has been a great find for us," Blaisdell said. "We are very pleased with the performance he has produced."

The ERS represents the largest of Bidwell's 60 accounts, 50 of which are from Hawaii and 45 of which are tax-exempt portfolios, endowments, pension plans and profit-sharing plans. A small part of his business is individual accounts, which require $250,000 to get started.

His large-cap equity portfolio has beaten the benchmark Standard & Poor's 500 index three of the last four years and, including fees and expenses, has returned an annualized yield of 15.2 percent since its inception at the start of 1996. Taken another way, $100 invested in this portfolio at inception would be worth $310.18 at the end of 2003 compared with just $204.49 for the S&P 500.

Bidwell's small-cap equity portfolio, which including fees and expenses returned an astounding 52 percent last year, has beaten the S&P 600, a small-market index, the last two years and has had an annualized gain of 7.9 percent since its inception at the start of 1999.

His staff consists of:

>> Senior Vice President Debbie Chun, who has an MBA from Columbia University and was a former student of Bidwell's at University of Hawaii. Chun previously worked as the vice president of finance at ship designer/builder Pacific Marine & Supply Co. from 1988 to 1999.Bidwell, who is an avid basketball and tennis player, as well as golfer, said he enjoys being away from the crowd.>> Vice president and Controller Niall Kilcommons, who has a certified management accountant professional designation from Canada. He previously worked in corporate finance as an accountant with FracMaster Ltd. from 1994-1999 in Calgary, Canada.

>> Account manager Paulo Ramirez, who is in a master's of science information systems program at Hawaii Pacific University. He has paralegal certification from the University of San Diego and a bachelor's of science in management information systems from San Jose State University.

"Analysts tend to move as a herd together," Bidwell said. "They all tend to gravitate, all recommending one thing then all recommending another. That kind of group thinking, to my knowledge, does not add to portfolio performance at all. It might add to your comfort feeling because you might say, 'Well, everybody else owns this stock and therefore I'm comfortable owning it,' but being 5,000 miles from Wall Street is actually an advantage."

Even working out of his home office has its merits.

"We can achieve better performance in this environment because we don't have to worry about the traffic going back and forth to work," he said. "We don't worry about the hassles of parking. This is a really good setting if you want to just think about concepts having to do with the market and achieving good returns."