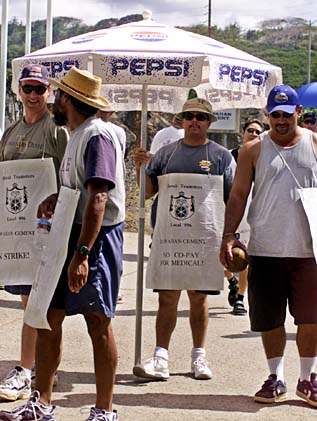

CRAIG T. KOJIMA / CKOJIMA@STARBULLETIN.COM

Michael Perry, a Hawaiian Cement mixer-driver, used a very large umbrella for walking the picket line earlier this week at the company's Halawa Valley quarry.

Health cost issues

not going awayThe sticking point in the cement strike

is common across many industries

At the heart of the dispute between local concrete workers and their employers, Ameron Hawaii and Hawaiian Cement, is a struggle over health care benefits and costs.

The tussle over who pays and how much is not new, even in Hawaii. Retiree health care benefits and greater cost sharing also were issues in the 2002 nurses' strike.

In California, the debate has been front and center in an impasse between the United Food and Commercial Workers Union and three national grocery chains. Employers there have argued that unless they can decrease health care costs, they can not compete with low-wage big box stores like Wal-Mart.

It's not surprising unions are facing increased pressure from employers relating to retaining rich health care benefit plans, said Gary Lee, a senior vice president with the insurance brokerage firm Marsh USA Inc. in Honolulu.

"The problem is that these plans have been too good when the rest of the non-bargaining world is facing the reality of benefits being reduced and contributions being increased in an attempt to control costs," he said.

A mainland employer health benefits survey by the Henry J. Kaiser Family Foundation last year found employers are addressing the problem and workers saw increases in cost sharing for health care, including deductibles and copayments.

However, the survey also found that for the first time, many large employers have imposed a separate and substantial deductible or copay for inpatient services.

In Hawaii, the state's Prepaid Health Care Act has governed monthly premium contributions by employees and set a minimum levels of benefits. Within those constraints, Hawaii employers have had less flexibility when it comes to increasing the employee health plan cost share on either the premium or individual benefits, said Cliff Cisco, vice president of the Hawaii Medical Service Association.

But despite the escalating price tag, most Hawaii employers have been reluctant to take away even optional benefits -- such as drug, dental and vision -- as a way to decrease premium costs, Cisco said.

"We had anticipated some employers would begin to drop their riders, but so far they haven't. Once you've given, it's hard to take away," he said.

But change could be in the wind in Hawaii if Kaiser and HMSA are successful in gaining approval for two new health plans. Targeted toward small businesses, they would require greater out-of-pocket costs by employees and would lower premium costs paid by employers.

Lee said he believes Hawaii employees -- union and non-union -- have to start getting beyond the entitlement mentality that has traditionally prevailed in the state when in comes to health care.

"We are all in this boat together. There is not enough money in the economy to give free medical at no cost," he said.

"I think the Teamsters are unrealistic in not coming to grips with what is reasonable under the circumstance."