DENNIS ODA / DODA@STARBULLETIN.COM

At the Hardware Hawaii Ace in Kailua, sales associates Paul Crimmins, left, and Eli Ferree helped Isabelle Piccini and her granddaughter Piper Crabtree select products for their pet dog on Tuesday. In back, looking for garden hose products is Quincy Choy Foo. Hardware Hawaii has seen an increased willingness among consumers to spend money on home improvement, another positive sign for the state's economy. A semiannual survey found that 53 percent of local businesses believe the economy will improve this year.

Biz optimism

hits highA survey finds 53 percent

of local retailers believe the

economy will improve this year

Hawaii businesses have never been as optimistic about the economy during the last five years as they are now.

In an upbeat semiannual survey that portends another robust year ahead, 53 percent of local businesses -- the highest percentage in the survey's history -- believe the economy will improve this year.

The past 12 months weren't bad, either, as the survey's performance factor index, which measures gross revenues, profit before taxes and employment changes, also posted its highest reading ever.

"People are feeling extremely positive," said Barbara Ankersmit, president of QMark Research & Polling, which conducted the Business Banking Council's economic indicator study. "When I look at every aspect of the report, it's just not in one area or another. It's throughout the entire report. All the numbers are encouraging."

The survey results, presented at a news conference yesterday at the Hilo Hattie store on Nimitz Highway, also included its annual look at retailers to get a pulse of how merchants were feeling after the recently concluded holiday shopping season. Like all businesses in general, the retailers had reason to celebrate as consumers returned in droves and with open pocketbooks.

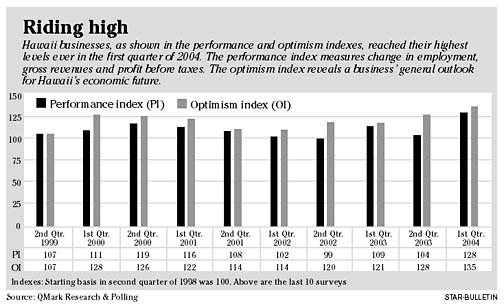

Overall, the optimism index had a 135 reading, seven points ahead of its previous high in the second quarter of 2003, when the last survey was done, and 14 points above its level from the first quarter of a year ago. The index began in the second quarter of 1998 with a base of 100.

The performance index, whose metrics look back at the past year, hit its highest mark ever at 128, 24 points above the second quarter of 2003 and 19 points above the same period of a year ago. The previous high was 119 in the second quarter of 2000, when the bull market was on its final legs. The elements that make up the performance index showed that 56 percent of businesses had an increase in gross revenue over a year ago, 47 percent said profits before taxes were up and 25 percent reported they had more employees than 12 months ago.

On the retail level, 51 percent of the merchants surveyed said their business has increased over the last year with only 5 percent responding that it had gone down. The numbers are a far cry from the post-9/11 environment in the first quarter of 2002 when only 20 percent of the retailers reported improved business and 46 percent said business had worsened. The data is also a considerable improvement over last year at this time when 40 percent said business had improved and 18 percent said business had gone down.The retail picture is even more dramatic when factoring in customers' spending habits. More than half of the businesses, or 52 percent, said the average amount a customer spent over the last year increased from the previous year while only 4 percent said customer spending had decreased. Those figures represent considerable jumps from the 2003 survey, when 32 percent saw increased customer spending over 2002 and 28 percent experienced decreased customer spending. In the 2002 first quarter that followed 9/11, only 11 percent of businesses saw increased customer spending from the previous year while 51 percent saw spending dry up.

"The survey kind of mirrors what my retailers and nonretailers are telling me," said Carol Pregill, president of Retail Merchants of Hawaii and one of the news conference panelists. "It just validates the unofficial reports I've been getting. I send out feelers all the time. The feeling in the marketplace over the holidays and even continuing on ... is that everyone is seeing this trend."

Paul deVille, chief executive officer of Hilo Hattie parent Pomare Ltd. and also one of the panelists, said the rebound in the tourism market has complemented the Hawaii retail clothing and manufacturer's burgeoning kamaaina market.

"When you look at the customer mix portion of the survey, you find it's very heavily weighted toward (retailers) mostly having kamaaina customers (53 percent) vs. visitor customers (11 percent)," deVille said. "In our case, we really have quite a bit of both (37 percent of the retailers had a mixed customer base). We're finding that the upswing in the tourism market has had a major positive impact on our revenues and profitability and our focus in growing the kamaaina market has only enhanced that."

DeVille said the retail chain's product line and wide selection attracts repeat visitors and the company's advertising and marketing campaigns bring in first-timers. He also said Hilo Hattie has targeted its promotions to kamaaina as well "so they can rediscover the new Hilo Hattie."

"You know the campaign about the car not being your father's Oldsmobile," he said. "Well, this isn't your mother's Hilo Hattie."

The survey, sponsored by American Savings Bank, was based on 408 interviews using a company listing purchased from Equifax Polk Business Directory and conducted from Jan. 6 to Jan 16. It divided the businesses into four groups based on size and the data was weighted to reflect the proper proportions of each company based on the number of employees as reported by the state Department of Labor and Industrial Relations. In addition, 101 businesses identifying themselves as being directly involved in retail or doing a majority of their business in the retail sector were sampled. The results have a margin of error of plus or minus 5 percent.

Panelist Larry Lanning, marketing director for Hardware Hawaii Ace, said the three stores (in Kailua, Kaneohe and Mapunapuna) independently owned by David Lundquist have seen a willingness by customers to increase spending. That bodes well for Hawaii's economy since consumer spending accounts for two-thirds of the gross state product.

"What we've noticed is people are now willing to spend money on the future," Lanning said. "They are willing to remodel their homes and to move into new homes. They're probably willing to even finance the improvements that they make."

Lanning credits the economy for the uptick in business.

"There is optimism," he said. "We're very fortunate in Hawaii to have low employment. In fact, businesses are looking for people to hire. We're talking about training construction people because of the construction that's scheduled, a lot of which is military construction, as well as our normal housing developers."

Another panelist, American Saving Bank's Gabe Lee, said he sees a rosy picture both from the bank's and the customers' perspectives.

"For the bank, business has been very robust on everything from residential mortgages to commercial real estate, as well as the business loans," said Lee, senior vice president of business banking. "And it's been due to a combination of the low interest-rate environment, the high resale values and the strong stock market, which has resulted in the wealth factor psychologically."

Businesses also have been more selective, he said, to aggressively go after potential consumers.

"For the customers, what it comes down to is they're the survivors," Lee said. "They are a lot more savvy in selecting their niches and changing their niches a lot more quickly. We see them either increasing their inventories or increasing their staff. If they're a service business, especially, we see them investing in technology."