Home values

on Oahu up 17%A red-hot real estate market

is cited as one reason for the

higher city tax assessments

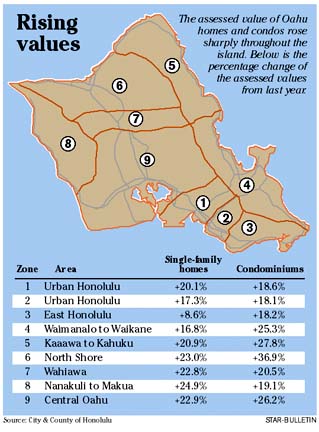

The value of Oahu homes rose 17 percent in the past year, driven by a continuing hot real estate market and new home construction.

The city mailed property tax assessments Monday to 264,000 property owners, showing double-digit percentage increases in residential property values. Values for single-family homes increased 17.2 percent, and condominiums went up by 16.8 percent.

Contributing to the increase was the construction of new houses and condominiums, the city said. The city also said the values mirrored rising real estate prices.

Commercial properties rose 4.6 percent in value, and industrial properties increased 5.4 percent. Hotel and resorts declined in value by less than 1 percent.

The value of all taxable properties on Oahu totaled $110.4 billion, up 16 percent from $95.1 billion last year. This is the fourth year the values have risen.

While the assessments have been out for only a few days, homeowners are already concerned.

"Of course they're upset with the assessments," said City Council Chairman Donovan Dela Cruz, whose district runs from Mililani Mauka to the North Shore and along Windward Oahu to Kahaluu.

The greatest increase in value for single-family homes was Nanakuli to Makua, where values rose nearly 25 percent. In condominiums, values on the North Shore went up nearly 37 percent.

"People are concerned about the size of the increases," said Councilwoman Barbara Marshall, who represents Waimanalo, Kailua and most of Kaneohe. "Most of them are people who have no intention of selling their homes, and therefore they don't understand why they should be appraised up based on somebody else who did sell their home."

Dela Cruz said he is telling unhappy constituents to appeal their assessments. The deadline to file an appeal is Jan. 15.

Assessment notices are not tax bills.

Property taxes are based on multiplying the assessed values by the tax rates given for different classifications of property. The Council sets the rates each spring.

This past year, the Council approved Mayor Jeremy Harris' proposal to increase the property tax rate for single-family homeowners by 2.7 percent.

"If the economy is improving and the real estate is going up, that's the way you increase and enhance revenues," said Councilman Charles Djou, who opposed last year's tax rate hike. "So the fact that the real property valuations have been going up is a good thing for the city because the city is strapped for cash."

But Djou is among those who believe that rising valuations will not stave off another tax rate increase.

"The city is in such dire financial straights that even with the hottest real estate market on record ... the mayor's still going to ask to increase taxes above and beyond that," Djou said.

Harris was not available for comment yesterday.

Marshall said her district received a double whammy with the highest increase in assessments last year coupled with the increase in tax rates.

"What people are telling us ... is that they don't want services cut, and that's what we're hearing from the majority of our constituents. And obviously if you're going to not cut the service, you're going to have to raise the revenue," she said. "Can we hold the line? I hope so, but realistically I think we're going to see another increase."