Emerging market

investing is back

in vogue

Despite the Asian crisis of 1997 and other emerging market disasters, many investors are once again eyeing these so-called "Wild, Wild West" markets and deciding the potential rewards to be lassoed are irresistible.

Countries with emerging economies are those that are behind economically, but show promise of healthy rates of growth and progress.

In recent months, flows into emerging-market equity mutual funds, especially into Asia outside of Japan, are at historically high levels, according to Brad Durham of Emerging Portfolio Fund Research, which tracks emerging market flow.

Assets from the dedicated emerging market equity funds EPFR tracks have grown 14 percent this year, with $10.5 billion in net inflows through last Wednesday, Durham said. Compare that to last year, when fund outflows were at $98.9 million and 2001 and 2000, when outflows were $3.69 billion and $2.86 billion, respectively, he said.

There are signs that some Hawaii investors are getting back into the saddle, too. Although whether that's a good idea depends on which fund manager is asked.

Asset allocation into international funds by Bank of Hawaii investors has doubled since March, with the percentage in international funds reaching the maximum the bank recommends for such funds, according to William Barton, executive vice president and chief investment officer for Bank of Hawaii.

There's no doubt that some Hawaii investors are becoming more enamored with these investments, said Colleen Blacktin, vice president and manager of Charles Schwab Honolulu investment center.

"Global markets expect and believe this sector should continue to outperform given the many positive macro and micro economic factors shaping these markets," Blacktin said. "This market is definitely drawing some interest in Hawaii, but I can't estimate how many are actually investing."

Many emerging markets are growing so fast that they've made the U.S. market look leaden despite climbing stock market indexes and other signs that the economy is recovering.

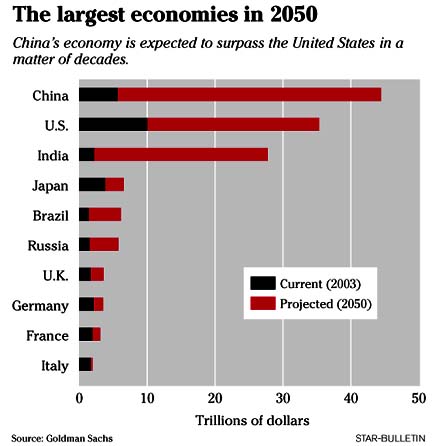

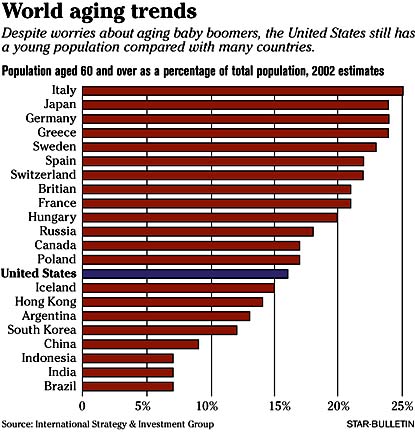

That's heady stuff for investors, said Barton, who added that buying stocks in China's rapidly-growing economy is particularly attractive due in part to the country's youthful demographics, huge economy and vast consumption of commodities.

"We view Asia very positively," Barton said. "It's going to be the dominant economic area of the world. And in our mind's eye, the most attractive market right now is China."

Inflows into the Asia market outside Japan, with a large amount going to China, are on pace to becoming the fattest that they've been since 1996 -- the year before some Asian investors got badly bitten, Durham said.

Excluding Japan, the Asia equity funds have received $3.77 billion in inflows this year, with $406 million coming in during the the week ended Wednesday alone, Durham said.

The rush of liquidity into the region and the funds dedicated to investing there have nearly doubled the assets in the 285 Asia ex-Japan equity funds that EPFR tracks weekly to $21.2 billion from $11.8 billion at the beginning of 2003, Durham said.

"Greed will always lead to short-term memory loss," he said.

Foreign equity fund managers tracked by EPFR have plowed a net $2 billion into Taiwan equities this year and have also been strong buyers of Korea, China and India, with more than half of the buying taking place in the last few months, Durham said.

"Asia is a very solid place to have exposure right now if you are an investor," he said. "When the global economy is in recovery, investors can get more bang for their buck by investing in emerging markets rather than in the markets of developed countries."

However those Hawaii-based investors who were the hardest bit, may find the Asian crisis harder to forget, said Barry Hyman, portfolio manager and vice president of Financial & Investment Management Group Ltd.

"I remember stockbrokers, especially inexperienced ones, selling people Asian and emerging market mutual funds like crazy in 1994 by enticing their customers with the recent performance of those funds. People who invested in those funds lost upwards of half their money in the next few years, and it took nearly 10 years, not until this recent rally did they get even," Hyman said.

During the past year, Financial & Investment Management has sold some of its Asian investments as the market has "overheated" and U.S. investors have begun to jump on the Asian bandwagon, he said.

"Until recently our portfolios were heavily weighted in Asian securities, and while we have trimmed our exposure to the 'tiger' markets considerably in the past several weeks, we still have significant investments in Japanese securities," Hyman said.

Hyman said there are still some bargains to be had in some of the lesser developed Asian markets, such as Malaysia or Indonesia, but the volatility associated with these markets is high and investors need to be careful.

"It's still buyer beware," he said.

That's why no matter how enticing an emerging fund investment looks, Schwab money managers still recommend investors diversify asset allocation, keeping the bulk of their investments in more stable markets.

"Because of the particular risk involved in investing in emerging markets, we warn investors that they should favor diversified global emerging markets as opposed to specific regions," Blacktin said.

Asia is coming back in a much healthier position and now is a more viable place to put a small portion of assets, Barton said.

"If there is a problem, we think it can be contained," he said. "China's growth rate, the size of its economy and their currency reserves are just so strong. They're driving the Asian market and they're putting upward pressure on commodity prices around the world."

Although there are signs that the emerging market could be a healthy long-term investment, those who are considering whether to jump on the emerging-market bandwagon need to remember that along with incredible growth potential comes volatility and risk, said David Zerfoss, chief investment officer at Central Pacific Bank.

"It's the Wild, Wild, West. There are no well developed systems or laws. The commercial laws are embryonic, and there's no mechanism for suing to recover damages," Zerfoss said. "It's a whole other milieu, and investors have to understand that going into it."

Emerging-market funds are a good investment only for clients who are able to absorb the risk and want to diversify their portfolios by investing a small percentage in these volatile markets, he said.

"If you put me in a time capsule and said you are going away for 10 years, then I'd want a significant investment in the Asian economy," Zerfoss said. "But that wouldn't be the case, if I were just taking a nap for a week."