RICHARD WALKER / RWALKER@STARBULLETIN.COM

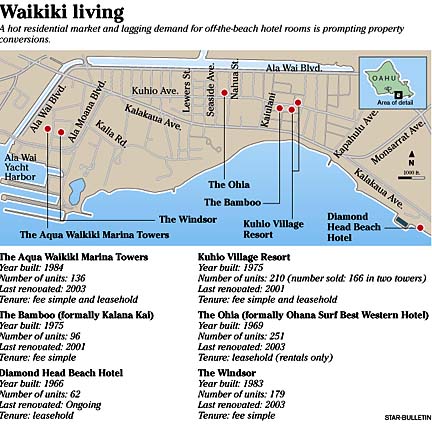

The dense pocket of humanity that is Waikiki is attracting more full- and part-time residents as former hotels become condominium and apartment complexes.

Location, location, location ...

Visitors increasingly want

beachfront digs, but locals don't

seem to mind the walk, making this

a ripe time for hotel conversions

With the residential real estate market continuing to boom, the conversion of hotel properties into residential condominiums and rental units seems to be taking off in Waikiki.

The properties are attracting investors, as well as owner occupants and those looking for long- and short-term rentals.

An active participant in the movement is local developer Peter Savio, who recently purchased the Ohana Surf Hotel on Kuhio Avenue from Outrigger Enterprises Inc. for $7.5 million. The property will be re-named the Ohia, Savio said.

Savio is betting that there will be strong rental demand from visitors and locals in both the short- and long-term categories for his studio and one-bedroom apartments. The units, which are not being converted to condominiums, will rent for between $650 and $900 per month.

A hotel property destined to enter the market soon as a condo-tel, as the residential condominium/hotel combinations are known in the industry, is Bamboo, a 96-room boutique hotel on Kuhio Avenue. The property, which will be marketed by Savio, was originally known as the Kalana Kai, but it was renovated by Baywest Investment Co. LLC about two years ago.

Baywest is known for its renovation of older condominium projects, such as several apartment buildings on Pualei Circle at the base of Diamond Head.

Watching the recent excitement generated by sales of units in other former hotel properties convinced Baywest partner Jonathan McManus the timing was right for the same move at the Bamboo.

"It's a unique opportunity," he said. "(The hotel) was developed over the last two years as a first-rate boutique hotel. Most of our business has come from the West Coast through the Internet. We'll have an association of owners that is managed independent of the hotel operation."

The units, which range from 250 square feet to about 750 square feet, will sell for $200,000 or less, he said. Having been extensively renovated and redesigned, the fee-simple units should be attractive to owner occupants as well as investors wanting to put their units into the hotel pool, he said. Baywest is in the process of choosing a management firm to run the hotel-pool side of operations, he said.

Savio previously was involved in converting the Diamond Head Beach hotel to residential condominiums for both investor-owned short and longer-term rentals and owner-occupants. That property is across from Kapiolani Park at the Diamond Head end of Kalaukaua Avenue.

"This was a project no one thought would succeed. It was leasehold with about 30 years remaining on the lease, but it sold quickly because of its location on the Gold Coast," he said

Savio believes that success got others thinking along the same lines.

The Aston Coral Reef Hotel on Kuhio Avenue, also a leasehold property, is another candidate for conversion, though that project is on hold. Savio was tapped by owner Andre Tatibouet to handle sales of the units, but Tatibouet subsequently became embroiled in a legal dispute with landowner Queen Emma Foundation over whether the property could be converted.

DEAN SENSUI / DSENSUI@STARBULLETIN.COM

Peter Savio's company recently purchased the Outrigger Ohana Surf Hotel and plans to market it as residential rental units.

Savio also converted a former Outrigger-owned and managed hotel property on Ala Moana Boulevard. It had been a condominium known as the Westbury before it was purchased by Outrigger, which ran it as a hotel named the Outrigger Ala Wai Tower for a number of years. When it was returned to condominium status about a year and a half ago, units sold quickly, Savio said.

It is now called Aqua Waikiki Marina Towers.

Andres Albano, vice president at commercial real estate firm C.B. Richard Ellis, said he's not surprised the hotel conversion trend is taking hold.

"It doesn't take a rocket scientist to figure out the hottest segment of the market is residential real estate. A lot of these properties have just been getting by. They're not beach front or trophy properties so a lot of these are going to be converted. It's the marketplace working to prune itself of nonproductive assets," he said.

Savio said price pressure on these properties has added to the motivation to convert.

"When the market decreased and all the hotels on the beach that were charging higher room rates needed to drop rates, that put enormous pressure on the hotels off the beach," he said.

Real estate market analyst Ricky Cassiday agreed.

"Some of these sites, since they are off the water, are not conducive to getting a high return and as the resort business has evolved, visitors have put a premium on the kind of experience they have in a property. An old building on a small site doesn't allow for the operator to provide lots of amenities," he said.

Savio agreed the tourism industry is changing.

"Right now (for visitors), the demand is for luxury-type properties," he said. "A lot of the ocean-front hotels are doing well and if you look at the neighbor islands, the newer, more modern ones are doing very well."

That trend puts some of the older Waikiki properties at a disadvantage, he said.

"In Waikiki, there are a lot of older properties that are difficult to change and upgrade on not a lot of land," he said.

Also, low interest rates and a shortage of rental units have created the ideal conditions for the conversions, he said.

One recent sale of a former Waikiki hotel property is a case in point. The Kuhio Village Resort caught the public's attention because of its price range. Former hotel rooms were sold starting at $40,000 for a leasehold studio and $50,000 for a fee-simple studio. All units were spoken within a couple of days of being offered.

In a higher price range, sales were brisk recently at Outrigger's former Ohana Hobron hotel. The property, now called The Windsor, was initially destined to become a retirement residence. The building, owned by a partnership of Oaktree Capital LLC and U.S. Pacific Construction, was renovated and converted to upscale apartments with one-bedroom units starting at $260,000.

Savio predicts more Waikiki hotel sales and conversions are on the way.

"I would suspect that right now, over the next 12 months, there could be as many as 2,000 units -- maybe 10 more hotels," he said.

But Savio cautions potential owners of condo-tel units need to do their homework before jumping at a purchase. There should be a homeowners' association, and buyers need to make sure the building has reserves, he said.

Then there's the hotel side of the business.

"It's more than just owning real estate, you are also buying into the business," he said. "You need to make sure it's still going to work well as a hotel. You need to know who owns the lobby and the front desk. All those things are part of what is being sold."

More Outrigger properties could be candidates for conversion although no decision has been made to do that, according to Senior Vice President Mel Kaneshige.

"There are some down on Lewers that may work better as condo-tels. But if they were converted, they would be converted to (individual) hotel rooms that Outrigger would manage," he said.

Savio notes that part of the appeal from a development standpoint is that the conversions are less costly and thereby less risky than building something brand new.

"You have high land prices and high construction costs, plus you're competing with other new projects," he said. "Conversion is certainly safer, the building is already up, you don't have the development costs, and can be in and out of the market fairly quickly."

Outrigger's Kaneshige also said the cost to repair and maintain older hotels can be a factor contributing to the willingness to sell and convert.

"It points out that the off-the-beach hotels are having a more difficult time penciling out because the amount of repair and maintenance to keep them in good shape is enormous," Kaneshige said. "Some buildings also have obsolesce issues that that can't be resolved by new paint and carpet."

Savio predicts some of the older properties on the neighbor islands will soon follow Waikiki's lead. He has been looking at potential candidates.

"There's no question we're looking on other islands," he said.