|

First Sunday Mark Coleman |

CRAIG KOJIMA / CKOJIMA@STARBULLETIN.COM

Adelia Chung, one of Hawaii's top selling life insurance agents, uses her hands to make a point during an interview at her office

Insuring the future

Adelia Chung is one of Hawaii's top sellers of life insurance, and has been since she started in 1981. In 2001, she began a five-year term on the executive committee of the international Million Dollar Round Table, the industry's premier association of qualifying financial professionals, which will culminate with her becoming its president next year. She will be the first person from Hawaii to have that honor, as well as the first woman and the first Asian American.

When MDRT was founded in 1927, membership depended on selling at least $1 million of life insurance in a particular year. These days, the membership requirement has been adjusted for inflation, but meet it for 10 years in a row and you become a life member. Chung has been a life member since 1993. She also is a past president of the Million Dollar Round Table Foundation, the group's charitable arm.

Chung says she originally planned to become an attorney. After graduating from Punahou School in 1975, she earned a bachelor's degree in political science from UCLA, then started taking courses at the University of San Francisco Law School. But while home for vacation in 1981, she went to work in her father's insurance office servicing so-called "orphan" policies -- policies no longer being serviced by the agents who sold them. She did so well that she stuck with it. Now she is a partner with her father in Chung Insurance & Investment Group, which offers not only life insurance but a variety of other financial services as well. Her father, Tai Yau Chung, also is an MDRT life member.

In 1997, Adelia Chung and her husband, Stephen Dung, established the Alana Dung Research Foundation, named after their daughter who died of leukemia at age 3.

CRAIG KOJIMA / CKOJIMA@STARBULLETIN.COM

"Even on the bittersweet side, for the people who have died too young, we have seen the difference life insurance has made in their lives." --Adelia Chung, President-elect, International Million Dollar Round Table

Matters of the heart

Mark Coleman: You are on track to become the first person from Hawaii to be president of the life insurance industry's international Million Dollar Round Table, in 2005. Not only that, you will be the first woman and the first Asian American to lead the group.Adelia Chung: Yes.

MC: I suppose those kinds of "firsts" are strange in a way -- you know, because of what they focus on.

AC: They are. The reality is, those things are true, but it's not because I'm female, and it's not because I'm Asian. I mean, I feel privileged to be able to represent these groups, but it's not like I aspired to set any kind of records or do anything like that.

MC: Right, because ultimately it's not about those kinds of things. It's about what's inside.

AC: Right.

MC: Still, I thought I'd call you because obviously you have had an impact in Hawaii. For example, you have more than 2,000 clients -- people in Hawaii you've set up with their financial future. Is it 3,000 clients yet?

AC: Well, talking about that, I think success can be defined in many ways. Often we're raised to think we always want more, but for me at least, at some point I needed to recognize that I can only do so much. So, no, I'm not striving for 3,000 or 4,000 clients. I feel a strong commitment to the promises I have made and the attempt to fulfill those promises. With this wonderful client base, I have an obligation to service them well, and given the kind of hours I want to work and the lifestyle I want to have, and the attempt to balance things out, really my growth just comes from my existing client base and I work primarily on referrals.

Keeping it personal

MC: So you maintain a personal relationship with your clients through the years?AC: Yes. What drives me really is the relationship. I love people, so to see them achieve is gratifying. Nothing is more gratifying than seeing the plans you helped put in place happen. Part of the joy of being in this business as long as I have is the children that you plan for are now going to college, so it works. Even on the bittersweet side, for the people who have died too young, we have seen the difference life insurance has made in their lives.

MC: You mean for their survivors?

AC: Yes.

MC: At the most simple level, life insurance seems to make a lot of sense: When you die, your beneficiaries get a lump sum of cash that's tax free, which helps them pay the funeral costs, wrap up your affairs, pay off the mortgage or whatever, right?

AC: Right, but it's more than that. We are really a misunderstood industry, because our industry is all about transforming lives and helping people, regardless of what happens.

MC: By protecting them against disaster?

AC: Right. You see, there's basically one of three things that's going to happen to you and me. We're going to either live a long time -- and the odds are that that will happen -- so we work with people in developing retirement plans so that they can have the kind of retirement they want. Second, we could die prematurely, and in that case, that's where the life insurance comes into play, because then you could leave a legacy for your family or charities that you care about. Then the third thing that could happen is that you could become disabled. So basically our goal is to create for you a financial foundation so that, regardless of what happens, the people you love are protected. And that's not a one-shot deal, because it's evolving, right? There will be children, there will be new organizations you care about. My dad (Tai Yau Chung) once told me -- and this is really true -- he said if someone won the lottery of a million dollars, the average person would say, I'll invest half-million and I'll take the other half-million and save it so when I die, maybe my family can have it. But if they understood the power of life insurance, what they would do is buy a million-dollar life insurance policy, pay the premium and when they die, they leave a million dollars, right?

MC: Yeah.

AC: So it's really about leveraging what you have. And what has become really fascinating for me is this whole area of charitable giving.

MC: Through life insurance?

AC: Right. For example, each of us has organizations we care about, whether it's your high school, your college or some medical research institute. So, for example, you could make an annual gift to that charity, and it would be appreciated -- no one would say they don't want a thousand-dollar gift -- but the reality is, a thousand dollars doesn't go that far today. So what you could do instead is buy a life insurance policy. We're all going to die one day. And there are ways to do it so you still get the tax deduction today. But when you die, instead of leaving $5,000, you could leave $100,000.

MC: And that's OK with the IRS?

AC: It is!

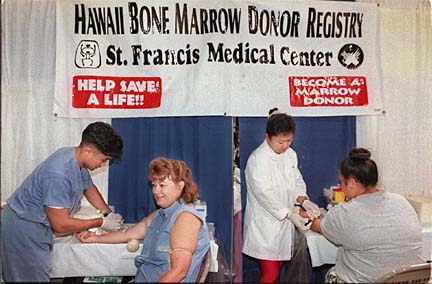

STAR-BULLETIN

Thousands of people responded to pleas for bone marrow donations in an effort to save Alana Dung. The Bone Marrow Donor Registry continued the battle to find matches for patients in need in November 1997, a month after Alana died from leukemia.

Merely a messenger

MC: Speaking of charities, I didn't know you were Alana Dung's mother until I read some background information about you. Alana, of course, died of leukemia in 1997 at age 3, not long after which you and your husband set up the Alana Dung Research Foundation, to fund medical research. Plus, because of your daughter, you got thousands of people to register with the Hawaii Bone Marrow Registry, and actually matched 65 donors with patients in need -- though, unfortunately, none with Alana. I think that is an incredible achievement.AC: We were merely a messenger.

MC: Are you still involved with the Hawaii Bone Marrow Registry?

AC: Yes, we continue to encourage people to register. But after Alana's death, as a result of that entire experience, and having moved to Seattle and having spent some time at a research institution there (so Alana could receive treatment), we really felt like she had inspired us and opened up a whole new world to us. We wanted to do something, so we created the Alana Dung Research Foundation.

MC: Does the foundation focus on leukemia?

AC: No. All things you learn in basic science are applicable, whether it's cancer or Parkinson's disease. Our most recent grant was to the Kapiolani Foundation, which is looking at breast cancer. We have sponsored a visiting professorship with the University of Hawaii Medical School. We also support a fellow at the Fred Hutchinson Cancer Research Center (where Alana received treatment in Seattle).

MC: Where does the foundation get its income?

AC: The spirit and the generosity of this community. Every few years we do a major fund-raiser. We did one last October, and we have one slated for October 2004.

MC: What goes on?

AC: It's a celebration of love. At our last fund-raiser, we invited the individuals who had become bone-marrow donors, and it was just an incredible experience.

MC: Do people pay money to attend?

AC: Yes. It's a dinner. And to meet these individuals who come from all walks of life, of all economic backgrounds ... these are chosen people because they have given others a second chance at life.

Learning from children

MC: What does your husband do?AC: Stephen now is manager of security for Servco. But he's a retired HPD guy. The last 12 years or so he spent in homicide.

MC: And your other children are how old now?

AC: We have a 14-year-old, Spencer, and then three years ago we adopted a little girl from China, Erin. She's 6 years old. We adopted an older child because they're a little harder to place because everyone wants infants, and Steve and I had decided we didn't need sleepless nights and toilet training to feel fulfilled. (Laughs). She's been another incredible gift.

MC: Adoption is another area of human compassion and making an impact on people's lives.

AC: Children can teach you so much if you're open to it. Alana taught us a lot about courage and strength. And Erin's teaching us about the simple joys in life, because having come from a place where there wasn't much, she embraces some of the simplest things, and she's a constant reminder to us that life is a precious gift and we don't need a lot of the other things that we complicate our lives with.

STAR-BULLETIN

Alana Dung sat with her parents, Adelia Chung and Stephen Dung in 1996.

Leader of the pack

MC: As president of the Million Dollar Round Table, what will you be charged with?AC: I will have the privilege, really, of representing our membership internationally.

MC: Making speeches?

AC: Right. And getting to know our members.

MC: Are you obligated to travel a lot?

AC: Not obligated, but there will be that opportunity to travel and it's always a joy because I'm always fascinated by the universality of what we do, even though there may be cultural and language differences. We have about 28,000 members in 60 different countries. At my first MDRT meeting, there were people from countries I never knew even existed.

MC: Is MDRT involved in lobbying for laws?

AC: No, we are strictly focused on ethics, productivity and providing education opportunities. But there is an organization, called NAIFA (the National Association of Insurance and Financial Advisors) that does the political advocacy.

MC: And what does its thrust tend to be, tweaking licensing laws and things like that?

AC: Well, life insurance is state regulated. That's why you need state licensing.

MC: What's a political issue right now for the life insurance industry at the state Legislature?

AC: Well, one of them was long-term care. The governor had proposed a state tax credit for those who purchase long-term care.

MC: What was the position of the organization on that?

AC: I wasn't intimately involved, so I don't want to give you NAIFA's position, but my position was that Governor Lingle's proposal for a state tax credit would've been a step in the right direction because as individuals I think it's important that we plan for our own future. And to the degree that we can motivate individuals to provide for their own financial security, the better off we as a state will be.

MC: I agree. I'm in favor of tax credits for everything. (Laughs). Of course, there's the other view, advanced by Lowell Kalapa (of the Tax Foundation of Hawaii), that you shouldn't use the tax system to manipulate social behavior.

AC: Right, but if you think about the reality of long-term care and what it's going to cost, it's a burden that this government can't bear.

MC: A lot of people just eat right through their savings in their last years because they need it to take care of themselves.

AC: Right, and it doesn't need to be that way.

See the Columnists section for some past articles.

Mark Coleman's conversations with people who have had an impact on our community appear on the first Sunday of every month. If you have a comment or suggestion, please send it to mcoleman@starbulletin.com.