Wall Street’s technology

rebound has lifted

stock pickers‘ fortunes

Investors have been letting down their guard this year, and one only has to look as far as technology stocks to see the reason why.

It may not be 1999 all over again, but the beaten-down sector has snapped back with strong gains while defensive issues like health, food and military-related stocks have languished.

Consequently, the local stock experts who made a bet on technology at the start of 2003 are sitting pretty at the third-quarter mark of the Star-Bulletin's annual survey of investment ideas.

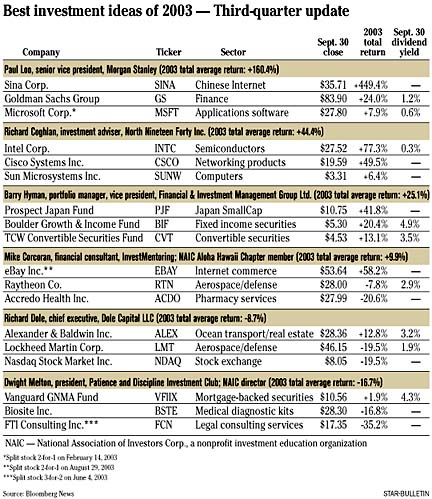

Paul Loo, senior vice president of financial services firm Morgan Stanley in Honolulu, continued to pull away from the pack as he posted an average total return, which includes reinvested dividends, of 160.4 percent for his three stock picks. The standout stock, without question, was Chinese Internet provider Sina Corp., which has rocketed nearly 450 percent this year and is easily the best performer among the 18 selections by the six Hawaii experts.

Hilo investment adviser Richard Coghlan of North Nineteen Forty Inc., who put his faith in three tech stocks, was second as of Sept. 30 with an average 44.4 percent return.

Barry Hyman, vice president of Financial & Investment Management Group Ltd. in Wailuku, Maui, was third with an average 25.1 percent gain. He was followed by InvestMentoring financial consultant Mike Corcoran, 9.9 percent; Richard Dole, chief executive officer of investment banking firm Dole Capital LLC, minus 8.7 percent; and Dwight Melton, a National Association of Investors Corp. Aloha Hawaii Chapter director, minus 16.7 percent.

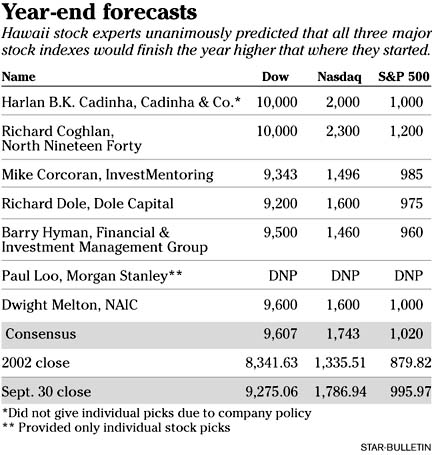

As a group, the six stock pickers had a 35.7 percent return. On a total return basis, that beat the nine-month gains of the Nasdaq composite index, 34.3 percent; Standard & Poor's 500 index, 14.7 percent; and Dow Jones industrial average, 13.1 percent.

"Inasmuch as I publicly stated that the 3-year-old bear (market) ended October 2002 and was reconfirmed March 2003, the recent strength (in the market) has not surprised me at all as the economy turned away from amazing pessimism," said Loo, who has invested in the market for more than 50 years.

Loo, whose stock picks are from his own trading portfolio and aren't necessarily recommended by his firm, had the only triple-digit percentage gainer in Sina, which as of Sept. 30 had risen 1,789 percent from its 52-week closing low of $1.89 on Oct. 9, 2002. Sina, which sells short messages, music and news to China's cell-phone users and provides online games, started this year at $6.50.

"The enthusiasm of China network stocks is warranted for the long-term growth of China," Loo said of a country economists are forecasting to grow 8.5 percent this year. "Since, however, many (China Internet stocks such as rivals Netease.com Inc. and Sohu.com Inc.) are up from single-digit lows and a fair amount of profit-taking from insiders appears to be happening, for the short term they are probably in need of consolidation at this point."

Among his other picks, Loo said Goldman Sachs Group (up 24 percent) continues to represent the turnaround in investment banking and Microsoft Corp. (up 7.9 percent), is a "blue chip" technology stock that recently increased its dividend.

"(Both) continue to be core holdings," Loo said.

Coghlan said investing in tech stocks at the beginning of the year was a "no-brainer" because as a value investor he said "this presented an opportunity to invest in great companies at their lowest market valuations in a decade."

In fact, on a share-weighted basis, Coghlan had the best return of the experts at 58.9 percent. He was followed by Loo, 49.3 percent; Corcoran, 29.8 percent; Hyman, 28.6 percent, Dole, minus 10.6 percent; and Melton, minus 27.5 percent. The share-weighted formula assumes each expert bought 100 shares of each of their picks, regardless of price. It prevents averages being skewed by a big gain or loss in one individual stock.

One of his tech picks, Intel Corp. (up 77.3 percent), is the best performer in the Dow this year while networking giant Cisco Systems Inc. (up 49.5 percent) has seen its business stabilize and recently increased its share buyback plan by as much as $7 billion to a potential $20 billion. Sun Microsystems Inc., a server-computer maker that has fallen upon hard times, has gained just 6.4 percent. Coghlan still likes Intel and Cisco but said he has concerns about Sun.

Coghlan sees the stock market adding to its gains before the year is out, but cautioned there are some land mines to overcome. "I have a nagging feeling that at some point our record federal deficit and continued military occupation in the Middle East is going to impact investor sentiment in a negative way," Coghlan said. "But if the Federal Reserve keeps interest rates low, the bond market remains week and S&P earnings continue to rise, then the stock market should continue on course to year-end."

Hyman, who was on vacation and unavailable to comment, has long been a proponent of Prospect Japan Fund Ltd. (up 41.8 percent), which is managed by Hawaii Kai resident Curtis Freeze and trades on the London Stock Exchange. His other choices, both closed-end funds, had respectable returns as Boulder Growth & Income Fund Inc. gained 20.4 percent and TWC Convertible Securities Fund rose 13.1 percent.

Corcoran, who stayed on the defensive by picking a defense stock and a health company, enjoyed his best return from his one tech selection, eBay Inc., which gained 58.2 percent and split its stock 2-for-1 in August. His other choices, Raytheon Co., maker of the Patriot missile, fell 7.8 percent, and Accredo Health Inc., a pharmacy benefit company, lost 20.6 percent but rebounded to $27.99 at the end of the third quarter after hitting a year low of $11.95 in April following a low earnings forecast.

"Accredo is firmly on the road to recovery," Corcoran said. "Their latest quarterly report showed earnings per share doubled over the period from last year. Going forward, it has raised its 2004 revenue and earnings guidance."

Corcoran, who had predicted the Dow to end this year at 9,343, has now changed his tune since the blue-chip index ended September at 9,275.

"I expect a robust fourth quarter after we get through the usual October blues," he said.

Dole's top pick and only winner is a local company, Alexander & Baldwin Inc., the parent of Matson Navigation Co. A&B had a total return of 12.8 percent through the first nine months while Dole's other choices, Lockheed Martin Corp. and the Nasdaq Stock Market Inc., each declined 19.5 percent.

"A&B suffered with the Hawaii economy, and should be a beneficiary of the current strong Hawaii economy, particularly in its construction shipping business," Dole said. "An unexpected negative is its new fight with the state of Hawaii over water rights. This issue is taking away from its positives."

Dole still likes Lockheed Martin, which recently raised its dividend 83 percent. "Lockheed Martin is a defense stock, but it is also an infrastructure company, which should benefit from government outlays for security and other related domestic matters," he said.

Dole still likes the Nasdaq Stock Market as well, although he acknowledges that the stock, which trades on the Over-the-Counter Bulletin Board, stumbled under its old management. Newly appointed leadership, he said, should steer the shares in the right direction.

Melton, who was the leading stock picker after the first quarter, has seen his selections head south. FTI Consulting Inc., a legal consulting services firm, has plunged 35.2 percent -- the worst performance among all the stock selections -- while Biosite Inc., a medical diagnostic device company, has fallen 16.8 percent.

Only Melton's conservative play, the Vanguard Ginnie Mae Fund, is in positive territory with a 1.9 percent return.

Melton, who has owned all three picks in his own portfolio this year, said one drawback of the Star-Bulletin survey is that it doesn't take into account writing covered calls. Melton said he wrote a covered call on Biosite this year that generated $578 in premium income and received $385 in premium income this year from writing three covered calls on FTI Consulting.

In the options strategy of writing covered calls, a covered writer must own the underlying common stock but is willing to give up price increases in excess of the option strike price in return for the premium.

"This premium income reduces the unrealized loss on the position," said Melton, who uses stock trend lines and rankings from investment services company Value Line Inc. to make his selections.

Melton said he still likes Biosite but would not make any purchases because its Value Line timeliness ranking has dropped and, as for FTI Consulting, he said the stock has fallen out of favor with investors.

"The trend-following approach to stock market investing is a proven strategy," Melton said. "The way this (Star-Bulletin) stock market game is structured, you don't have the ability to change your holdings as you do in real life. The premium income received from writing covered calls are not computed in the total return. These two factors make it difficult to show the real power of my trend-following approach."