RICHARD WALKER / RWALKER@STARBULLETIN.COM

New homes are selling faster than they can be built. These are under construction near Kapolei.

Construction lags

demand for homesSales slowed for the second month

in July, but developers say lack

of inventory is the only obstacle

The pace of sales contracts on new homes appears to be slowing as the number signed in July fell for the second month in a row.

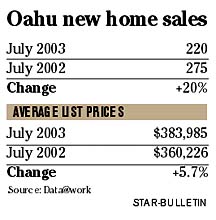

Developer sales fell by 55 units or 20 percent to 220 sales last month, compared to July of last year when 275 new sales contracts were initiated, according to Data@work.

Real estate analyst Ricky Cassiday said the fall corresponded with the drop in the number of available units and the number of new projects being marketed. In July 2002, there were 1,283 available units. Last month there were just 595, a drop of 54 percent. Similarly, the number of new projects marketed fell from 39 last July to 34 last month.

Cassiday attributes the drop to developers' inability to keep up with demand.

"The building side is the real reason. Sales go down when you don't have things to sell. It's on the supply side, not the demand," he said.

Schuler Homes Hawaii Vice President Mary Flood said her company had intentionally slowed the pace of its sales recently by releasing fewer homes.

"In some of our subdivisions, we are nine to 12 months out in delivering some our new homes. We decided we wanted to decrease the gap between sales and delivery," she said.

Schuler continues to see strong demand, as demonstrated in recent lotteries for homes, she said.

"We held couple of lotteries recently. At our HighPointe project in Makakilo we had 129 people for 8 homes. On Maui, when we opened the Legends, we had over 300 people for 12 homes. So we have not seen a slow down," she said.

Likewise, the recent increases in interest rates have yet to impact the company's new home projects, Flood said.

"Rising interest rates hasn't affected our traffic or our buyers. It continues to be consistent with what it has been over the last year," she said.

At Castle & Cooke, Vice president for Sales and Marketing Bruce Barrett said sales for the company are up 25 percent year to date but were down 7 percent in July from the same month last year.

"We had 70 sales last year in July, this year we had 65, so for us we are still at a high level," Barrett said.

Barrett also noted that contract closings year to date were up 40 percent.

The problem is keeping up with demand, he said.

Right now it's taking six to seven months to deliver a home, he said.

Like Schuler's Flood, Barrett has seen no impact from the recent rise in interest rates but that could change if they edge up around the 7 percent range, he said.

"If interest rates crossed the 7 percent threshold, then I do think we'd see some immediate impact," he said.

Average sales prices for new homes showed a smaller year-over-year increase last month than the jump recorded in July of 2002.

Average prices went from $363,226 in July 2002 to $383,985 in July 2003, a gain of $20,759, or 5.7 percent. However, in July 2002, prices had jumped more than 27 percent over the same month the year before.

The number of completed home sales, which typically are behind the number of new contracts initiated, grew by 47 units to a total of 184 closings compared to July 2002's 137 closings.

The best selling projects in July were Castle & Cooke's II Vista multifamily units, with 13 sales, and The Renaissance, also by Castle & Cooke, with 26 single-family home sales, according to Data@work.