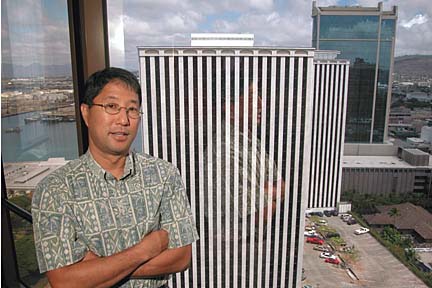

CRAIG T. KOJIMA / CKOJIMA@STARBULLETIN.COM

Cid H. Inouye has been named chairman of the board for Junior Achievement of Hawaii.

[ INSIDE HAWAII INC. ]

Inouye helps

juniors achieve

Cid H. Inouye

Board post: Chairman of the board of Junior Achievement of HawaiiDay job: Partner at Reinwald O'Connor & Playdon.

Other JA officers: Vice Chairman for Board Development Peter T. Kashiwa; Vice Chairman for Education Craig Matsuda; Vice Chairman for Resource Development Robert Schuster; Secretary Willis H. Sanburn; Chairman-Elect Steven J. Teruya; and Treasurer Marcia Wolff.

New JA directors: Carrie Y. Ashimine, Kristine Castagnaro, Joan H. Ching, Benjamin A. Nakaoka, George Szigeti, Cindy Thomas, Rick Towill, James R. Wills Jr., Ryan Wong, and Jerel Yamamoto. Yamamoto also serves as Hawaii Island district board chair and Jeannie Wenger serves as the organization's Maui district board chair.

Junior Achievement: Offers economic and financial education to primary and secondary school students. Presently has programs at 70 Hawaii campuses, 50 percent of them elementary schools. To volunteer, call Program Manager Carol Kettner at 545-1777, ext. 12.

How did you get involved in Junior Achievement?

I first got involved as a teacher. I taught classes way back when I was an associate working at this law firm. I've been with the firm about 16 years, so that was probably about 14 years ago. One of the partners, John Hoskins, was on the board and he recruited me to teach. At some point he was leaving the board and he asked me to serve as his replacement.What level did you teach?

I taught in fifth or sixth grade. They have a curriculum that the teachers deliver. Junior Achievement trains the teachers. But what we try to do is get people from the community that have business experience to integrate that experience with the pre-set curriculum.What kinds of innovations did you make?

I talked about my experiences as an attorney, because I think we're also there to be role models for the kids. And in one of the exercises, I asked them what they thought they were going to do after high school. We looked at whether they were going to be able to go to work at McDonald's and still be able to afford their lifestyle. We went through how much are you going to make? Are you going to have an apartment? Are you going o own a car? How much is that going to cost? They quickly learned they were not going to be able afford the apartment and the car and work at McDonald's.What are your goals as chair?

We're not really an organization that has a lot of emotional appeal like the American Heart Association or the Cancer Society, but we provide a lot of value to the community. I want to bring that back out to the forefront. We have a lot of really good board members now and we're heading in the right direction.How would you characterize the quality of business and financial education in Hawaii, K-12?

There's not a lot of programs that emphasize business education and that's why we're here. We provide something that's not available to kids otherwise.What would allow Junior Achievement to make more of a difference?

Junior Achievement has some new programs out there that it offers and we're seeking to see that they get implemented in Hawaii schools. They are really cutting edge programs that require computer infrastructure. I think they'll be very effective.Folks are going to learn about this stuff when they get out in the world of work, why push it in school?

It's important to introduce kids to business and economic education early on because they're going to be much better equipped to function in the work world. Some people will get a certain amount of economic education in the real world, but not everybody will. That's one of the reasons we've got such a problem with credit card debt and other issues.Was there a "eureka" moment in your own life where understanding a finance or business issue set you on a different path?

I was lucky. My parents were pretty good about exposing us to financial issues and the concepts of saving from an early age. I worked when I was in high school for my father's company doing various jobs, he was a local contractor. I saved that money. At the time (certificates of deposit) were paying 12 percent, 13 percent, 14 percent, 15 percent, even 16 percent. I was banking the money and putting it into CDs and I saw how that money grew. That helped me learn the value of managing your money and investing it and seeing your money grow. I was lucky to have that experience. As a result I had a nest egg to use when I got out of school.

Inside Hawaii Inc. is a conversation with a member of the Hawaii business community who has changed jobs, been elected to a board or been recognized for accomplishments. Send questions and comments to business@starbulletin.com.