[ HAWAII AT WORK ]

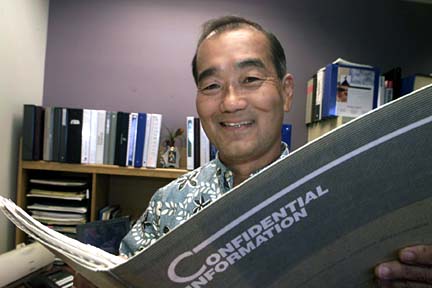

DENNIS ODA / DODA@STARBULLETIN.COM

Goose,

golden egg

are safeGary Kawamura helps

provide safeguards

with disability insuranceAfter teaching art at a high school for 10 years, I never imagined that I would be selling disability insurance today. I loved teaching art, and besides, I had a hard time selling the few chili tickets my kids brought home when they were young.

I have now been in the insurance business for more than 22 years, with the last 15 years specializing in disability insurance. Today, I'm very thankful for my job -- after all, who wouldn't feel good about helping people?

I am presently with the Guardian Life Insurance Co. of America. Although I sell life insurance, mutual funds and annuities, I find it most satisfying helping people with their disability insurance needs. Since statistically there is a three times greater chance that my clients will be disabled than die before age 65, I'm more likely to see them collect on their disability than their life insurance policies. It gives me great satisfaction to see my disabled clients collect money from the insurance company. That's what my job is all about.

I tell my clients, especially the professionals and business owners, how important it is to protect the goose as well as the golden eggs. As business owners they have overhead expenses and business loans that can drain their savings in just a few months.

Although there has been a lot of publicity about the financial tragedy of disability, there has been very little said about how to protect oneself. In my work I see a lot of misconceptions and confusion about disability insurance. My job is to help my clients choose the appropriate plans and to make them aware of what their existing plans do and do not cover. Then I can help them get the best plan in place before a disability occurs.

I have to smile when I recall delivering the first disability claims check to one of my clients, a medical professional. When he bought his first policy, he chuckled and commented about how he would never collect because he was so healthy. Later, after he bought his second policy, he again joked about how healthy he was. Just 11 months after the second policy was purchased, he became totally disabled. His first policy kept him out of debt by paying his business overhead expenses until he was able to sell his practice. The second policy is still paying him tax-free benefits today, and should his disability continue to age 65, he will collect more than $500,000.

Whenever I see those blue and white signs with the man in the wheelchair, I'm reminded of how important my job is.

"Hawaii at Work" features tells what people do for a living in their own words. Send submissions to business@starbulletin.com