HMSA will ask

for rate increaseThe isle health insurer plans

to submit its proposal to the state

for a rate hike in January

Unexpectedly higher health care costs, driven by Hawaii's aging population, as well as a $2.1 million net loss in the second quarter, have prompted Hawaii's largest health insurer to consider a rate increase that could take effect in January.

The exact increase has not been determined, though the Hawaii Medical Service Association's health care costs have risen 11.6 percent this year, to nearly $650 million in the first half of the year from $581.6 million in the first half of last year. Of the revenue HMSA receives from premiums, more than 93 percent paid for health care services.

When HMSA requested a small-business rate increase of 11.5 percent beginning in July, it thought medical inflation would be around 8.5 percent. HMSA received approval for a 9.9 percent rate increase, which took effect July 1, and medical inflation has proven to be higher.

HMSA plans to submit proposed rate increases to the state Insurance Commission by the end of this month covering 140 of Hawaii's larger employers, companies with more than 100 employees that have their contracts coming up for renewal at the end of the year. Also, individual consumer plans will come up in January, and they will face increased rates, as will some small businesses.

An additional 160 large employers will see rates increase when their memberships come up for renewal throughout next year.

"Health care trends continue to go up," said Steve Van Ribbink, senior vice president and chief financial officer of HMSA. He said the average rate increase could be around 10 percent to 12 percent, but he noted that was a guess.

The state will have 90 days to review and approve the rate increases, under a recently passed state law.

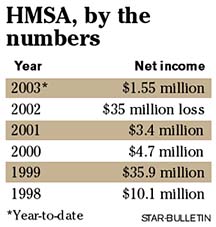

HMSA announced yesterday that it had a $2.1 million net loss in the second quarter, compared with a $17.5 million net loss in the same period last year. The insurer's operating loss widened to $11.2 million from $8.5 million. HMSA has not had an operating gain since 1997.

Last year, HMSA lost nearly $35 million.

In-patient hospital costs are a major factor, though hospital admissions have remained stable, Van Ribbink said.

Investment gains helped the insurer's financial picture this year. Investments gained $8.3 million in the second quarter, compared to a loss of $9.1 million last year.

HMSA's portfolio has had a 5.7 percent return so far this year, Van Ribbink said.

HMSA has 670,000 members in Hawaii, and membership increased 3.9 percent from last year.

Van Ribbink said HMSA's financial picture is likely to improve in the second half of this year, because of the small-business rate increase, though operating losses will likely continue through next year.

HMSA had administrative expenses of $28.1 million in the second quarter, or 8.2 percent of its revenue. A nonprofit member of the Blue Cross and Blue Shield Association, HMSA took in $347.3 million in medical premiums.

HMSA's reserves stood at $424.6 million as of June 30, up 5.3 percent from $403.3 million the year before.

Separately, insurer University Health Alliance reported a year-to-date profit of $2.7 million yesterday, and said it hopes to be removed from supervision by the state Insurance Division.

UHA, a nonprofit mutual benefit society founded in 1996, was placed under a rehabilitative order in July 2001 after failing to bring its reserves to minimum required levels. UHA has now exceeded the required levels.

UHA cut administrative costs, moderated expenses and increased premiums, though its membership has dropped to around 25,000 members from 30,000. UHA had net income of $650,000 last year.