A forum for Hawaii's

business community to discuss

current events and issues

» Rebuilding Hawaii starts with children's education » Internet misuse can be costly to employers » Down economy can prompt changes in estate planning

BACK TO TOP |

ILLUSTRATION BY DAVID SWANN / DSWANN@STARBULLETIN.COM

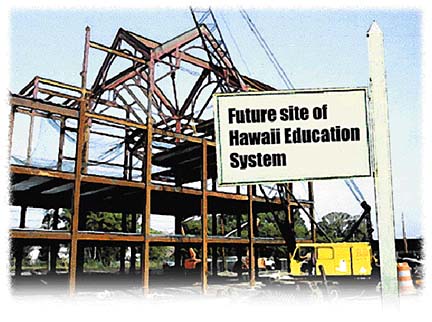

Rebuilding Hawaii starts

with children’s education

So how do we rebuild Hawaii's economy? So many people have come up with visions and ideas to move us into the 21st century.

Among these thoughts which have been talked about for decades are cut government, tax the pensions of our seniors, privatize certain government functions, sell or master lease state lands, promote gambling and a lottery, reduce the general excise tax, have a sales tax in addition to other new taxes, increase ecotourism spending and promotion, diversify business through high technology, reform the state's employee retirement system, and make Hawaii the medical center of the Pacific.

All sound well and good, but each reform requires politicking and will take years just to reach consensus, let alone implement, and decades to yield results.

So what do I think? We need to reconstruct and rebuild our basic education infrastructure. We all agree our children are our future, but they are presently leaving our land in droves because of lack of quality jobs.

And our economic growth has been virtually nonexistent for over a decade. We also agree we want and need to uphold the Aloha spirit, which makes us so unique to the rest of the world. And we want to preserve the beauty of our islands as many of us stay here because of our gentle environment.

Given these important goals, all things begin with education.

No one would consciously buy or build a house without first making sure the foundation and structure were strong and sound. If the plumbing or electrical systems were inadequate, or their were termites throughout the building, these things would be immediately restored or rebuilt.

So, then, why do we allow substandard physical conditions and inadequate teaching salaries and programs to exist in our public schools and library system?

Education is the incubator of new and diversified thoughts, and future economic growth. Silicon Valley is a proverbial stone's throw from Stanford University. Do you think that was an accident of fate?

Education gives people hope and creates a future. Recent polling showed Hawaii residents are more concerned about getting the economy moving again than about rebuilding education, but without a strong educational system, we will never have true expanded growth outside of tourism and its ancillary businesses.

There are still jobs for our young people in this arena, but these jobs pay relatively low wages and force our young into a certain level of income and status. What happens when they do not want these kinds of jobs? The alternative has been to work for government, but we cannot continue to support this type of job growth.

These alternatives are not enough to offer our young people. Many of our children do not want a life servicing visitors. This form of plantation existence has no appeal to them.

So we need to do better. We are the caretakers of their future. The great anthropologist, Margaret Mead once said, "Never under estimate the power of people who wish to change the future."

Benjamin Franklin understood the way to control government and thereby stop dictatorships or oligarchies was to have an educated populace, so he created the public library system.

Rebuilding education will take some time, but the effects will be immediate with our children. Education is a safeguard of liberty and gives us the ability to revitalize government and the economy.

It gives us all -- particularity our young people -- the freedom to think, to dream and to create a better world.

Stephany L. Sofos is the owner of SL Sofos and Co. and a licensed broker and appraiser. She can be reached at stephany@slsofos.com.

BACK TO TOP |

[ ON TECHNOLOGY ]

Internet misuse can

be costly to employers

First of two parts By now everyone knows that the public Internet is not always an appropriate place to hang out. In the early days of the World Wide Web my main concern with employee use was focused on discovering and eliminating malicious code such as viruses, worms and other insidious items from files, mail, mail attachments, etc.

While searching for viruses and the like is still a worthy pursuit, the world has gotten more complex, and employers have even more to worry about when protecting their assets. What's on the minds of many IT managers are the dangers inherent in "cyberslacking" -- employees spending an inordinate amount of time online in nonproductive or irresponsible pursuits.

The problem is a lot more pervasive than workers sending out a few personal e-mails during the lunch hour. According to a recent Georgia Tech study, employees spend only 36 percent of their time on the Internet doing work-related activities. An IDC Research/Harris Interactive poll reports that the average employee spends more than 8.3 hours a week -- a full workday -- on non-work-related Internet use. Lost productivity related to Internet misuse at work easily runs into the tens of billions of dollars a year.

Unfortunately, wasted time is just one of the issues employers need to think about when it comes to cyberslacking. Consider that only about 16 percent of U.S. households have high-speed Internet access, whereas almost 60 percent of employees currently have high-speed Internet access in the workplace. Workers take advantage of high-speed connections at the office to download music files, video files and other broadband entertainment more frequently than they would at home.

Think of large numbers of employees running streaming applications for Internet radio, stock and news tickers. If you consider that streaming a 30-minute Webcast to be the equivalent of downloading the entire Encyclopedia Britannica onto a network, you begin to get an idea of how non-work-related use of bandwidth can slow company networks.

Then there are legal issues to consider. In the old days off-color jokes were confined to the water cooler or perhaps lewd pictures were duplicated on office Xerox machines. Nowadays, employees are logging onto Web sites that promote hate groups, pornography, gambling and other illegal or offensive activities.

Even a cursory look at X-rated material by an offended co-worker might result in an expensive lawsuit. When you consider that a single workplace lawsuit can costs hundreds of thousands of dollars in legal fees, it's not difficult to comprehend how important it is to stem the flow of unwanted material into your office cubicles.

Finally, untrammeled use of the Web at work raises security issues. It was employee browsing of infected Web sites that unwittingly spread the Nimda worm from company Internet servers to outside computers. This is not unusual with blended viruses such as Nimda, because Web-based worms often are hidden on harmless Web sites that employees might visit daily.

What's the solution?

Business managers need to come to terms with their employees' abuse of the Internet and follow up by deploying some form of filtering, or as we say in the industry, "content inspection." After deciding to implement this technology, you need to define precisely what you hope to accomplish. Are your objectives to free bandwidth, protect information assets or monitor acceptable use? All of these entail slightly different technologies. Next time, we'll examine more closely what goes into content inspection and what you'll need to know before you deploy it.

John Agsalud is the president of ISDI, a Honolulu-based IT outsourcing, systems integration and consulting firm. He can be reached at jagsalud@isdi-hi.com or by calling 944 8742.

BACK TO TOP |

[ YOUR ESTATE MATTERS ]

Down economy can

prompt changes in

estate planning

A poor economy puts a different spin on planning. It is likely many of your assets have decreased in value. Interest rates are low. The size of your overall estate may be smaller than it once was. All of these factors should be considered as you evaluate or re-evaluate planning options.

In a poor economy, many assets decrease substantially in value. After the tech boom, many companies lost the vast majority of their market capitalization, resulting in steep declines in share prices. If you have such assets that you expect will rebound, now may be the time to gift them to an irrevocable trust. Their value for gift tax purposes is much lower now, allowing you to gift more shares for the same gift tax value.

Conversely, a down economy may not be the time to gift such assets to charity. The low value of the assets would translate to a smaller charitable deduction. Further, one of the advantages of a common charitable giving strategy, the charitable remainder trust, or "CRT," is to shield the gain in the asset from capital gain. If the asset has dropped in value, you may have less gain or even a loss.

Historically, low interest rates accompany a down economy. Low interest rates make some strategies more attractive while others less attractive.

Grantor retained annuity trusts, or "GRATs," work well with low interest rates. With a GRAT, you retain a right to payments and the remainder goes to your beneficiaries.

For example, you put $100,000 in trust for 20 years. Each year it pays you $7,000 and at the end it goes to your beneficiaries. If the interest rate used were 4 percent, you would have made a gift of less than $5,000. However, if the interest rate were 8 percent you would have made a gift of more than $31,000.

Conversely, a CRT works better in a high interest rate environment. Let's say you put $100,000 in a trust that pays a charity $7,000 each year for 20 years and then you or your beneficiaries get what remains in the trust.

If the interest rate were 4 percent, you would get a charitable deduction of less than $5,000, while an 8 percent interest rate would result in a charitable deduction of more than $31,000.

As asset values and interest rates change, it is important to re-evaluate your estate plan. Strategies that were ruled out a few years ago may work well now. Similarly, plans that you made a few years ago may no longer work the way originally intended.

For example, let's say you have two adult children, a son and a daughter. You had two major assets, some stock in the company from which you retired and your home. A few years ago they were each worth about the same.

So, you drafted your estate plan to give your son the stock and your daughter the house. At the time, it seemed fair and your daughter loved the house while your son had his own that he liked. Over the intervening years, the stock dropped to one-fourth its value while your home doubled in value. Without reconsidering the plan in light of these changed values, your son would get only one-ninth of your estate and your daughter would get eight-ninths.

A down economy can change the relative value of different estate planning strategies as well as change the effectiveness of existing plans. A qualified estate planning attorney can help you formulate a plan that takes advantage of the down economy while anticipating future upswings.

Attorneys Judith Sterling and Michelle Tucker are partners in the Honolulu law firm of Sterling & Tucker. Reach them through www.sterlingandtucker.com or www.hawaiielderlaw.com, or by calling 531-5391.

To participate in the Think Inc. discussion, e-mail your comments to business@starbulletin.com; fax them to 529-4750; or mail them to Think Inc., Honolulu Star-Bulletin, 7 Waterfront Plaza, Suite 210, 500 Ala Moana, Honolulu, Hawaii 96813. Anonymous submissions will be discarded.