DENNIS ODA / DODA@STARBULLETIN.COM

The Case Middle School construction site on the Punahou campus served as the backdrop for yesterday's presentation of the Business Banking Council's semiannual confidence survey. Participants included, from left, Brian Awakuni, president of the Masonry Institute of Hawaii; Russell Young, president and chief executive officer of Albert C. Kobayashi; John Arizumi, president of Carrier Hawaii; Myron Nakata, president and CEO of Acutron Co. Inc.; Riley Mende, vice president and manager of commercial banking with American Savings Bank and Barbara Ankersmit, president of QMark Research & Polling.

Firms gain confidence

A survey by the Business Banking Council

finds 25 percent of local companies

added staff over the past year

One-quarter of Hawaii businesses increased their staffing levels during the past 12 months as confidence that the state economy is improving reached its highest level since the peak of the bull market.

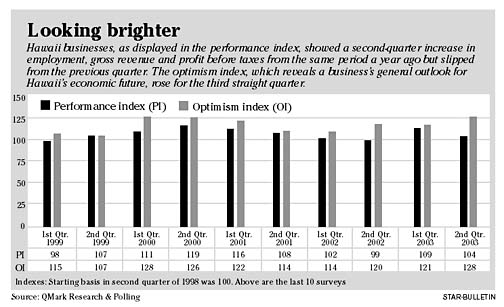

The Business Banking Council's semiannual survey, which uses several metrics to keep a pulse on Hawaii's business environment, showed that optimism in the second quarter of 2003 rose for the third straight survey period and matched its highest mark ever since the index was established in the second quarter of 1998. The 128 reading equaled the total that was achieved in the first quarter of 2000.

The performance index, measuring changes in employment, gross revenue and profit before taxes, slipped to 104 from 109 in the first quarter but was up from 99 a year ago.

Results of the survey, which this year focused on the construction industry, were released yesterday during a news conference at Punahou School in a room overlooking the Case Middle School construction site.

Thirty-eight percent of the respondents said they expected things to improve in the coming year while 51 percent expect things to remain the same and 9 percent are anticipating things to get worse. The number expecting improvement was the second-highest percentage ever in the 12 surveys that have been taken and was the highest mark since 39 percent expressed optimism in the second quarter of 2000.

One of the most encouraging signs that business may be picking up is that 25 percent of the companies polled increased their work force over the last year. Fifty-three percent said staffing levels have remained unchanged over the past year while 22 percent reduced their number of employees.

It was the biggest gain in work-force hires since a 27 percent increase in the second quarter of 2000 and represented the second-biggest gain ever.

The survey, conducted by QMark Research & Polling and sponsored by American Savings Bank, was based on 400 random interviews conducted from July 3 to July 16. It divided the businesses into groups based on size and equally weighted the answers. At the conclusion of the sampling, an additional 59 interviews were conducted among building industry-related companies in order to satisfy the 100-company minimum for the construction survey. The survey results have a margin of error of plus or minus 5 percent.

In a sign that the construction industry is benefiting from the improving economy, the performance index of the building industry posted a 118 reading, 14 points above the 104 scored by the overall index. The building industry's 127 mark in the optimism index was just one point below the 128 level of the overall index.

QMark President Barbara Ankersmit attributed the strong reading in the building industry's performance index to the fact that 42 percent of the construction-related businesses had revenue growth of 5 percent or more over the past year and only 25 percent had no growth or lost revenue. Altogether, 72 percent of the businesses had some type of revenue growth.

"That's pretty much a healthy industry," Ankersmit said.

In 2001, the last time the survey was taken, 41 percent of the construction-related businesses said they had revenue gains of 5 percent or more when comparing 2000 to 1999, and 36 percent had no growth or lost revenue.

Riley Mende, vice president and manager of commercial banking at American Savings Bank, said the survey results are consistent with what he's seeing at the bank. He said that during the first half of 2003 that American Savings' construction industry loan portfolio grew by more than 15 percent and its commercial real estate loan portfolio increased by more than 30 percent.

"It's our opinion that the real driver of the current construction boom in Hawaii is the low interest rate environment," said Mende, who was one of six experts participating at the news conference. "Construction is clearly outpacing other sectors of the economy, and this is especially true on the neighbor islands, where residential construction is especially strong."

Brian Awakuni, president of the Masonry Institute of Hawaii, said an upturn in federal spending by the Navy and the Army, along with the residential housing boom, has given his particular sector a shot in the arm.

"It's really been a boom and I only foresee more jobs coming up the pipeline," said Awakuni, who does promotional work for the masonry industry and represents both union and nonunion subcontractors, as well as suppliers, in promoting the use of building material manufactured in Hawaii.

Navy housing projects that have been completed or are in the process of being built, ancillary facilities needed by the Navy, and facility upgrades that the Army recently said it needs figure to keep some segments of the construction industry busy for awhile.

But the survey showed there is more of a shift toward private contracts from government projects. In this year's survey, private contracts represented 75.7 percent of companies' workloads compared with 63.4 percent in 2001.

"The Army just announced it will have (7 to 10,000) units it will be privatizing, and that will have a huge impact on construction," Awakuni said. "That will include barracks, housing and other supporting buildings."

Russell Young, president and chief executive officer of Albert C. Kobayashi, one of the state's 10 largest contractors, said most of his company's work is coming from the private sector. He sees a condominium construction boom coming and said school projects, such as Case Middle School, Mid-Pacific Institute, Kamehameha, and Kapolei High School, have kept Albert C. Kobayashi pretty busy.

"We're finding out that jobs we had on the books in the past are now starting up," Young said. "We did revenue of $66 million in 2001, and in 2002 we jumped to $360 million. It's not that the work just came in. We had it there on the books for years. But, because of the lower interest rates, people decided now it was time to build."

The next big wave, he said, will be with the privatization of military housing. Young said the military branches are expected by the end of this month to select the contractors who will be conducting more than $2 billion worth of work over the next 10 years for the Army, Navy and Air Force.

"I can say optimistically that we don't have enough people here on the islands to do all the work or to get into the construction industry," Young said. "Looking forward, it looks very promising for the construction industry here in Hawaii."

Young said that if local contractors are selected, the ripple effect will benefit everyone by filtering down to local subcontractors and distributors.

Myron Nakata, president and CEO of Acutron Co. Inc., whose company provides insulation and fireproofing primarily for the commercial and industrial sector, said he's also relatively optimistic.

"From the various organizations that I participate in, it seems that the architects and engineers are busy designing things, so when they're busy, in future years the projects will go through and we can remain busy."

Acutron, which is based on Oahu, also has some of its 60 employees living on Maui and the Big Island. Nakata said he's increased his work force about 5 percent over the last year.

"I think what's happening is that the residential market is busy, so all the contractors seem to have enough work to spread around," Nakata said.

However, John Arizumi, president of Waipio Gentry-based Carrier Hawaii, an air conditioning product distributor, said that even though his revenues have grown, business has been relatively flat during the past 13 years while he's added stores in downtown Honolulu and Kona.

"There's no new real construction going on as we had 15 years ago," said Arizumi, whose business is about 80 percent focused on commercial. "Most of our work has been in the replacement market."

Arizumi said his business has expanded from 11 employees to 24 over the last 13 years but that he hasn't increased his head count during the past four years.

He said he's encouraged, though, about the future.

"I think there's going to be more work, more federal projects, more state projects," he said. "And, I'm kind of optimistic that the economy will improve."

The Masonry Institute's Awakuni said it's best to enjoy the good times while one can since the construction industry is cyclical.

"It's always been three, four years up and then, perhaps, three, four years down," he said. "The last big cycle we had was in the late '80s, early '90s, where we had a cycle of seven, eight years of suddenly growing construction activity, followed by eight or nine years of a prolonged slump.

"I don't expect this thing to go up, hit a plateau and remain up. I expect it to come back down. Where I see us right now is that we have an additional two or three more years left in this cycle."