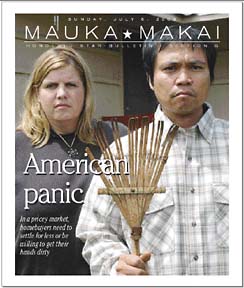

[ MAUKA MAKAI ]

With a dream home out of financial reach,

our writer and her husband go the DIY route

Before starting your search for the perfect dream home, get one thing straight. It doesn't exist. Not at a price most of us can afford anyway. I discovered this firsthand.

Buying a home appeared to be a relatively easy process. Go to open houses that fit my price range, find the ideal home, put down some cash, sign some papers and move in.

Unfortunately, the progression was much more complicated for my husband and I, and our 7-year-old son. At first we didn't think we could afford homeownership and were simply looking for a place to rent, but with the low interest rates, we learned it would actually be cheaper to obtain a monthly mortgage.

Now, amidst the rubble of torn floors and bare bones where the kitchen used to be, I keep wondering, What sort of mess have we gotten ourselves into this time? Buyer's remorse was temporarily invading my thoughts as I used a shop vacuum to remove the dust and debris from having to repair termite-eaten beams, tearing down walls of a 1950s kitchen to make way for a 2003 interior and ripping out bits of flooring that had rotted away.

Our reason for choosing the Wahiawa home was simple: We were able to afford it. Along with Waipahu and Kapolei, Wahiawa remains one of the most affordable neighborhoods on Oahu, though it's anyone's guess how long it will stay that way.

We had visited many pristine new homes in hopes of finding one we could afford. Our real estate agent was patient and showed us what we wanted to see, waiting for reality to eventually set in.

FL MORRIS / FMORRIS@STARBULLETIN.COM

Renovating the kitchen of his newly purchased Wahiawa home is Nando Arcayna.

After watching prices rise steadily upward over a month, we settled for a home that needed a little work. OK, it needed lots of TLC.

We didn't have enough money to buy a new house, and we would not have been able to manage the maintenance fees attached to a condominium or town home on top of the mortgage payments.

My husband, Nando, and I had to close our eyes and envision some sort of end result. The shabby cupboards, horrid kitchen décor and run-down bathroom would have sent most people running in the other direction. And how could I forget the Brady Bunch-style vinyl tiles that were laid in each bedroom and down the main hallway. At least the bright orange curtains went with the home's previous tenants.

After the tenants left, the home's owner decided to treat us to industrial-style carpeting in the living room to cover the uneven ground and holes in the floor, as if to hide what we already knew existed. The circumstance left us with yet another costly task: removing the rug and glue. No credit was given for areas of the house that were in disrepair, so this was apparently his way of trying to make things "a little more presentable."

Another nightmare was getting the seller's disclosure statement, that simple piece of paper that supposedly tells the buyer what is wrong with the house. The copy signed by the seller basically stated that everything was in working order "to his knowledge," despite the fact that the range was missing a couple of burners and there was tape on the buttons that screamed out "Beware." The disclo sure form, we quickly found, rather than bringing peace of mind to the buyer, is an obvious attempt to protect the seller from any future liabilities. A home inspection confirmed our suspicions about the myriad things wrong with the place, but "not to the seller's knowledge."

The tenants in the home until the final walk-through also decided to keep a bedroom door padlocked during the home inspections. The room was inaccessible until three days prior to closing the sale.

Although we knew about all of the "problems," we still forged ahead. Renovations began in the bathroom because that is one room needed for survival. Each time I visited the house, there were more pieces missing.

First, Nando and I carried out the leaky toilet -- which was quite a fiasco. As we lifted the structure, a band of B-52 cockroaches and a family of ants decided to bless our home. Fortunately, I managed to set aside my bug phobia long enough to make it to the yard.

Luckily, Nando's friends helped move out the bathtub, sink and vanity, and other wasted structures. The bug incident was enough to make me realize that renovation work is not for me.

FL MORRIS / FMORRIS@STARBULLETIN.COM

Wife Nancy and son John Paul pause in the living room of their new home.

Instead of tearing up tiles and doing useful things, I became the "can you hand me that tool" or "could you go throw this away for me" girl. Staying away was the best choice for me, although curiosity and a sense of hope had me constantly visiting to see the work in progress.

Each visit seemed to show more disrepair. At one point there was no floor in the bathroom. I could stare straight through to the ground for several days.

After retiring as "tool girl," I was allowed to assist with stripping the kitchen cabinets. Nobody warned me of the hazardous material that would be used. It ate through paint, gloves, just about anything on which it landed.

Scrubbing out red dirt stains from clothing as a result of crawling around under the house became my latest contribution to the effort -- as well as helping my son come to some kind of realization that we are not moving to a "junkyard."

Since the purchase at the end of May, many accomplishments have been made. We have received a great sense of satisfaction from tackling these projects on our own.

The wall in the kitchen was knocked out, making both kitchen and living room appear larger. Areas were cut in the counters so the appliances were not taking up added kitchen space. The bathroom floor is now intact, and we almost have working plumbing.

Luckily, Nando is quite the handyman. So, if someone were to ask if we would do it all over again, we would both have to say "yes." We hope the renovations will add new style to a charming old home. And, we trust that with lots of hard work over the next couple of months and loads of help from our dear family and friends that our rough jewel will eventually shine like a diamond.

We are now regular watchers of the Home and Garden channel. Often, people are interviewed for a "before and after" scenario. I watch with envy as the interviewees seemingly endured a complete renovation or the gutting of a structure with a good sense of humor and exceptionally clean clothes.

Realistically, it would be nice if they would show a person in dirty work clothes, drenched in sweat. Or, better yet, someone like me, screaming and swatting at an army of invading insects.

"Realizing the American Dream

With Gregory Field and Lehua Rosa Malott

-- First Time Home Buyers"Honolulu Community College: 6 to 8 p.m. Mondays and Wednesdays, Aug. 4-27 or Oct. 27-Nov. 21. Call 845-9296.

Leeward Community College: 6 to 8 p.m. Tuesdays and Thursdays, July 8-31 or Sept. 2-25. Call 455-0477.

Waianae: 8:30 a.m. to 1 p.m. Saturdays, Aug. 2-23 or Nov. 1-22 at Leeward Community College's Waianae campus. Call 259-9558.

Waimanalo Public Library: 7 to 9 p.m. Tuesdays and Thursdays July 8-31 or Aug. 5-28. Call 259-9558.

Big Island Classes: 8:30 a.m. to 1 p.m. Saturdays July 12-Aug. 2 at Hawaii Community College in Hilo, or Aug. 9-Sept. 6 in Kailua-Kona. Call 800-807-9558.

Community Home Buyer Fair

Guidance for people interested in becoming homeownersWhere: Filipino Community Center, 94-428 Mokuola St.

When: 9 a.m. to noon Saturday

Call: Claudine Allen at HUD, 522-8175, ext. 223

Also: At the Paukukalo Community Center, 657 Kaumualii St., Wailuku, Maui, 9 a.m. to 2 p.m. Sept. 13.

Tips for prospective homebuyers

>> Find out how much of a house you can afford. Visit with a lender to get pre-qualified for a mortgage. Questions to ask the lender: How much or what percentage of a down payment will I need? What is the current interest rate? Approximately how much will I have to pay in closing costs? Points?>> Find out what other home-buying resources are available in the community. For example, take a homebuyer education course, meet with a housing/credit counselor, look into an individual development savings account, inquire about self-help housing and Hawaiian Home Lands, etc.

>> When you are ready to shop for a home, use a real estate agent. They have access to information on homes for sale. Determine your needs and priorities: Which communities would I like to live in? How much of a commute will I have to work or school? What type of home would I like (single-family home, condominium, townhouse)? How much space do I need? Do I want a yard?

SOURCE: U.S. HOUSING AND URBAN DEVELOPMENT

Click for online

calendars and events.