China stock gamble

pays off big timePaul Loo's Sina Corp. bet keeps

him atop the Star-Bulletin ranks

Most Internet stocks have imploded. China is coping with two-thirds of the world's severe acute respiratory syndrome cases. And other countries generally are trailing the United States in their economic recoveries.

Yet, for local market veteran Paul Loo, Chinese Internet stock Sina Corp. was the one to buy during the first half of 2003.

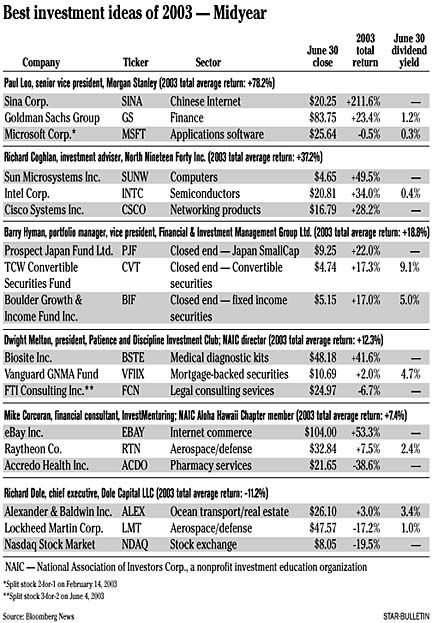

Loo, senior vice president of financial services firm Morgan Stanley in Honolulu, rode Sina's 211.6 percent gain to an average 78.2 percent total return for his three stock picks in the Bloomberg Honolulu Star-Bulletin's survey of the best investment ideas of 2003.

Hilo investment adviser Richard Coghlan of North Nineteen Forty Inc. also had a strong performance as his picks averaged a 37.2 percent gain.

Overall, the six local stock experts who participated in the survey averaged a 23.8 percent total return, with five of them finishing in the black. The averages are based on the experts hypothetically putting the same amount of money in each stock.

Barry Hyman, vice president of Financial & Investment Management Group Ltd. in Wailuku, was third with an 18.8 percent gain followed by Dwight Melton, a National Association of Investors Corp. Aloha Hawaii Chapter director, at 12.3 percent, and InvestMentoring financial consultant Mike Corcoran at 7.4 percent. Richard Dole, chief executive officer of investment banking firm Dole Capital LLC, lost 11.2 percent.

On a share-weighted basis, Coghlan had the best return with a 33.1 percent gain. He was followed by Loo, up 29.3 percent; Hyman, up 19.4 percent; Corcoran, up 18.6 percent; Melton, up 13.8 percent; and Dole, down 11.9 percent. The share-weighted formula assumes each expert bought 100 shares of each of their picks, regardless of price. It prevents averages being skewed by a big gain or loss in one individual stock.

Loo said that Sina and rivals Sohu.com Inc. (up 431.3 percent through June 30) and Netease.com Inc. (up 218.5 percent) are currently overpriced but believes that volatile sector could pay off in the long run.

"I think the Chinese Internet is probably an area that can be overwhelming when you look at the numbers of people and what that country needs in terms of communication," Loo said. "This is why in the long run these stocks are highly volatile. Nobody but an extremely high-risk person should be considering Chinese stocks ... I think the Chinese Internet companies' stocks will go through volatile swings that will shake the hair off a horse, but in the long run, they'll reflect the growth in China."

China's economy grew 9.9 percent in the first quarter -- its fastest pace in seven years -- and is expected to grow up to 8 percent this year despite the impact of SARS, according to the country's official news agency.

Loo also still likes his other picks, financial services firm Goldman Sachs (up 23.4 percent), as well as software giant Microsoft Corp. (down 0.5 percent).

"I like Goldman because the two industries that were the worst hit by everything were the airline industry, and the investment banking business because there were no IPOs (initial public offerings)," Loo said. "There also was fraud involved (with investigations of insider trading and analyst recommendations). Logically, Goldman was the dominant firm in the IPO business.

"I chose Microsoft because I thought it was going to begin a good dividend program (it declared a post-split dividend of 8 cents a share in January), but it's been struggling with technological replacement. Tech stocks have really snapped back this year, but being so big, it's taking longer for Microsoft."

Coghlan, who disagreed with using the average method to determine results, is still enamored with his technology picks -- Sun Microsystems Inc. (up 49.5 percent), Intel Corp. (up 34 percent) and Cisco Systems Inc. (up 28.2 percent). Coghlan said he likes Intel and Cisco for their product and market share dominance, good management, strong balance sheets and lack of long-term debt.

"Both companies have recently increased expectations for revenue and profits over the next 12 months," Coghlan said. "I believe Cisco and Intel will continue to do well in the market and both stocks will continue to increase in value."

Coghlan said he's also a fan of Sun Microsystems even though its falling sales bring into question whether the company can recapture its former glory. He said Sun's first profit in 12 quarters indicates that the worst is behind it. Coghlan also notes that Sun recently announced an agreement with Dell Computer Corp. and Hewlett-Packard Co. to include Java, a Sun programming language, with future PC shipments.

"The stock price, which was in the $60 to $70 range (during its peak), remains very attractive at its current price ($4.65 as of June 30)," Coghlan said. "I expect Sun to perform as well in the second half. I am a value investor. I buy good stocks cheap."

Hyman, who believes the U.S. economy will struggle until its debt level is reduced, said he's bullish on Asian and, more recently, European stocks, than he is in large-cap U.S. stocks. He said his firm has been adding aggressively to Prospect Japan Fund, which was his best performer with a 22 percent gain during the first six months. Prospect Japan Fund trades on the London Stock Exchange and is managed by Hawaii Kai resident Curtis Freeze.

"We feel small companies in Japan present some of the best investment opportunities in the world," Hyman said.

TCW Convertible Securities Fund (up 17.3 percent with a 9.1 percent dividend yield) is still reasonably priced with a solid income stream, but is "not nearly the bargain it was at the beginning of the year," said Hyman, adding that his firm has trimmed some of its position in that closed-end fund. Hyman also said the firm is maintaining its position in Boulder Growth & Income Fund (up 17 percent with a 5 percent dividend yield) and is no longer buying additional shares.

Melton, who always keeps a fixed-income component in his portfolio, had an average 15.5 percent return for his two stock picks excluding the 2 percent gain he picked up from the Vanguard GNMA Fund. Biosite Inc., a San Diego-based company that develops medical diagnostic tests, was his top winner with a 41.6 percent gain. His other stock pick, FTI Consulting Inc., split 3-for-2 in June and ended the first six months down 6.7 percent.

"I'm still confident with those picks even though FTI Consulting's Value Line ranking has dropped from 1 to 2," said Melton, who uses rankings from the investment service company as one of his criteria for picking stocks.

Corcoran's selections covered both extremes as eBay Inc. (up 53.3 percent) was the second-best performing stock of any of the experts and Accredo Health Inc. (down 38.6 percent) was the worst performer. Accredo fell 44 percent on April 8 when it cut its fiscal 2003 forecast and announced it was investigating the accounts of a business it acquired in 2002. Corcoran, who's a fan of defense stocks, saw Raytheon Co. gain 7.5 percent.

"The three picks all look very good. EBay is at a 52-week high and Raytheon is creeping up," Corcoran said. "As long as the war that's over is still going on, the U.S. will still be heavily in need of a lot of defense stuff. It's really a good long-term play."

"Accredo has been slowly coming back," he added. "It's in a good field, pharmacy management, and it should do well with the government plan for Medicare prescription drugs."

Dole, the lone forecaster to finish in the red, also was the only one to pick a Hawaii company. Alexander & Baldwin Inc., the parent of Matson Navigation Co., had a 3 percent gain.

"A&B is benefiting from the Hawaii economy, but it will be (working against higher pensions in 2003)," Dole said. "(Pensions aside), it looks pretty good for A&B for the rest of the year as long as the Hawaii economy remains strong."

Dole had double-digit losses in his other selections -- Lockheed Martin Corp. (down 17.2 percent) and the Nasdaq Stock Market (down 19.5 percent).

"We don't have a current war right now, but I think defense spending will continue higher than in the recent past," said Dole, echoing Corcoran's sentiments.

Dole also believes that the Nasdaq Stock Market, which gained 57.1 percent from April 16 to the end of the quarter, is poised to move higher.

"It's come a long way up and it has a new president," Dole said. "Things are looking up for it."

BACK TO TOP |

Optimism building for

the thunder of hoovesLocal stock experts say

we're past the bottom, but

it's too early to celebrate

Are the bulls back in town or has the post-war rally left investors in shock and awe?

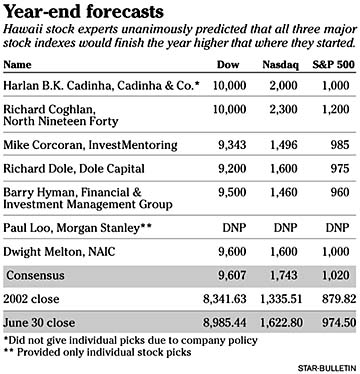

Hawaii's stock experts have divergent views following a stock blitzkrieg that has the major market indexes already approaching the year-end numbers that were forecast by the experts at the start of 2003.

Paul Loo, senior vice president of financial services firm Morgan Stanley in Honolulu, said there's a bipolar view even within his own firm. Loo, though, believes the market won't see its October lows again.

"We're like a polar missile fired by a sub," Loo said. "We were right at the bottom of the ocean, we fired the missile up, and we're just about to reach the surface. We're not in the air yet, but when we reach the surface of the water, we'll see it pop up into the sky."

Until then, though, Loo said he expects the market to be very slow as the economy struggles to regain its footing.

"We're not all at a peak," he said. "We're at a trough. And while it will be slow and laborious, you'll never see the prices of October of last year."

Several local stock experts pointed to geopolitical events as factors that could derail the U.S. economy and the market.

Richard Coghlan, an investment adviser with North Nineteen Forty Inc. in Hilo, said increasing interdependence of the world's financial powers, any large-scale domestic terrorist activity, long-term military occupation in the Middle East and a fast-growing federal budget deficit all could play significant roles in curtailing the recovery.

"I believe the markets will not move forward until we see increased corporate profits and capital spending, a substantial improvement to GDP, and a clear upward trend in our national labor market."

Portfolio manager Barry Hyman of Financial & Investment Management Group Ltd. in Wailuku, Maui, also isn't ready to jump into the bullish camp yet.

"While there are signs the economy is beginning to see signs of life, those signs are sparse at best," he said. "The employment picture has not begun to pick up (June's 6.9 percent U.S. rate was the worst in nine years), and worse, the debt burden is so high that the economy is dragging a lead ball behind itself. Pessimists are calling it the Humpty Dumpty economy. We are not pessimists, but realists."

Hyman said he believes the economy will struggle amid periods of growth, but that the debt level is the key to a sustained recovery.

"In an environment like that, we feel investors should have their money in income-producing securities so that they are paid while they wait for the economy to accelerate," Hyman said. "Given this scenario, we feel the U.S. stock market, as measured by the major indexes, has gotten ahead of itself."

Dwight Melton, a director with the Aloha Hawaii Chapter of the National Association of Investors Corp., said he's more concerned with trend lines than he is in predicting the market. He recently changed his asset allocation to 70 percent stocks and 30 percent fixed income from an opposite 30-70 mix.

"The S&P 500 and the Dow Jones industrials are now trading above their 200-day moving average," Melton said. "This is how I identify an uptrend in the market."

Financial consultant Mike Corcoran of InvestMentoring said it may be time again to let the good times roll.

"I think the momentum is going to carry and there's more faith in the economy," Corcoran said. "There's a feel-good time right now," he said. "But the summertime is usually a time for the doldrums because all the traders are gone and nothing really happens until the fourth quarter.

"I'd be fully invested in stocks right now. Cash is not doing anything, making 1 percent. So the risk-reward is if you have a good stock, you've got to be in there. Of course, you still have to have an emergency fund."