Hawaii stocks hold up

Overall, the local index is

up 19.6% through 6 months

A year ago, Central Pacific Financial Corp. was money in the bank for investors as it posted an astounding 86.7 percent return in a down market.

Six months later, the bank is one of the driving forces behind rival CB Bancshares Inc. turning in the best performance among Hawaii companies midway through 2003.

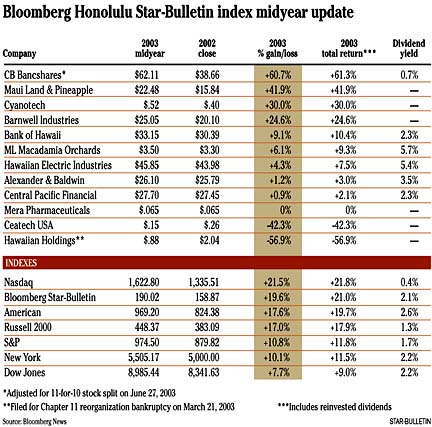

CB Bancshares' stock, which received a boost of more than 50 percent in mid-April when Central Pacific Bank's parent said it was making an unsolicited merger offer, held a commanding lead in the Bloomberg Honolulu Star-Bulletin index with a 60.7 percent gain as the second quarter came to an end yesterday.

Overall, it was a solid six months for the index as Maui Land & Pineapple Co., Cyanotech Corp. and Barnwell Industries Inc. -- in addition to CB Bancshares -- posted gains of 24 percent or more and 10 of the 12 stocks in the index ended either even or in the black.

The Bloomberg HSB index rose 19.6 percent, trailing the 21.5 percent return of the Nasdaq composite index but beating out the Standard & Poor's 500 index's 10.8 percent gain and the Dow Jones industrial average's 7.7 percent return.

Richard Dole, a local stock analyst and chief executive officer of Honolulu investment banking firm Dole Capital LLC, attributed the big gains of the top four to special situations.

However, he acknowledged that "the Hawaii economy is doing better than the national average."

Despite the merger-related boost, CB Bancshares executives said the stock, which closed yesterday at $62.11, was doing well even before Central Pacific Financial came into the picture. City Bank President Richard Lim said CB's stock appreciated 124 percent during the three years prior to CPF's merger proposal becoming public.

In fact, CB's stock was up 9.1 percent in 2003 before the merger announcement, although some of that gain could be attributed to CPF accumulating 88,741 shares of CB stock prior to announcing the offer.

"CB Bancshares' outlook has improved due to positive momentum, with compound annual earnings growth per share of more than 15 percent over the past five years," CB spokesman Wayne Miyao said. "We've also experienced continued growth in core deposits and fee income, along with a declining efficiency ratio and improved asset quality."

Dole said the attention generated by CPF's hostile merger offer eventually may benefit CB's stock if the deal doesn't go through. He said more people are aware of CB now and he doesn't think the bank's stock would fall to its split-adjusted price of $42.16 prior to CPF's April 16 merger announcement. CB split its stock 11-for-10 on June 27.

"I think (CB) had been somewhat neglected in the past," Dole said. "Its returns have been lower than other banks but they've been improving, so I don't think the stock would go all the way down (if CPF called off the deal). The relative price value of CB Bancshares (compared with) other banks has been disproportionate. I think more attention now has been drawn to CB Bancshares."

Central Pacific Financial, meanwhile, is barely in the black this year with a 0.9 percent gain to $27.70 as the uncertainty of the merger weighs down its stock.

Surprisingly, Maui Land & Pineapple chalked up the index's second-best return over the first six months despite losing $5.7 million in 2002 for its worst financial performance in nine years. The company's thinly traded stock was up 41.9 percent to $22.48, just off its 52-week closing high of $22.59 on Friday.

MLP was busy during the first six months as the company shuffled its management and took major steps toward selling the two shopping centers that make up the brunt of its commercial property division.

President and Chief Executive Officer Gary Gifford retired at the May shareholders and was replaced on an interim basis shortly before that by MLP executive Donald Young. A permanent CEO is expected to be named later this month. Chairman Richard Cameron also stepped down at the meeting while retaining his directorship and David Heenan, a trustee of the James Campbell estate, replaced Cameron as a nonexecutive chairman.

On the commercial real estate front, MLP announced in May it had a letter of intent to sell Queen Kaahumanu Center, the largest retail and entertainment center on Maui. Real Estate Alert, a weekly newsletter published out of Hoboken, N.J., said the buyer was Somera Investment Partners and the purchase price was approximately $80 million.

MLP has declined to identify the purchaser or name the price.

Last month, MLP said it also had reached agreement to sell Napili Plaza and that it expects the deal to close at the end of July. The closing date for Queen Kaahumanu Center is uncertain.

MLP Chief Financial Officer Paul Meyer attributes the positive stock movement to the housing market and the managerial moves.

"There's a strong real estate market and a general interest in single-family homes and resort homes on Maui," Meyer said. "It also may be that the management change has had a positive influence."

Cyanotech, which faces delisting from the Nasdaq SmallCap Market if it can't get its stock to $1 or higher for 10 consecutive days by Sept. 10, was the third-best performer as it rose 30 percent to 52 cents.

Barnwell Industries, whose shares have been trading at 10-year highs, was the fourth stock to post a gain of at least 24 percent during the first six months. Barnwell's stock rose 24.6 percent to $25.05.

The worst performer in the index was Hawaiian Holdings Inc., whose main operating subsidiary, Hawaiian Airlines, is in Chapter 11 bankruptcy. Hawaiian tumbled 56.9 percent to 88 cents as investors speculated whether the stock will continue to trade in its present form once the company emerges from reorganization.

Bank of Hawaii Corp. hit an all-time high during the first half of 2003 as it reached $35.50 on June 6 before ending midyear with a 10.4 percent gain at $33.15.

ML Macadamia Orchards LP, which offers a 5.7 percent dividend yield, gained 6.1 percent to $3.50 but had a total return of 9.3 percent.

Hawaiian Electric Industries Inc., which also owns American Savings Bank, began to catch fire after Congress in May approved President Bush's dividend tax cuts. HEI's stock, which offers a 5.4 percent dividend yield, was up 4.3 percent to $45.85 for the first six months with a total return of 7.5 percent.

Alexander & Baldwin Inc., which hit a 52-week high of $27.48 on June 16, was the only other Hawaii stock to finish in the black with a 1.2 percent gain at $26.10.

Among the two lowest-priced Hawaii stocks, Ceatech USA Inc. fell 42.3 percent to 15 cents while Mera Pharmaceuticals Inc. was unchanged at 6.5 cents.

STOCK QUOTES/CHARTS/DATA