[ INSIDE HAWAII INC. ]

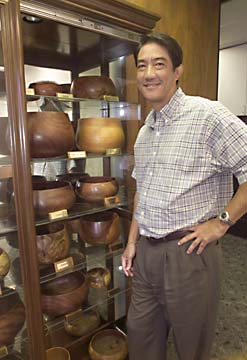

DENNIS ODA / DODA@STARBULLETIN.COM

Bill K. Richardson, president of HiBeam, stands next to part of his collection of wood bowls in his Davies Pacific Building office.

New president is

high on HiBEAM

What is HiBEAM's mission?

William K. Richardson

>> New post: President of the Hawaii Business and Entrepreneur Acceleration Mentors, or HiBEAM>> Background: A founder of HiBEAM, he has been vice president for the past three years. He is the general partner of HMS Hawaii Management Partners and HMS Investments GP; founding co-chair of University Connections; a trustee of the UH Foundation; chairman of Kona Bay Marine Resources and Hawaii Biotech Inc.

>> HiBEAM board of directors: Vice President Gregory R. Kim, Barry Weinman, Ron Higgins, Eric K. Martinson, Bruce M. Nakaoka, Kenton Eldridge, Curtis Y. Harada, Kazuo Shirakawa, Michael T. Fitzgerald, Nick Halsey, Jonathan G. Morgan, Robert J. Robinson, Richard L. Sherman, John V. Bautista, Glen R. Van Ligten, Charles A. Sweet, Darlene Blakeney, Rann Watumull, John C. Dean, Harry W. Kellogg, Kitty Lagareta, Clifton Y. Kagawa, Brad J. Wagenaar, Michael J. O'Malley, Patrick H. Oki and Keith Mattson.

HiBEAM was founded primarily by University Connections, of which I used to be co-chair with David McClain. It was myself, Greg Kim, Barry Weinman and Ron Higgins. We intended to be a quiet group that would aid entrepreneurs and entrepreneurial companies become credible with venture capitalists. We went about hiring an executive director to run it for us and we agreed to pay in $10,000 year to finance the executive director and get things off the ground. The mission hasn't changed. We have accepted six companies into the program. One of the things they all get is advice from HiBEAM members. The members have increased to include MN Capital Partners, Hawaiian Electric, Enterprise Honolulu, Rostrevor Partners, the Venture Law Group, Carlsmith Ball, Bank of Hawaii, Silicon Valley Bank, Communications-Pacific, King & Neel and Pricewaterhouse Coopers. The entrepreneur gets a virtual board and we try very hard to get them to build a strong presentation that gets them to a venture capitalist. We help them get angel financing. We help them with legal and accounting work so they don't mess up their capital structure.

You don't exactly lack for projects, what inspired you to take on the role of president?

The funny answer is I probably didn't attend the meeting and got assigned this. The true answer is Barry (Weinman) has been the president for three years and I guess it's my turn.

What are your goals?

I want to continue to do exactly what we're doing. We have a very simple concept. My goal is to keep it a simple concept and not be all things to all people. Our goal is to foster investments in quality Hawaii start-ups. There is no other goal in my mind.

What do you think of the criticism that have been leveled at Act 221?

As the president of HiBEAM, I believe that professional venture capital investing requires longevity. It requires between three and five rounds of financing for a company to achieve significant liquidity. Act 221 is very useful in the first round of financing. The ability of it to take companies through subsequent rounds at larger amounts is doubtful. It's a good thing for early stage investing, but provides an incomplete mechanism for growing these kinds of companies. On a persona l note, I would say it's too broadly drafted and may need to be scaled back a bit.

HiBEAM aims to foster the capital infrastructure necessary for starting large corporations in Hawaii, but history suggests we're more likely to grow tech firms to a certain size and then export them. Are we doomed to that pattern?

I accept that companies founded in Hawaii are going to be global companies and in many cases that requires them moving. That's just a fact of growing these kinds of companies, but I don't see that as a negative. If these companies grow, even if they move, many of the jobs and revenues they create remain in Hawaii. If you look at the companies in HiBEAM, many of them have strong ties to Hawaii science and infrastructure, like the university. We have science in Hawaii that is comparable to any fundable idea coming out of California as far as I'm concerned. So the hopeful side of the equation is that more of these companies will be able to stay. That was not true when the capital structure was such that companies had to leave to get financing. But as the capital structure in Hawaii improves we may see that change. So there are two developments, one is the science is based here, the other is the capital may be better able to sustain itself here at the present time and in the future.

Is the local labor pool keeping up with the demands of Hawaii's technology companies?

That's a mixed answer. No, the current Hawaii environment can't sustain the kinds of companies I envision for Hawaii. The mitigating factor is there are a lot of Hawaii born and raised professionals working on the mainland who want to come home and work in technical companies.

Are local technology companies offering salaries that will keep local talent here or bring it back from the mainland?

The professionally funded ones are. But I would also add that there's a premium to living in Hawaii that many of these people value and they may be willing to accept slightly less.

What's it going to take for mainland investors to take Hawaii seriously as a place to do business?

I think the only way to convince nay-sayers is a record of success, and that's a time sensitive process.

Inside Hawaii Inc. is a conversation with a member of the Hawaii business community who has changed jobs, been elected to a board or been recognized for accomplishments. Send questions and comments to: business@starbulletin.com.