A forum for Hawaii's

business community to discuss

current events and issues

» Whipping up your potential » Tax credits are boon to economy

BACK TO TOP |

DAVID SWANN / DSWANN@STARBULLETIN.COM

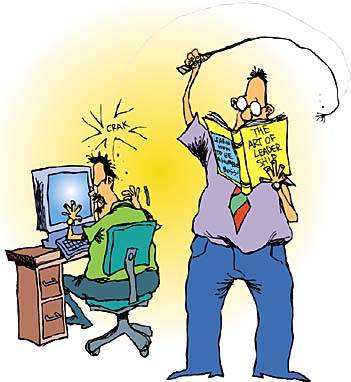

Whipping up

your potential

Even a cursory reading of Jim Collins' recent bestseller, "Good to Great" would be an eye-opener for many managers and leaders.

It would drive home the point that the challenge facing organizations -- both public and private -- is counter to the old adage of having too many chiefs and not enough Indians to do a job. The real challenge is that too many "chiefs," leaders who should have what it takes to release the fullest potential of the highly motivated "Indians," don't always do what it takes to release their own fullest potential as a pre-requisite to helping others release theirs.

In the first place, great leaders recognize that their hierarchical position -- be it CEO, parent, teacher or governor -- is the least useful means of influence at their disposal. The practice of pulling rank, either verbally or silently, with a menacing eye, will get you compliance but it will not get you real commitment.

Worse, if you continually pull rank to get people to follow your lead, you're guaranteed to kill the very creativity that your organization must have these days to survive and keep growing.

In Hawaii, for example, a plantation mentality is sadly still alive and well in many organizations. It's more subtly expressed than the "The boss will tell me what he wants me to do!" excuse for a lack of initiative heard in old days, but none-the-less debilitating.

Second, great leaders recognize that leadership is a quality that characterizes a relationship. Heads of corporations and business enterprises worldwide invest enormous amounts of time and money in the training and development of their future management.

And even when the going gets rough financially, they don't allow this investment to be slashed. By honing everyone's skills of collaborative conflict-resolution -- beginning with their own -- they are ensuring that the whole will be greater than the sum of its parts. This is particularly true in the face of the current trend of downsizing, which results in having fewer parts to handle the same workload.

Finally, no matter what their hierarchical position, great leaders are humble, not only in the office but in their personal life. They recognize and embrace the fact that being a good human being and being a good leader are one and the same.

For example, when Max Dupree was the chairman and chief executive officer for officer furnishings leader Herman Miller Corp. he would ask for a moment of silence before he and his executive team had to make an important decision. Why? He needed to pray for the courage to put his ego aside and do the right thing for the whole. He is a man who understands that the role of a leader is as a servant to a higher calling.

Irwin Rubin is a Honolulu-based author and president of Temenos Inc., which specializes in executive leadership development and behavioral coaching, communication skill building training, and large system culture change. His column appears twice a month in the Honolulu Star Bulletin. Send questions and column suggestions to temenos@lava.net or visit temenosinc.com.

BACK TO TOP |

Tax credits for hotel

construction and remodeling

are boon to economy

There is much misunderstanding regarding HB1400 CD2, the statewide hotel construction and remodeling tax credit awaiting the governor's approval. Let's look at four main issues of confusion.

1 >> Don't lump the hotel construction tax credit of 4 percent or 8 percent with excessive tax credits offering 100 percent to 400 percent tax refunds.

After Singapore and Hong Kong, the Hawaii economy has been reported to be that most affected by international investment. Already, we are one of the few states to tax construction investment at all, with a 4 percent general excise tax. We have to do something to compete against states offering 10 percent to 30 percent construction tax incentives.

Why do car dealers offer rebates or no-interest incentives? Is it because these businesses are stupid or want to lose money? No, reasonable incentives are offered by businesses that wish to survive in a competitive market. Why does Longs Drugs offer coupons for things like toilet paper, which people can afford and would buy anyway? It is so you'll buy your toilet paper from Longs and shop there instead of some other store that doesn't offer incentives. Note that these incentives, like the proposed 8 percent and 4 percent hotel construction tax credits, are reasonable offers designed to increase competitiveness, not 100 percent to 400 percent giveaways. And unlike construction, other tax credits don't have a proven record of generating jobs, sales, tax revenue or lasting benefits.

The state Department of Business, Economic Development and Tourism recently reported tourism is responsible for about a quarter of all state jobs and tax revenue. Improving our aging visitor industry infrastructure will result in higher quality/lower environmental impact/higher sustainability tourism, and higher income, transient accommodation tax and property tax revenue.

The long-term nature of construction has been the moderating influence to the volatility of tourism in our state economy. For that steadying influence to continue, the construction pipeline must be kept flowing.

2 >> Tax losses will be greater if the existing law is not changed.

Critics lump all tax credits together as the cause for more than $100 million in budget shortfalls. The fact is most of the existing budget shortfalls have nothing to do with tax credits, and include $36 million due to unrelated reductions in individual estimated taxes, and $11 million from a reduced capital gains tax. The costly residential tax credit is set to expire after June and has nothing to do with hotel tax credits. If HB1400 CD2 (offering a non-refundable 8 percent hotel construction tax credit thru June 2006 and a 4 percent non-refundable credit thru June 2010) is vetoed, existing law still provides a 4 percent refundable hotel construction tax credit thru June 2005. Unless HB1400 CD2 is passed, the existing refundable tax credits will result in larger tax revenue losses because they can be claimed even though many new hotel construction projects have little or no income tax liability. Passing the non-refundable HB1400 CD2 will actually help save tax revenue.

HB1400 CD2 is much narrower in scope than thought. The hotel construction tax credit can only be claimed by taxpayers subject to both income tax and transient accommodation tax. The proposed legislation does not give construction tax credits to offsite facilities, nor to commercial projects in resort areas.

3 >> Hotel construction tax credits generate net tax gains.

The Toy/Mak study using Tax Department and DBEDT figures shows $1.2 million in hotel construction tax credits granted in 1999, $7.1 million in 2000, and $7.4 million in 2001. These tax credits generated $29.4 million in hotel construction in 1999, $177.5 million in 2000, and $159 million in 2001. The credits generated $3.4 million in tax revenue in 1999, $20.4 million in 2000, and $18.3 million in 2001. Therefore, these hotel construction tax credits generated $2.2 million in net tax revenue in 1999, $13.3 million in 2000, and $10.9 million in 2001.

4 >> Fiscal policy has consequences.

Cutting $1 billion from the next two-year capital improvement project budget to save money will cause an unintended $2 billion in lost business sales, $870 million in lost employee wages, $145 million in lost tax revenue, and 26,000 job-years lost in construction and other industries. These drastic cuts by the state, with hundreds of millions more by the counties, will devastate Hawaii's economy unless replaced by incentives to stimulate private sector activity.

We urge Gov. Linda Lingle to examine all of the facts before making an important decision on hotel construction tax credits.

Brian Lee is executive director of the Hawaii Construction Industry Association.

To participate in the Think Inc. discussion, e-mail your comments to business@starbulletin.com; fax them to 529-4750; or mail them to Think Inc., Honolulu Star-Bulletin, 7 Waterfront Plaza, Suite 210, 500 Ala Moana, Honolulu, Hawaii 96813. Anonymous submissions will be discarded.