State ERS slips

for third quarterBut the fund manages to perform

better than the Dow and S&P

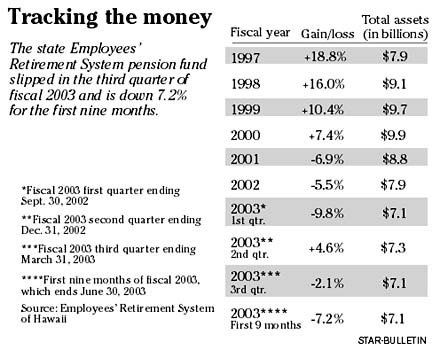

Hawaii's largest pension fund, heading toward its third straight year of losses, slipped 2.1 percent last quarter as the war with Iraq kept a lid on stock prices.

Despite falling for the third time in four quarters, the Employees' Retirement System fund stayed virtually even with its benchmark return of negative 2.2 percent. Fixed income and real estate were the only asset classes to rise during the period.

By comparison, the Dow Jones industrial average ended the quarter down 3.6 percent, the Standard & Poor's 500 index lost 3.2 percent and the Nasdaq composite index edged up 0.6 percent.

The head of the consulting firm that advises ERS told board members yesterday he sees a shift in the marketplace.

"The high-yield managers did better as well as the emerging debt managers," said Ron Peyton, president and chief executive officer of San Francisco-based Callan Associates Inc. "Because some of the higher-risk asset classes have done better, I think that's good news because it speaks to an environment where risk is now being rewarded. Hopefully, the risk we've experienced is behind us and we've got positive signs ahead."

The ERS fund, which had assets of $9.9 billion at the end of fiscal 2000, shrank $250 million to $7.1 billion at the end of March. The lower asset value is deceiving, though, since $165 million is due to benefit payments.For the first nine months of its fiscal year, the fund is down 7.2 percent, virtually even with its benchmark of minus 7.1 percent. The fund, which lost 6.9 percent in fiscal 2001 and dropped 5.5 percent in fiscal 2002, ranked in the 57th percentile of other large public funds through the first nine months of the fiscal year. A fund ranked in the first percentile is considered the best.

The board decided yesterday to terminate one of its fund managers, Trust Co. of the West, which fell 4.9 percent in the quarter and ranked 88th in the small growth style group. The board said it would take the approximately $61 million from the fund and distribute it to T. Rowe Price (small-cap equity, negative 5 percent) and Jennison (small-cap equity, negative 3.2 percent).

The board also voted to keep Bank of Hawaii on its watch list after the large-cap growth fund finished the quarter with a negative 1.2 percent return that placed it in the 69th percentile in its style group during the period and in the 93rd percentile over the past 12 months. Peyton said he was concerned about organizational changes within the bank's portfolio management group and the switch in portfolio managers to Clyde Powers from Roger Khlopin, who left in early 2001.

Kimo Blaisdell, ERS' chief investment officer, said the board will be closely monitoring the fund's performance to see if it can improve with the help of Chicago Equity Partners, which recently formed an alliance with the bank.

"The stock picker in place, Clyde Powers, is still the guy who will be picking stocks," Blaisdell said. "It's just that he now has another source of information and research that he can use while making those decisions. I still believe that's cause for concern because it's still the same stock picker who's been in charge the last two years."

AllianceBernstein (large-cap growth, negative 0.4 percent return in quarter), CIC/HCM Asset Management (core fixed income, 2.1 percent), Delaware Investment Advisers (large-cap value, negative 5.1 percent) and Pacific Income Advisers (core fixed income, 1.98 percent) all were kept on the watch list. The board added Capital International (emerging markets, negative 6 percent) and Schroders Investment Management (foreign equity, negative 12.7 percent) to the watch list.

Rich Humphreys, chairman of ERS' investment committee, said the better-performing managers shouldn't be overlooked.

"We have some wonderful results from three of our managers, and one of them is local," he said.

Honolulu-based CM Bidwell was ranked first in its large-cap core class with a 1.4 percent return last quarter, negative 15.6 percent return over the past 12 months and annualized 0.7 percent return over the past five years.

Other managers that Humphreys singled out were PIMCO, a core plus fixed-income fund which had a 2.4 percent return in the quarter that placed it in the 32nd percentile; and Denver Investment Advisers, a mid-cap growth fund whose 2 percent return last quarter ranked in the seventh percentile.

The ERS provides retirement, disability and survivor benefits for 96,000 city, county and state retirees and their beneficiaries.