CB rejects new deal

But in a memo from 2000, the top

exec of CB Bancshares' espoused the

benefits of a merger with Central Pacific

City Bank's top executive was touting the benefits of a three-way merger with Central Pacific Bank and a local insurance company in 2000, in stark contrast to City Bank's more recent opposition to a two-way merger with Central Pacific.

The board of CB Bancshares Inc., parent company of City Bank, unanimously rejected a second hostile takeover proposal by Central Pacific Bank yesterday, saying the offer was inadequate and not much different from the first proposal.

But three years ago, City Bank and Island Holdings Inc. talked about merging with Central Pacific Bank. The discussion was the result of a 1999 change in federal law allowing banks to join forces with insurance companies, said Colbert Matsumoto, president of Island Holdings.

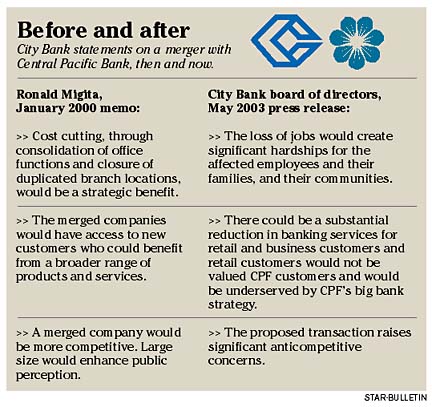

A January 2000 memo from Ronald Migita, president and chief executive of CB Bancshares, which went to Central Pacific Bank, said a merger would create a more competitive and viable financial services company. Many of the reasons appear to contradict recent statements by City Bank's parent company that the merger would hurt employees and the Hawaii community.

The memo was leaked to the media yesterday by a source close to Central Pacific Financial.

In the memo, Migita said a benefit of the merger would be reduced costs through consolidation of back-office functions and closure of overlapping bank branches. Central Pacific Bank, which was going through a restructuring at the time, rejected the merger.More recently, in rejecting a merger proposal by Central Pacific Bank, City Bank's parent company said more than 200 employees would be laid off, and job losses would create hardships for employees and their families.

Wayne Miyao, a spokesman for City Bank, said the bank's previous statements shouldn't be compared with its more recent statements because the merger proposals are different and would have required the consent of all sides. He described the memo as a confidential communication.

"We're kind of disappointed Central Pacific has resorted to bringing up a dated and private correspondence that detracts from the current proposal that we feel is very inadequate," Miyao said. "It's our belief that the discussions were very informal and confidential, and there was no proposal, nothing concrete made."

Miyao said City Bank respected Central Pacific's decision to reject the merger, unlike Central Pacific's recent efforts to take its takeover offer directly to shareholders of CB Bancshares Inc. "We never resorted to a hostile takeover at that time," Miyao noted.

In the 2000 memo, Migita called for a merger in which Central Pacific's stock would be used as the stock of a new company, and that Central Pacific would be positioned as a "big brother" while CB Bancshares would be the "little brother." Central Pacific Bank, with 24 branches, is Hawaii's fourth-largest bank, while City Bank, with 21 branches, is fifth-largest.

"Times have changed," Matsumoto said.

Some things have changed since Migita wrote the pro-merger memo in January 2000. Notably, the stock of Central Pacific has increased substantially. On the date of Migita's memo, Jan. 5, 2000, Central Pacific's stock was worth $14.375 a share. Last week, when the City Bank board announced its rejection of the offer, Central Pacific's stock was worth $25.75 a share, a 79 percent increase.

The increased share price poses a risk for CB shareholders, CB's board said, since the shareholders would be paid 70 percent in stock in Central Pacific and 30 percent in cash. Since the stock is trading near a high, Central Pacific stock could fall. Last week, Central Pacific sweetened the deal to a combination of 65 percent stock and 35 percent cash, an offer that CB's board has also rejected.

Another thing that has changed since 2000 is that Migita wrote the memo shortly after the close of 1999, a year when CB's net income plummeted 96 percent to $306,000 from $8.4 million a year earlier.

More recently, in 2002, CB's net income performed far better, jumping 118 percent to a record $13.5 million from $6.2 million a year earlier.

Another difference is that the 2000 merger proposal by CB Bancshares called for a three-way merger with local insurance company Island Holdings Inc., which would have opened City Bank and Central Pacific Bank to the insurance business. Island Holdings is owned by the Tokioka family, and Lionel Tokioka is chairman of CB Bancshares Inc.

Yesterday, Central Pacific said the 2000 merger proposal was rejected in part because of CB Bancshares' "asset quality problems." Central Pacific also said merging with an insurance underwriting company was inconsistent with Central Pacific's business strategy.

Meanwhile, CB Bancshares derided Central Pacific's more recent merger proposal as a slight revision of Central Pacific's original April 15 offer to buy CB Bancshares. The new proposal would give CB Bancshares' shareholders the same amount for each share of their stock, approximately $69 a share, but would change the mix of stock and cash. The price represents a 52 percent premium over CB Bancshares' stock price on April 15.

Central Pacific criticized CB Bancshares today for its rejection of the new offer.

"CB Bancshares once again rejects an attractive offer with no explanation or support for its statement that the offer undervalues CB Bancshares," Central Pacific said. "It then adds insult to injury by persisting in a plan to hold a May 28 meeting that would deny the people who own their company a fair opportunity to consider whether this new offer should proceed."

Central Pacific, which said the new offer has made the May 28 special shareholders meeting moot, has asked CB Bancshares to push back the meeting date to June 19.

CB Bancshares rejected that logic yesterday, saying the new offer did nothing to address the board's concerns about the first offer. "We believe that Central Pacific's revised proposal is just shibai to try to postpone the date of the CB Bancshares special shareholders meeting," said Tokioka.

Central Pacific Bank

City Bank