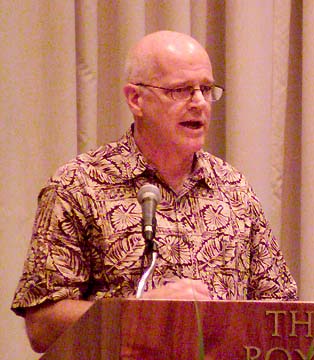

STAR-BULLETIN / 2002

Hawaiian Airlines' Chairman John Adams, pictured at last year's annual meeting, defended his management decisions in bankruptcy court yesterday.

Hawaiian CEO

takes the standCreditors want the bankruptcy

court to appoint a trustee to

take over the ailing carrier

John Adams, the embattled chairman and chief executive officer of Hawaiian Airlines, refused to buckle during 70 minutes of questioning yesterday as a U.S. Bankruptcy Court hearing got under way on whether to appoint a trustee to take over the ailing carrier.

Adams, accused of self-dealing and conflict of interest for his role in various monetary transactions at the airline, said even though Hawaiian lowered its earnings projections, the company's board of directors went ahead with a $25 million tender offer last June because it felt Hawaiian had enough cash on hand.

Hawaiian filed for Chapter 11 bankruptcy March 21.

Attorney John Karaczynski, representing Hawaiian, said after yesterday's hearing that he thought the company "made a good-faith business decision at the time."

"I feel very good about our case, and I thought Mr. Adams' testimony at the end was the key," he said. "There's a real tendency to be Monday morning quarterbacks."

Susan Foster, an attorney for Boeing Capital Corp., which is seeking to replace Adams with a trustee during bankruptcy, said the aircraft lessor's discovery and depositions were "absolutely compelling. Testimony aside," she said, "the company was ready to rely on its pleading files."

Adams, who is also president of Smith Management Inc. and controlling member of AIP LLC -- Hawaiian's majority owner -- came under fire for his financial take. He received a $200,000 pay increase to $600,000 in April 2002 when he added the title of CEO, and he also receives $600,000 as president of Smith Management, to which he said he devotes about 5 percent to 10 percent of his time. Smith Management also received a $2 million lump sum for advisory services and $75,000 a month.

Adams said Smith Management, through its fuel-hedging strategies, helped bring $3 million to the airline and also helped the airline develop a strategy for its interisland seat-coordination plan. He said he also sacrificed financially when he was asking Hawaiian's employees to take $15 million in labor cost concessions. Adams said he made a $60,000 contribution to charitable organizations on behalf of Hawaiian's employees and also stopped receiving the $75,000 monthly consulting fees when Hawaiian filed for bankruptcy.

The most telling revelations of the day did not come from the witness stand, but from opening remarks from Boeing Capital and creditors' committee attorneys.

Boeing Capital attorney Steve Hedberg said the aircraft lessor uncovered during discovery that immediately before the bankruptcy filing, Hawaiian had transferred $500,000 to its parent, Hawaiian Holdings Inc. The parent company did not file bankruptcy.

A Boeing Capital filing that was unsealed during yesterday's hearing referred to the money as "yet another fraudulent transfer." It said Hawaiian cited the purpose of the transfer was for legal and other expenses.

New York-based attorney Brett Miller, who represents the seven-member committee of unsecured creditors, said he received three calls from people interested in investing or acquiring Hawaiian Airlines if Adams, business partner Randy Smith and AIP are removed from the scene.

Hedberg, in his opening arguments, said Boeing Capital would show "a remarkable pattern of self-dealing" and that there was a serious issue of conduct by Hawaiian's senior management with fraudulent transfers. The company's $25 million tender offer represented a conflict of interest, he said, and left the airline either insolvent or with relatively little cash.

Hawaiian attorney Karaczynski said he would prove that a trustee was not warranted because there had been no fraud, dishonesty, incompetence or gross mismanagement. He also said that a trustee would not be in the best interest of the company, employees or shareholders.

Adams, who said financial projections looked promising when the tender offer was made, said the changes that hit the airline after completing the tender offer were like "a 100-year storm."

Miller, the creditors' committee attorney, tried to paint the picture that Adams, by virtue of tendering the entire 51 percent of the stock he and AIP owned, was attempting to get back his group's initial $20 million investment in the company.

Louis DeArias, a financial expert for PriceWaterhouseCoopers who was hired by law firm Perkins Coie LLP to represent the interest of Boeing Capital, said Hawaiian was artificially inflating its cash position by about $50 million prior to the tender offer by stretching its account payables to make the airline's cash position appear better than it actually was. He said this prevented the board from making a fully informed decision about the tender offer in its May 29 board meeting.

Karaczynski responded in a subsequent cross-examination that Hawaiian had unrestricted cash of $81 million at the end of June and $71 million at the end of the year. That was increased by $24 million by end of year because Hawaiian sold two years of frequent-flier miles to Bank of America.