KEN IGE / KIGE@STARBULLETIN.COM

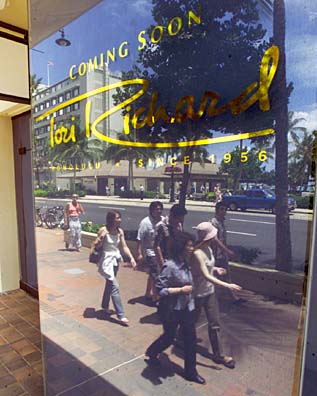

Tori Richard is preparing to open its first independent store in years in the Hyatt Regency on Kalakaua Avenue in Waikiki.

Waikiki makeover

Retailers and hoteliers are

rediscovering vacant spaces

Papered-over windows fronting empty stores in Waikiki hotels create an image of hard times, big vacancies and dwindling rent income for the hotel owners.

And business is down in the stores that are open in the state's most-prominent shopping strip.

But hoteliers and commercial real estate brokers say there is a lot of activity behind the scenes and the empty stores are filling up fast, despite the dip in tourism caused by 9/11 and exacerbated by the Iraq war and the SARS scare.

"It's very deceiving. Even though the market is down, there's a lot more leasing going on," said Sheryl Kojima, commercial properties manager at the Hyatt Regency Waikiki. At Hyatt, there is some obvious activity.

The Tori Richard name is posted on the window of one new 1,800-square-foot store on the Kalakaua Avenue frontage. That will be the first retail store of its own in some years for the Hawaii garment maker.

"Waikiki's going through a seismic shift right now," said Joshua Feldman, Tori Richard vice president. "To a lay person walking through Waikiki it looks like a desolate wasteland. There's been an exodus of the old-school retailers, but a whole new generation is coming in."

Waikiki has had its hard times but it is still one of the prime retail areas anywhere. For years it was a Japanese destination, but that has shifted and retailers have learned to target Americans as well, he said.

"The people that can hit both up are going to survive," Feldman said. Tori Richard had a dozen local retail stores in the 1960s but for a long time has been a manufacturer, selling its merchandise through department stores and on the Internet.

He said local residents and tourists should expect something "pretty dramatic" in the final design of the new store.

A lot of the Hyatt's space fronting Kalakaua had become vacant because a big Gucci store moved to the Honu Group's new 2100 Kalakaua building at the entrance to Waikiki. So did a smaller Gucci store elsewhere in the hotel.

KEN IGE / KIGE@STARBULLETIN.COM

The Hyatt Regency in Waikiki is expecting several new tenants, including Japanese department store Mitsukoshi and local clothing maker Tori Richard.

But Mitsukoshi, a Japanese department store, stepped in to fill the gap and is moving into a 4,000-square-foot store on the Diamond Head side of Tori Richard. Coach, the handbag and accessories business, will share that space. It's called Coach at Mitsukoshi, because the brand was licensed to Mitsukoshi, Kojima said.

The surf-fashion business Billabong opened late last year in the separate building that houses Hyatt's parking floors and meetings facilities. That is the first separate brand store in the islands for Billabong, which previously had sold through other shops.

Most of Hyatt's retail business is in the three floors of the atrium running through the two main towers and it really is a shopping center, Kojima said. "Typically in a hotel you'll find a handful of stores," she said.

The usual amount is as many as 10, she said, but Hyatt has 60, with the hotel's retail complex encompassing a gross leasable area of about 100,000 square feet.

Kojima recalled that when she started out with the hotel a dozen years ago, she was instructed "we are a hotel, not a shopping center."

That changed. "As the years went on, shopping got to be more popular with our visitors. Now we are a hotel with a shopping center," she said.

Kojima's two-person office handles all the leasing.

Hyatt still has some vacancies but negotiations are under way and Kojima expects the gaps will soon be filled. The hotel has had to make rent concessions to attract new customers but hasn't done so for the existing lessees, who pay a minimum rent or a percentage of their gross, whichever is higher.

"It's a break for the first few months," she said.

Some shifting of gears has been required. Through the years of big spending Japanese visitors, the aim was always to put in stores that would sell to them.

"The ultimate goal now, realistically, is to get tenants in that will attract westbound and eastbound visitors," she said.

Rents are definitely not as high as they were five years ago, said Kojima, who recalls the days when Kalakaua Avenue was such a sought-after location that a few luxury retailers were prepared to pay hundreds of thousands of dollars in "key money," fees that were not part of the lease but were charged just to let them secure the location.

One hotel that does have a number of vacant spaces is the Waikiki Beach Marriott Resort. There is 50,000 square feet of retail space in the hotel, with only 41 percent occupied.

But that empty spaces are mostly intentional, said Stan Brown, Marriott International Inc. vice president for the Pacific Islands Area. Marriott has spent more than $60 million renovating the hotel since taking over the former Hawaiian Regent two years ago.

"What we did during the course of the renovations over the last 18 months was reposition the resort," Brown said. That meant new types of customer. Once the pattern was established, marketing could be directed to retailers and restaurants best suited to the customer mix.

The marketing is going well, Brown said. With new stores already moving in, plus what is under contract, the retail space will be 84 percent occupied by the end of the year, he said.

A major new tenant to open soon is Arancino di Mare, a 4,500-square-foot Italian restaurant on the Oahu Avenue side of the property.

"We're working on another restaurant outlet and a spa and a couple of other items," he said. "Now you'll see something every few months."

While the hotel did have to make some rent concessions, the enhancements have greatly helped its position, Brown said. The interest in taking out retail leases in the hotel demonstrates confidence in Waikiki and a lot of confidence in the Marriott brand, Brown said.

"What they have faith in is the strength of the Marriott brand. Even in down times, we will have pretty good occupancies. You won't see the peaks and valleys that they saw without the Marriott brand," he said.

The Starwood Hotels & Resorts Hawaii hotels on Kalakaua have about 70 shops. Edna Wong, who runs the retail operations for the company, said the tourism downturn has brought "extremely challenging times."

McInerny stores closed, leaving vacancies in the Royal Hawaiian, the Sheraton Waikiki and the Sheraton Princess Kaiulani.

All those spaces have been leased, and "all of our shops are currently occupied or in negotiations for leases," Wong said.

The owner of the Starwood-managed hotels, Japan-owned Kyo-Ya Co., has been supportive by waiving minimum rents and charging only a percentage of revenues, she said.

That's something that other hotels don't like, but Wong said it is working for Starwood.

"We're optimistic about the rebound" that will follow the end of the Iraq war and, everyone hopes, a fading of the SARS scare, she said.

Barbara Campbell, vice president of retail leasing for Outrigger Enterprises Inc., said retail spaces in Outrigger and Ohana hotels are all taken.

"We have 300,000 square feet of retail space and we are fully leased. We have just a little space, one or two tiny spaces, and we're just shy of 100 percent leased," she said. "We're very confident in the market. We have not been hurt as bad by the war as we thought we might be."

Despite the reduction in visitor arrivals, "you've got people arriving every day, wanting to take back souvenirs, memories of Hawaii," she said.

And they have to eat. "Of the 300 or so leases that we have, about 35 or 40 are restaurants," Campbell said.

Not all hotels feel qualified to manage their own retail leasing.

"As far as we're concerned, we're hoteliers," said Kelvin Bloom, president of Aston Hotels & Resorts Hawaii, which operates a number of hotels in Waikiki.

Aston leaves the retail business to commercial real estate broker Colliers Monroe Friedlander Inc.

Bloom keeps a close eye on the retailing activity, however, and has seen it strengthen.

"We are fully leased," Bloom said. "We've been very pleased with the response that we've gotten from the retailers."

The recently completed $30 million renovation of the flagship Aston Waikiki Beach has helped. "There's no question that the city's revitalization of Waikiki has contributed tremendously," Bloom said.

"There's one vacant space and it has been leased to del Sol," he said., a sports clothing business whose garments are black and white indoors but take on colors when in the sun.

The Aston Waikiki Beach has a small string of new retailers along its Kalakaua front. There's a Wolfgang Puck Express, selling Puck's name-brand food items in a quick-service format.

There's a Cold Stone Creamery ice cream business and a 1,500-square-foot Hawaii Five-O casual clothing business, which owner Talia Shaw calls a "surf shop for the entire family."

"We just opened in December, we love it. It's a high-volume location," she said. She loves the city's Sunset on the Beach program, which takes place close by, and is delighted by the city's physical revitalization of that end of Waikiki.

Andy Friedlander, chief executive and principal broker of Colliers Monroe Friedlander, said the key to leasing out retail space in hotels is knowing what the hotel's market is.

"When we look at a hotel property, we try to understand the clientele in that hotel, who the visitor is and what is the visitor experience and how can retail further enhance that visitor experience.

"That's how retailers can be successful in hotels," he said. "That's the key. If the shops are properly geared for the visitor, they will normally do very good to great."

Premiums, or key money payments, are a thing of the past, Friedlander said. It hasn't been necessary lately for property owners to make special deals to get stores into their hotels, Friedlander said.

"That's because Waikiki is in a transition period and the smart retailers are taking advantage of that to secure spaces for the future," he said.