Small companies Hawaii Medical Service Association has asked the state Insurance Division to approve an average 11.5 percent hike in insurance premiums for small business customers on its most popular health plan. The new rate would take effect July 1, the company said yesterday.

face 11.5% HMSA hike

It would be the largest rate

increase for the medical insurer

in more than a decadeBy Lyn Danninger

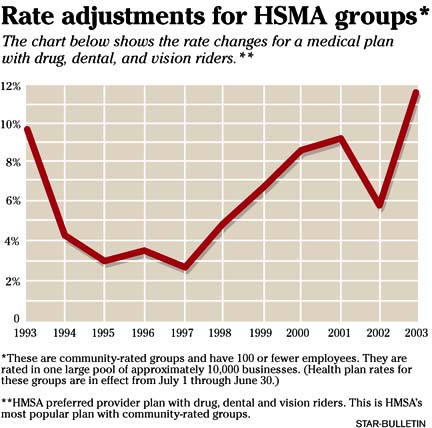

ldanninger@starbulletin.comIf approved, the rate increase for the Preferred Provider Plan would be the largest for the company's small business customers in more than 10 years. In 1991, HMSA increased rates for those groups by 13.5 percent. Last year, by comparison, HMSA passed on a 5.8 percent increase to its small business customers for the same plan.

The increases, which range from 6.5 percent to 16.5 percent depending on plan usage, affect about 10,000 businesses having fewer than 100 employees. About 138,000 people make up the pool of so-called community-rated groups.

Employers will begin receiving letters announcing the increase in the second week of May, said HMSA Senior Vice President Cliff Cisco.

HMSA filed its rate request with the Insurance Division yesterday. The state has 90 days to review the filing. This is the first year the insurance division has the power to approve or disapprove rates, following passage of a rate-regulation measure last year.

HMSA's main competitor, Kaiser Permanente, filed a request with the division in October to raise its small business rates by an average of 8.7 percent effective Jan. 1. The rate was implemented as scheduled pending a ruling by the division, said Kaiser spokeswoman Jan Kagehiro.

The HMSA increase comes on the heels of a $35 million operating loss for 2002 announced in February. Kaiser announced a $2.8 million loss in February.

HMSA officials said the requested increase is necessary to make up for losses in dues income.

"Clearly the rates in 2002 were inadequate, so this is a matter of catch-up, to get ourselves back in sync with the trends," Cisco said.

Small business customers of HMSA's second most popular plan, its health maintenance organization called Health Plan Hawaii, will see an average increase of 7.8 percent if approved by the division. The increases for both plans include drug, dental and vision coverage.

HMSA had, in the past, been able to come close to break even with small to moderate rate increases for its smaller groups, said Steve Van Ribbink, HMSA's chief financial officer. But not this year.

"We must move to catch up with medical trends. Our hospital, medical and drug costs are moving up much faster than dues payments," he said.

Van Ribbink said 95 percent of all dues collected by HMSA went to pay for health care services in 2002. Of that, 74 percent went to hospitals and physicians, prescription drugs accounted for 18 percent, and dental and vision expenses totaled 8 percent.

"The remaining 5 percent was insufficient to cover administrative costs, and investment income didn't cover it either," he said.

Another significant factor affecting last year's increased costs was Hawaii's aging population, HMSA officials said.

HMSA's Cisco said about half of the organization's membership is now more than 40 years of age, with the fastest growing segment between 50 and 64 years of age.

"About half of our membership overall is over 40 and even 20-something's go to the doctor more than they used to," he said.

The Insurance Division had no comment on yesterday's rate filing. Commissioner J.P. Schmidt was traveling on the mainland.

Hawaii Medical Service Association