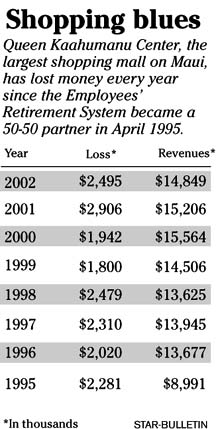

Maui Land & Pineapple Co. and the state Employees' Retirement System, which together have been exploring the sale of Queen Kaahumanu Center, lost a combined $2.5 million in 2002 on their 50-50 joint partnership in the Maui mall. Maui center bleeds red ink

Queen Kaahumanu Center cost the

state Employees' Retirement System

and Maui Land & Pineapple Co.

a combined $2.5 million last yearBy Dave Segal

dsegal@starbulletin.com

The loss, disclosed in Maui Land & Pineapple's annual report, continues a flow of red ink by the Kahului center, which saw revenues slip 2.3 percent to $14.8 million from $15.2 million in 2001. The center has not had a profit since the state's largest pension plan became a 50-50 partner on April 30, 1995.

Eastdil Realty LLC, the largest real estate lender in the United States with more than $349 billion in total assets, has been handling the search for a buyer, but declined yesterday to provide any information. Eastdil is a wholly owned subsidiary of Wells Fargo Bank.

Meanwhile, Maui Land & Pineapple continues to search for a president and chief executive officer to replace the retiring Gary Gifford, who will step down at the May 27 annual shareholders meeting.

Randolph Moore, a member Maui Land & Pineapple's board, said global management consulting firm Spencer Stuart is conducting the search.

"We hope to have someone identified by the annual meeting date," Moore said. "We're looking everywhere. Often when you look everywhere, you find somebody with a local connection."

A Spencer Stuart representative declined to comment on the search.

The effort to explore a sale of the 570,000-square foot shopping center comes as both Maui Land & Pineapple and the ERS have been under increasing pressure to improve results.

Maui Land & Pineapple announced in February it lost $5.7 million last year. Three weeks later, the company said Gifford was retiring at 55. The company also announced at that time that Chairman Richard Cameron was stepping down but retaining his directorship and that David Heenan, a trustee of the James Campbell estate, would replace Cameron as nonexecutive board chairman.

Gifford's retirement announcement followed what marked the company's worst annual earnings results in nine years.

"You have to believe (the earnings) played some role," Moore said.

Gifford declined yesterday to elaborate on the circumstances surrounding his retirement. However, he said he has "a good relationship with Maui Land & Pineapple and intend to help with the best of my ability through the transition period.

"My wife and I have some travel plans in the immediate future and those include seeing my father, who has been very ill, in Prescott, Ariz.," said Gifford, who started with the company in 1987.

Meanwhile, the ERS, the state's largest pension plan, received pressure from the state auditor in December to improve its results. The plan was down 5.2 percent through the first six months of fiscal 2003, despite a 4.6 percent gain in the second quarter ending Dec. 31, 2002. Last quarter's results are not yet available. This fiscal year's performance follows losses of 5.5 percent in fiscal 2002 and 6.9 percent in fiscal 2001.

Queen Kaahumanu Center, the largest retail and entertainment center on Maui, is owned and operated by Kaahumanu Center Associates. KCA is the partnership formed in June 1993 on behalf of Maui Land & Pineapple and the ERS to finance the expansion and renovation of the center.

The ERS contributed $312,000 and made a $30.6 million loan to fund the improvements that were completed in November 1994. In April 1995, the ERS converted its $30.6 million loan to an additional 49 percent stake in the partnership to give it a 50 percent interest. Maui Land & Pineapple said its investment in the KCA partnership was a negative $12.8 million as of Dec. 31, 2002.

The mall, which was 98 percent occupied with 135 tenants as of Dec. 31, lost J.C. Penney as a tenant in January. Penney's 83,000-square-foot space, however, was purchased by Macy's, which already had another store in the mall. The renovation for the new Macy's outlet is scheduled for completion later this year.

Despite the uncertainty involved the sale of the center and a new president and CEO, Maui Land & Pineapple's stock continues to climb.

The shares, which were down 34 percent last year, lead 11 other stocks in the Bloomberg Honolulu Star-Bulletin index in 2003 with a 35 percent gain.

Queen Kaahumanu Center