Discipline It's not surprising that Dwight Melton follows a disciplined approach to investing.

wins the day

Sticking to the data puts

Dwight Melton ahead

in stock pickingBy Dave Segal

dsegal@starbulletin.comAfter all, he just retired from the military after 26 years in the Marine Corps.

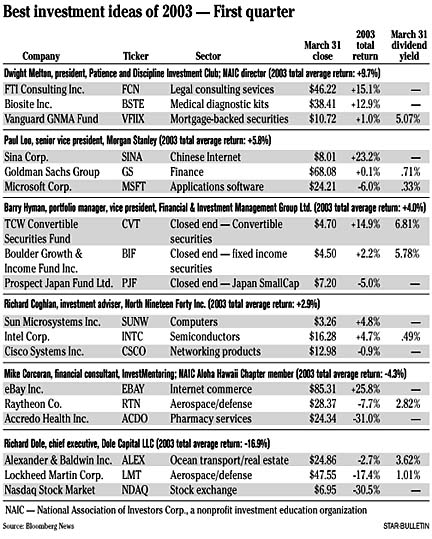

That ability to stick to his plan of attack served him well during the first quarter as his three investment picks posted an average 9.7 percent total return to outpace five other Hawaii stock experts in the Honolulu Star-Bulletin's survey of the best investment ideas of 2003.

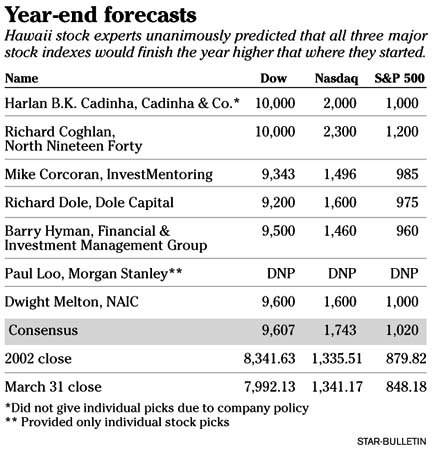

In fact, four of the six participants chalked up positive returns over the first three months to surpass the 3.2 percent loss of the broad-based Standard & Poor's 500 index.

"I don't try to make predictions where these things are going to go. I use a trend-following approach," said Melton, president of the Patience and Discipline Investment Club and a director of the National Association of Investors Corp., a nonprofit investment education organization.

Paul Loo, senior vice president of financial services firm Morgan Stanley in Honolulu, was second with a 5.8 percent average return; followed by Barry Hyman, vice president of Financial & Investment Management Group Ltd. in Wailuku, Maui, at 4.0 percent; and financial adviser Richard Coghlan of North Nineteen Forty Inc. of Hilo at 2.9 percent.

Finishing in negative territory was last year's runner-up, Mike Corcoran, a financial consultant with InvestMentoring in Honolulu at a 4.3 percent drop; and Richard Dole, chief executive officer of Dole Capital LLC, at negative 16.9 percent.

As a whole, the six participants eked out a 0.2 percent total return, which trailed the 0.6 percent total return of the Nasdaq composite index but beat the 3.6 decline of the Dow Jones industrial average.

Melton was the only Hawaii expert to have all three of his selections finish in the black. FTI Consulting Inc., a legal consulting services firm, rose 15.1 percent and also declared a 3-for-2 stock split to take effect June 5. Medical diagnostic device company Biosite Inc. gained 12.9 percent.

He said he still likes both companies for the same reasons he did when he initially picked them -- a timeliness ranking of 1 from the Value Line Investment Survey, a price between $10 and $50 a share so that he can buy at least 100 shares; options-trading capability so that he can write covered calls; an estimated five-year growth rate of 20 percent or better; and a price/earnings to growth ratio of 1.5 or less.

In addition, he said both are still trading above their 50- and 200-day moving averages. Melton's other winner was a fixed-income play, Vanguard GNMA Fund, which rose 1 percent.

Loo, whose stock picks are from his own trading portfolio and aren't necessarily recommended by his firm, had a big winner in Sina Corp. The China-based Internet provider rose 23.2 percent in the quarter to $8.01 but actually was up as much as 59.7 percent before retrenching.

Although he no longer personally owns Sina, or his other picks, Goldman Sachs Group (up 0.1 percent) and Microsoft Corp. (down 6.0 percent), he said he still considers all of them good investments.

"No sooner had I talked about them, I had grave misgivings about events happening in the Middle East and I bailed out of my account and went to all cash," said Loo, who still has equity exposure in his long-term mutual funds and his 401(k).

Loo said he lost a little money on Microsoft, broke even with Goldman Sachs and "made a substantial amount" with Sina, a company that his firm had underwritten and in which he was very familiar.

"I think they are still good companies," Loo said. "Sina continues to be promising, Goldman is as prominent as we are in the world of corporate finance, and Microsoft, if you just took its cash and considered it a company, it would be the 35th largest company in the world with its $40 billion in cash. It's a strong company whose stock is down right now and I wonder today if it would be a screaming buy."

Hyman had a double-digit gainer in TCW Convertible Securities Fund, a closed-end fund that had a 14.9 percent gain and was yielding 6.8 percent as of March 31. By contrast, TCW's net asset value, or worth of its holdings, has risen less than 2 percent since the beginning of the year.

"This (14.9 percent share-price gain) is from a convertible bond fund in a market where such bonds have returned only a few percent since the beginning of the year," Hyman said. "It shows the leverage investors can gain by buying the right closed-end fund at a discount, and is also reason to take the money off of the table when the discount shrinks."

Hyman said he still likes the two equity funds, Boulder Growth & Income Fund Inc. and Prospect Japan Fund Ltd., for the same reasons as he did three months ago.

"They own portfolios of risk-adjusted bargains overlooked by institutional investors and analysts," Hyman said. "On top of that, since closed-end funds trade on the stock market like a stock, they are often priced inefficiently and thus investors are able to buy them at prices well below the price it would cost to own the underlying portfolios they own.

Since they are selling for discounts to net asset value in excess of 10 percent, we believe they are tremendous bargains."

Corcoran, last year's survey runner-up with a 0.4 percent gain in a down market, had the best-performing stock in the quarter with Internet auctioneer eBay Inc. rising 25.8 percent.

However, he also had the worst performer as Accredo Heath Inc., a pharmacy services company, fell 31 percent.