Bankruptcies tumble Statewide bankruptcy filings dropped 23 percent in the first quarter to the lowest level since the final three months of 1996 as low unemployment and a booming real estate market helped prop up consumers' bank accounts.

State filings during

the first quarter dropped

23 percent from last yearBy Dave Segal

dsegal@starbulletin.com

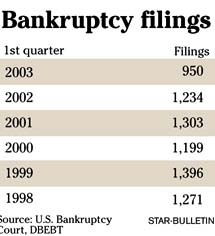

Although the war with Iraq could reverse the downward trend, the 950 filings in the first three months provided further evidence that Hawaii residents' fortunes are changing after hitting a peak of 5,811 bankruptcies for all of 1998. The number of filings in the first quarter was significantly below the 1,234 filed in last year's first quarter and was the lowest amount for a three-month period since 921 were filed in the fourth quarter of 1996.

"Our unemployment rate has remained quite low and fairly steady, and the real estate market has really helped out a lot of people with the increased values," said Gayle Lau, assistant U.S. trustee. "A lot of people have had a chance to refinance and improve their cash flow, and that has enabled them not to file bankruptcies and stay out of financial difficulty."

In January, the not-seasonally-adjusted jobless rate in Hawaii was 3.7 percent, down from 4.9 percent in the year-earlier period. Meanwhile, the value of single-family home and condominium resales on Oahu during the first two months of this year soared 39 percent to $406 million from $292 million during the first two months of 2001.

Of course, the biggest bankruptcy filing in the quarter belonged to Hawaiian Airlines, which is seeking protection while it reorganizes under Chapter 11.

"Bankruptcy numbers are useful to gauge the individual consumer's financial condition, but those numbers don't necessarily reflect business trends because often times businesses don't bother to file for bankruptcy. They basically close down," said Chuck Choi, a partner and bankruptcy attorney with Wagner Choi & Evers. "Also, a very large Chapter 11 case, such as Hawaiian Airlines, is equivalent to Chapter 11 filings by dozens of smaller companies."

Lau said Hawaiian's filing deserves to be in a class of its own since the majority of filings in Hawaii are Chapter 7.

"Hawaiian's filing relates to what is going on in the entire airline industry," Lau said.

Until the fourth quarter of 2002, the number of Chapter 7, 11 and 13 filings in Hawaii had exceeded 1,000 each quarter. But the number fell to 991 during that three-month period as total bankruptcies in 2002 fell 11 percent to 4,479 from the previous year's 5,033.

Chapter 7 filings involve the liquidation of a business' or consumer's assets. Chapter 11 filings mostly cover business reorganizations. Chapter 13 filings have debt limits and allow a wage-earner to pay his net disposable income to creditors over a three-year period.

Now, of course, Hawaii's economy in the near term rests on what happens in Iraq.

"I think the travel industry as a whole and those that rely on tourist dollars face a very uncertain future depending on the length of the war," Choi said.