|

Professional investor

sees optimism returningHow long have you been a member of the Investment Society of Hawaii?

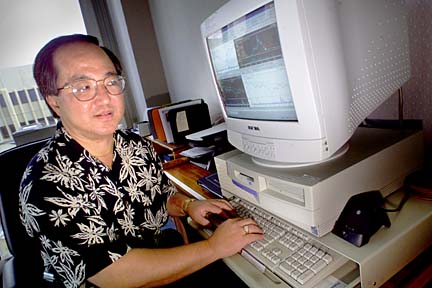

>> New post: Investment Society of Hawaii president for 2003. Wesley Yamamoto

>> Day job: Vice president for investments with Prudential Securities.

>> Other Investment Society officers: Vice President David Nako, Edward Jones; Treasurer Barby Clarke, Bank of Hawaii; and Secretary Robert Choy, Merrill Lynch.

>> Investment Society directors: Michael Chun of Morgan Stanley; Scott Ellis, Patrich Daily and Patricia Kwan of Smith Barney; Gregory Boxold of UBS Paine Webber; Walter Knoc of Merrill Lynch; and Mero Giasolli of First Hawaiian Bank.

>> Investment Society: The 47-year-old group provides a platform for companies to get information out to investment professionals and individual investors.

About 3 years.

How did you get involved?

There are three past presidents at this firm. Bruce Atkinson, John Kramer and Lee Maxwell III of Prudential Securities are all past presidents. It was Bruce Atkinson who recommended me to the board.

Has the market's performance hurt membership?

Not too much. What it has hurt is our ability to put on programs sponsored by different companies. They will host a lunch to tell our members about their companies and their industries. It was very hard last year to find firms that wanted to participate. In years past, we had Intel come out, that was standing room only; we had Nokia come out. That kind of thing was more difficult last year. But that's looking up this year. Companies are getting more optimistic. We're also looking at having a few local companies make presentations.

What are your goals as president?

To increase the membership, to provide a networking platform with other professionals and to put on more programs with companies. We're going to be opening the membership up to people who want to network with investment professionals.

Given the tumultuous couple of years we've seen in the market, what are your goals as an investor?

To not lose any more money. Seriously, what we always try to do is look at asset allocation and timing. Speaking personally, I've always followed the philosophy that if you're investing for something there has to be a time frame attached to that goal. My risk tolerance may have changed a bit. But this is just a market cycle, that doesn't change the time frame of your goals. Say I'm saving for my daughters' college tuition, the time frame on that doesn't change in the face of market volatility.

Is this market downturn the worst you've seen as an investor?

Yes.

How are you handling it personally?

I haven't sold anything.

Are there things you wish you sold?

Probably, but the thing is, I think the market will come back eventually, so no sense. I'm a pretty conservative investor, not only in work but for myself. I'm not the put-all-my-money-in-one-stock investor, so my investments have always been pretty balanced. It's not like I put everything on the hot tip and expected to make it overnight. I've never done that.

How are your clients handling the market downturn?

People who've been in the market, they're staying in. People who have money on the sidelines are either holding it or putting it in little by little, through dollar cost averaging.

What's been the biggest lesson for you in going from fat times to lean times on the stock market?

Again, speaking personally, it's still that a proper asset allocation is the key, within the context of a proper time frame and the proper risk tolerance.

Are there some hot industries the society is looking at for presentations that might interest its members?

The companies that we're hoping to get are from the banking sector and maybe the utilities. Last year, we had a couple of money management firms, including Curtis Freeze who runs Prospect Asset Management out of Hawaii Kai. His Prospect Japan Fund specializes in Japan small-cap stocks. That was fascinating.

Inside Hawaii Inc. is a conversation with a member of the Hawaii business community who has changed jobs, been elected to a board or been recognized for accomplishments. Send questions and comments to business@starbulletin.com.