Investors say 2003 Hawaii stock experts believe the market will end its three-year bloodbath with a positive return in 2003.

will stop the fall

But few predict the stock market

will launch a massive reboundBy Dave Segal

dsegal@starbulletin.comBut the majority of the experts responding to a Star-Bulletin survey see modest gains for the three major indexes with a possible U.S.-Iraq war acting as the wild card.

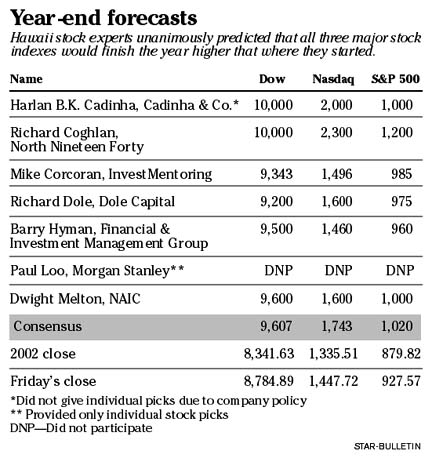

Of the six participants who selected year-end numbers, four of them see the Dow ending the year between 9,200 and 9,600 and the Nasdaq finishing between 1,460 and 1,600. Five of the experts see the Standard & Poor's 500 index closing between 960 and 1,000.

"My general outlook for the markets in 2003 in conservative," said Honolulu financial consultant Mike Corcoran, the runner-up in last year's survey.

|

"With the unsteady economic conditions, almost certain war in Iraq, and investors still shaking over the governance of companies, I see a slow first half with a pickup in the second half," added Corcoran, who expects all the indexes to finish about 12 percent higher.One of the most optimistic experts, Vice President Harlan B.K. Cadinha of Honolulu broker Cadinha & Co., expects the Dow to return to 10,000, a 19.9 percent gain for the year. He's even more upbeat for the Nasdaq composite index, which he sees jumping 49.8 percent, while he's calling for a 13.7 percent increase in the S&P.

"The Bush package is very positive for financial markets, and if it is passed, financial markets will only be held back by global uncertainty of the magnitude of a war on Iraq or North Korea," Cadinha said.

However, Cadinha, who cited company policy in not making individual stock picks, also was bullish last year. He forecast in June that the Dow could reach 12,000 to 14,000 by the end of 2002 if the Republicans took over Congress in the November election. The GOP prevailed but the Dow ended the year at 8,341.63.

Another megabull is Richard Coghlan, a financial adviser with North Nineteen Forty Inc. in Hilo. Coghlan, who also picked the Dow to hit 10,000, predicts the technology-heavy Nasdaq will soar to 2,300. That's a 72.2 percent jump for an index that fell 31.5 percent in 2002. Coghlan expects the S&P, which lost 23.4 percent last year, to jump 36.4 percent to 1,200.

Four of seven participants from the 2002 survey are back with more stock picks along with two newcomers -- Paul Loo, the senior vice president at Honolulu's Morgan Stanley brokerage, and Coghlan, the North Nineteen Forty financial adviser who previously was a broker at Prudential and PaineWebber.

The returnees are Corcoran, who runs InvestMentoring in Honolulu and is a member of the National Association of Investors Corp. Aloha Hawaii Chapter, a nonprofit investment education organization; Richard Dole, chief executive officer of Honolulu-based Dole Capital LLC; Dwight Melton, president of the Patience and Discipline Investment Club in Ewa Beach and an NAIC director; and Barry Hyman, portfolio manager and vice president of Financial & Investment Management Group Ltd. in Wailuku, Maui.

|

For the second year in a row, none of the experts picked the same investment. However, seven of the selections are repeats from last year -- Intel Corp., Sun Microsystems Inc., Raytheon Co., Lockheed Martin Corp., Nasdaq Stock Market, Prospect Japan Fund and Vanguard GNMA Fund. Not all those picks, however, were chosen by the same expert who did so in 2002.Conservative investments are prevalent among the selections, but seven of the 18 picks have strong links to technology.

"I can only say that 2003 should be better as a rebuilding year over the last three," Loo said.

Loo, who is an administrator and not a personal consultant, said he doesn't recommend stock portfolios. But he disclosed the three largest positions -- excluding his own company's stock -- in his personal portfolio. They are software giant Microsoft Corp.; investment banker Goldman Sachs Group Inc.; and Sina Corp., China's leading Internet provider.

Sina, which closed Friday at a 52-week high of $8.88 on the Nasdaq, skyrocketed 311.4 percent last year and is up 36.6 percent so far in 2003.

Corcoran, who had the second best return of last year's participants with a 0.4 percent gain, is sticking again with his primary theme of 2002 -- defense and health care. Corcoran is going again with Raytheon as a security/defense play despite the stock posting a total return last year of minus 3 percent.

"With homeland security, Iraq, North Korea and the Middle East, its products should make this defense company into a growth stock," Corcoran said.

He also likes eBay, the online auction site that has become "a retail monster, hawking everything."

"It has no inventory to maintain, no sales force, no locations," he said. "Its customers do everything -- advertise, sell, ship, collect, etc. The company takes a small bit off the top."

Corcoran's other pick is Accredo Health Inc., a pharmacy services company.

Melton, who lost just 2.6 percent last year in the survey, said he's not one to get greedy.

"My equity investment goal is to attain 20 percent annualized compounded growth," he said. "My fixed-income investment goal is to achieve a rate of return greater than U.S. Treasury securities, which are risk-free investments."

His two stock picks are Biosite Inc., a leading provider of rapid tests that diagnose critical diseases, and FTI Consulting Inc., which provides litigation support and consulting services. Melton said both companies are ranked No. 1 by the Value Line Investment Survey, both are trading above their 50-day and 200-day moving averages, and their projected earnings growth rates are 32 percent and 23.5 percent, respectively. Melton also favors the Vanguard GNMA Fund, whose goal is to invest 80 percent of its assets in Government National Mortgage Association certificates. The fund is a repeat selection.

Dole, who changed his Alexander & Baldwin Inc. survey pick last year at the last minute to Hawaiian Airlines Inc., saw his decision backfire when Hawaiian's merger with Aloha Airlines fell through. This time, Dole is sticking with A&B, which he said will benefit from an improving local economy as long as the United States doesn't go to war Iraq.

"The company pays a healthy dividend, and should be a beneficiary of the president's plan to eliminate income taxes on dividends," said Dole, whose picks lost 23.6 percent last year.

His other picks are Lockheed Martin and the Nasdaq Stock Market, which he picked in 2002.

"Nasdaq would benefit from a market recovery because small company stocks (listed on Nasdaq) would likely do better than the market in general," Dole said. "Plus, Nasdaq is probably going to list on the Nasdaq National Market, which would give it better liquidity than the OTC Bulletin Board."

Coghlan is the most bullish of the experts.

"I think the market will recover in 2003 because the conditions necessary for a run-up are in place -- rising economic indicators, very low interest rates, full employment and low inflation," Coghlan said. "What could derail a market recovery is a prolonged conflict with Iraq, a major domestic terrorist event or a huge deficit budget."

Coghlan, who describes himself as a value investor, picked Intel and Cisco Systems Inc. for their industry dominance, excellent management, strong cash positions and no long-term debt. His other pick was Sun Microsystems, citing its undervalued stock, history of innovation, management, strong cash position and investment in research and development.

Hyman, whose picks fell 19.1 percent last year, said he felt uncomfortable recommending only three investments because "it is not prudent to suggest anyone invest in only a handful of investments." As a compromise, Hyman came up with three closed-end funds.

He said one of his firm's favorite investments are Japanese real estate investment trusts, which investors can get exposure to through the Prospect Japan Fund. The fund trades on the London Stock Exchange and is run by Hawaii Kai's Curtis Freeze. The fund also owns Japan small cap stocks.

"In Japan, long-term government bonds are paying investors less than 1 percent annually while the six REITs which trade in Japan yield between 5 and 6 percent," Hyman said.

Hyman's other picks, TCW Convertible Securities Fund and Boulder Growth & Income Fund, are both selling at significant discounts to their net asset values. In other words, the price at which the funds sell in the market are less than the sum of the prices of the securities in the funds.

TCW Convertible Securities, which this month cut its quarterly dividend to 8 cents from 21 cents, owns convertible bonds and has a 7 percent dividend yield.

"The bonds have some of the upside potential of the stocks of the underlying companies with most of the stability of bonds," Hyman said.

Boulder Growth and Income invests in Warren Buffett-type stocks and pays a 7.1 percent dividend yield. Hyman expects the yield to decrease as the fund manager moves into more growth-oriented investments.

Hyman, who calls the major indexes overvalued, said corporations are not yet ready to rapidly expand their capital expenditures.

"However, due to the stimulus and focus of Washington to be market and economy friendly," Hyman said, "there should be upward pressure on stocks. As these pressures pull in opposite directions, it will be a stock picker's market more than one in which all ships rise with the tide."