CPB Inc., impersonating The Little Engine That Could, left 11 other publicly traded Hawaii companies in its tracks in 2002 as its stock nearly doubled in a down market. CPB leads the way

for Hawaii stocksThe bank posted an 86.7%

Bull run in 2003?

gain during 2002By Dave Segal

dsegal@starbulletin.comSo what does the parent of Central Pacific Bank do for an encore?

It switches its stock listing from the Nasdaq Stock Market to the New York Stock Exchange to increase exposure and stock liquidity and films a new television advertisement to be aired during Super Bowl week featuring the bank's popular "fiercely loyal" mascot dog, Alex.

|

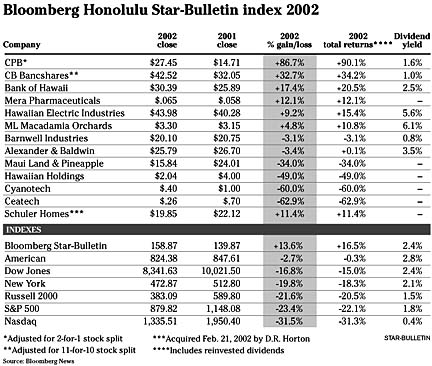

CPB, whose shares at one time last month had more than doubled for the year, ended 2002 with a gain of 86.7 percent -- 90.1 percent counting its 1.6 percent dividend -- in leading a strong financial sector. Four of the top five Hawaii stocks in the Bloomberg Honolulu Star-Bulletin index all had ties to banking and helped the index post an overall 13.6 percent return. It was a remarkable achievement for Hawaii stocks when compared with the performance of their down-and-out mainland brethren.The Dow Jones industrial average fell 16.5 percent, the Standard & Poor's 500 index lost 22.1 percent and the Nasdaq composite index tumbled 31.3 percent.

"I think the reason Hawaii companies have held up fairly well is because there are not a lot of high-tech companies here," said Randy Havre, local stock expert and chief executive officer of Hawaii Venture Group LLC. "The companies we do have are older companies like the Alexander & Baldwins that pay a dividend which is better than you can get in a money market account. The banks also have been doing pretty well recently, with obviously Central Pacific being the star of the year."

Clint Arnoldus, CPB's chairman, CEO and president, said he's realistic enough to know that the bank's stock will be hard-pressed this year to duplicate 2002's gain.

"We'd quickly be on the way to becoming the No. 1 stock in the U.S. if we did that every year," said Arnoldus, laughing. "It's been wonderful what happened with our stock price this year. We're just going to focus on the fundamentals of our bank and continue to run a very clean credit portfolio and to continue focusing on our core businesses that benefit the growth of the bank. We're growing loans, core deposits and fee income business, and the price of the stock will take care of itself. We continue to believe we have a very strong bank to invest in and that we will have a very solid performance."

While CPB was the front-runner, it had plenty of company in posting solid stock gains. City Bank parent CB Bancshares Inc. jumped 32.7 percent, Bank of Hawaii Corp. rose 17.4 percent and Hawaiian Electric Industries Inc., which owns American Savings Bank, came in fifth with a 9.2 percent gain. Hawaiian Electric had a more impressive return of 15.4 percent when its 5.6 percent dividend yield, which is second best in the index, is taken into account.

"The financial stocks benefited from low interest rates as their spreads increased," said Richard Dole, local stock analyst and CEO of Dole Capital LLC. "Many of them had very good earnings. There was a lot of active mortgage refinancing."

The other Hawaii stocks to post gains were Mera Pharmaceuticals Inc., which came in fourth, and ML Macadamia Orchards LP, which finished sixth.

Mera, formerly Aquasearch Inc., emerged from Chapter 11 bankruptcy earlier this year and ended up 12.1 percent based on a gain of just half a penny. ML Macadamia, the Big Island grower of macadamia nuts, finished ahead 4.8 percent even though it had to endure late payments throughout the year from exclusive nut purchaser Mauna Loa Macadamia Nut Corp. ML Macadamia had a total return of 10.8 percent counting its index-leading 6.1 percent dividend yield.

A&B, whose Matson Navigation Co. subsidiary was adversely affected by the 11-day West Coast dockworkers lockout, narrowly finished in the red as its stock declined 3.4 percent. Overall, though, it eked out a positive 0.1 percent return counting its 3.5 percent dividend yield.

Barnwell Industries Inc., which is involved in oil and gas exploration in Canada, slipped 3.1 percent.

The remaining five Hawaii companies all had double-digit losses. Maui Land & Pineapple, whose Kapalua Resort operating profit dropped off dramatically from a year ago, fell 34 percent. Hawaiian Holdings Inc., the parent of Hawaiian Airlines, dropped 49 percent after its proposed merger with privately held Aloha Airlines fell through in March.

Cyanotech Corp., which now trades on the Nasdaq SmallCap Market after getting delisted from the Nasdaq National Market due to a low stock price, lost 60 percent. Ceatech USA Inc., which has been seeking outside financing to keep its company afloat, plunged 62.9 percent.