ERS underfunding grows A 2 1/2-year bear market and reduced payments by state and county employers have resulted in underfunding of the state Employees' Retirement System. Officials of the state's biggest pension program will ask for increased contributions next fiscal year to reverse the dwindling asset base.

A falling stock market and

legislative raids have cost the

state and county employee

retirement fundBy Dave Segal

dsegal@starbulletin.comThe ERS, which said this week that investments in its pension fund fell 9.8 percent, or $747 million, last quarter, plan to seek higher contributions in fiscal 2004 than the $188.5 million currently being collected for the 2003 fiscal year ending June 30, according to ERS Administrator David Shimabukuro.

"Those appropriation reductions will have to be made up in the future," Shimabukuro said. "That's why the employer contributions, plus the poor investment returns, are going to result in an increase in employer appropriations next year and in the future. The actuary will be coming in with those numbers at our December board meeting."The ERS fund, which provides retirement, disability and survivor benefits for 96,000 city, county and state employees, retirees and their beneficiaries, was underfunded by 9.4 percent as of June 30, 2001, and is expected to have been underfunded by an even greater amount when the number for fiscal 2002 is made available next month, Shimabukuro said.

Last quarter, assets in the fund shrunk to about $7.1 billion from about $7.9 billion on June 30, 2002. The quarter's $814 million asset decline included benefit payouts and administrative expenses of $136 million and employer and employee contributions of $69 million.

Total assets were $9 billion in 2001 and $9.9 billion in 2000. Legislation passed by the budget-strapped state in 1999 was part of the reason for the dwindling asset base.

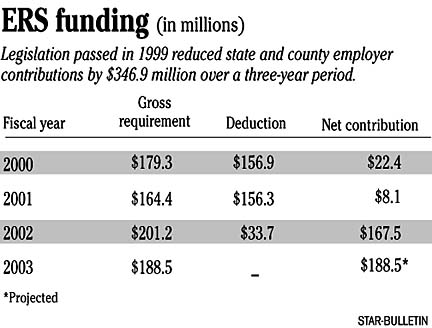

The legislation enabled the state to use all of ERS' investment earnings over 10 percent to reduce state and county employer contributions over a two-year period. The withholding wound up spilling over into a third year and $346.9 million ended up being deducted during the three years.

The legislation, passed near the height of the bull market, came at a time when the pension plan was exceeding its annual investment yield assumption of 8 percent. Now, though, times are different and the assets of the fund continue to drop.

Even though the fund last quarter outperformed 51 percent of other large public funds and easily beat the 10.4 percent negative return of its benchmark, it still continues to lose ground. If the trend continues for the rest of the fiscal year that ends June 30, the fund would post its third straight losing fiscal year.

ERS investment adviser Callan Associates said in a letter to the ERS trustees that funding levels for pension funds are estimated to be just as bad as they were in 1974 when investors experienced the last major bear market. The fund was down 13.1 percent through the first nine months of this calendar year.

"The only good news," Callan said, "is that stock markets have rebounded significantly since the end of the quarter."

In the bull market's heyday, the ERS pension fund had gains of 18.8 percent in fiscal 1997, 16 percent in 1998, 10.4 percent in 1999 and 7.4 percent in 2000. Even though the bull market ended in March 2000, the pension fund had a gain for that year since its fiscal year ended at the end of June.

However, a negative 6.7 percent return in fiscal 2001 and an unaudited negative return of 5.1 percent in fiscal 2002 have altered the picture. Shimabukuro expects the actual fiscal 2002 return will be even a little worse, about 5.2 percent, when the audited numbers are released next month.

"We're not happy with (last quarter's) results, but the fund has been beating our benchmark," Shimabukuro said. "Everyone's having a tough time."

Shimabukuro also pointed out that despite the bear market, the ERS fund's annualized return is 6.8 percent for 10 years, 7.3 percent for 15 years and 9.4 percent for 20 years.

State of Hawaii