THE FOURTH QUARTER CENTURY

1975-2000

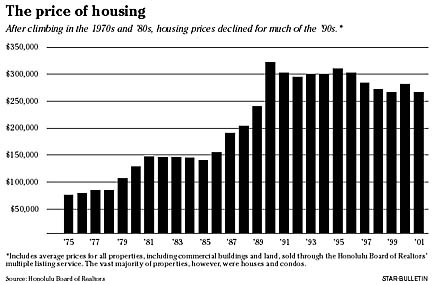

The bubble finally burst in Hawaii's housing market. In an unprecedented blow to local homeowners, Hawaii real estate prices, which soared in the 1980s, went into a prolonged decline in the '90s, coinciding with a nearly decade-long economic slump that colored virtually all facets of island life. Real estate boom

went bust in ’80sThe fallout from a slumping Japanese

economy left the isle market in tattersBy Rob Perez

rperez@starbulletin.comThe dramatic turnabout in the housing market was one of the bigger business stories locally in the final 25 years of the 20th century. It also was one of several major developments during that period that greatly changed the face of Hawaii real estate.

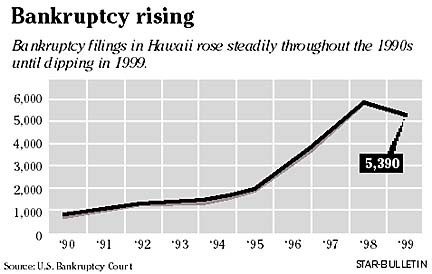

Falling real estate values and the sluggish economy were reflected in greater numbers of Hawaii bankruptcies, foreclosures, job losses, company closings, consolidations, restructurings and, to some extent, a flight of talent from the state.

Only in the past several years has the real estate market returned to a semblance of normalcy.

But normalcy was nowhere to be found in the late 1980s, when housing prices surged at double-digit rates, lotteries were used to sell high-demand units, and Japanese investors swooped into neighborhoods and offered cash on the spot for some properties.

Investors, many from Japan, also paid inflated prices for hotels and other commercial properties.

STAR-BULLETIN / 2000

West Oahu has developed substantially in the last quarter-century due to new communities like Kapolei.

It was known as the Japanese bubble period, the likes of which had never been seen before in Hawaii, and which likely will not be seen again, experts say.

At its peak in 1990, the average housing resale price (mainly for condos and single-family homes) approached nearly $320,000.

As the market started heating up in the '80s, affordability became a major issue. Young people believed they would not be able to afford their own homes, prompting many to leave for the mainland.

Government responded in the mid-'80s by aggressively getting into the housing development business, paying millions of dollars to lay the infrastructure for planned projects in West Oahu and on the neighbor islands.

On Oahu the move was part of the state's effort to steer growth westward, particularly to the then-new area of Kapolei, Oahu's "second city."

Both the state and county governments required builders in these new communities and others to set aside a certain percentage of the homes -- as high as 60 percent in some projects -- for "affordable" units, which were priced below the going market and offered to lower-income buyers. The market-priced homes, in theory, would subsidize the affordable ones."This was a period in which government went hog wild," said Ron Lim, a housing executive for Gov. Ben Cayetano's administration.

Lim said the policy, which drew criticism from free-market advocates, was born out of the hefty profits that developers were making at the time and the sensibility that they had a social obligation to give back to the community.

But the affordable-housing requirements became a financial drag as the real estate bubble burst and the market went south.

"It literally drove developers out of business," said Nick Ordway, a University of Hawaii real estate expert.

A lengthy land-use and zoning process, which could stretch for years before a new development could begin construction, also meant that only big, deep-pocketed developers, for the most part, remained in Hawaii.That bureaucracy-heavy process has been both lauded and panned over the past 25 years.

It has been praised for helping curb growth and preserving some of Hawaii's natural beauty, but critics say the system has contributed to high housing prices, largely by limiting the amount of land designated for development.

Hawaii's leasehold land system also stirred its share of controversy.

Although the state successfully defended a law requiring landowners to sell leasehold land under single-family homes, problems cropped up involving leased property under condos.

By the 1990s, lease rates started coming up for renegotiation, and the dramatic increases that resulted captured headlines and spooked buyers, sending the leasehold condo market into a tailspin.

But like with the rest of the real estate market, even leasehold condos have rebounded somewhat. Hawaii's overall market, though, still is well off its 1990 peaks.