State pension fund Hawaii's state pension fund, unable to escape the clutches of one of the worst bear stock markets in history, fell for the second year in a row as it ended its 2002 fiscal year with a $419 million investment loss.

logs big loss

The market delivers a $419 million

punch to ERS investmentsBy Dave Segal

dsegal@starbulletin.comInvestments by the Employees' Retirement System fund lost 5.08 percent for its fiscal year ended June 30 and finished with a market value of just more than $8 billion, according to unaudited figures released yesterday.

The drop in the fund's market value from just under $9 billion at the end of fiscal year 2001 is attributable to benefit payouts of about $560 million and the investment losses of $419 million.

In addition, about $223 million in employee and employer contributions were roughly offset by fund expenses.

The 77-year-old Employees' Retirement System provides retirement, disability and survivor benefits for 96,000 city, county and state retirees and their beneficiaries.

Despite the fund's 2002 losses, ERS Chief Investment Officer Kimo Blaisdell said he was pleased the fund was able to outperform the 6.54 percent loss posted by its total fund benchmark, which is derived from the individual benchmarks for each of the fund's asset classes.

"On an absolute return, we'd rather see (the return) positive than negative," Blaisdell said. "But relative to what some of our peers have done, we've performed well."

For fiscal 2002, the fund outperformed 53 percent of public pension funds with more than $1 billion in assets.The diversified pension fund, which has its investments spread out domestically and internationally over stocks, fixed income, real estate, venture capital and timber, posted positive returns in 33 of 34 years until declining 6.68 percent in fiscal 2001.

It gained 7.46 percent in fiscal 2000 when the bull market was on its final legs.

In fiscal 2002, though, the fund stayed fully invested at its predetermined asset allocations even as many investors were switching to bonds or fleeing to cash.

"At the time when we made the (asset allocation) decision, it was based upon our capital market assumptions," Blaisdell said. "There are different risk tolerances that the fund has, much like individual investors. We have different time horizons.

"We do not change the asset allocation quickly. We're in it for the long term. We do not market time. If we see that bonds are going to outperform, we don't suddenly change the allocation. We're an $8 billion fund. It's not easy to suddenly up and change."

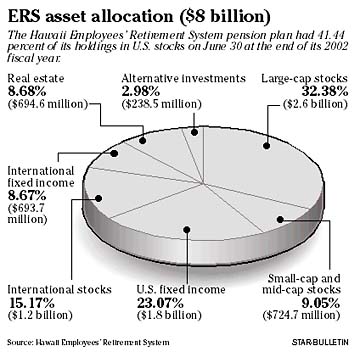

The fund, as of June 30, had its largest concentration of holdings in U.S. stocks at 41.44 percent, or $3.3 billion. That was broken down into 32.38 percent ($2.6 billion) in large-cap stocks and 9.05 percent ($724.7 million) in small- and mid-cap stocks.

Its next biggest stake was 23.07 percent ($1.8 billion) in U.S. fixed income investments, followed by 15.17 percent in international stocks ($1.2 billion), 8.68 percent ($694.6 million) in real estate, 8.67 percent ($693.7 million) in international fixed income and 2.98 percent ($238.5 million) in alternative investments such as venture capital and timber.

In the just-concluded quarter, the fund fell 4.08 percent, but still outperformed the total fund benchmark's return of a minus 4.72 percent.

"It's not a fair comparison to always look at what the S&P 500 is doing because it's just stocks," Blaisdell said. "Being a larger organization, we're more than just stocks. We have to be diversified for times like this."

For the fiscal year, the pension fund's U.S. stock holdings fell 14.57 percent as all, but one of its mutual fund holdings posted negative returns. Among the other investments, international fixed income advanced 16.84 percent, U.S. fixed income gained 8.82 percent and real estate rose 8.73 percent while international stocks fell 12.25 percent and alternative investments dropped 13.40 percent.