What is POP? Cost-conscious series makes a comeback

The Price of Paradise is a new series starting today in the Star-Bulletin, renewing a name and concept originated by Randy Roth in 1992. It will appear each week in the Sunday Insight section.

Price of Paradise began as a book of essays compiled by Roth, a law professor at the University of Hawaii. POP, as it became known, later evolved into a long-running series of Sunday newspaper articles, a radio show and a second book.

The mission of POP is to contribute lively and informed dialog about public issues, particularly those having to do with our pocketbooks.

The dialog begins with opinion pieces by local experts.

From there, we'll open things up to letters and e-mails from readers, which we'll publish weekly in Thursday's paper.

If you have thoughts to share about today's POP articles, please send them, with your name and daytime phone number, to pop@starbulletin.com, or write to Price of Paradise, Honolulu Star-Bulletin, 7 Waterfront Plaza, Suite 210, 500 Ala Moana, Honolulu, HI 96813.--John Flanagan

Contributing editor

|

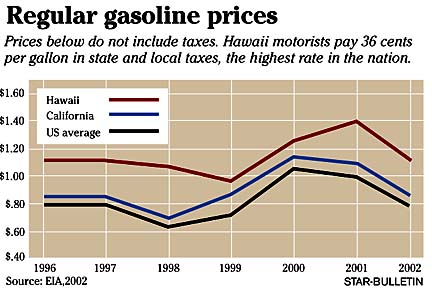

PHOTO ILLUSTRATION BY DAVID SWANN / DSWANN@STARBULLETIN.COMHawaii drivers pay the nation's highest gasoline prices and the Legislature has passed a law capping what stations can charge. If it's really a good idea, why don't other states do it?

In the first of a new weekly series, the Price of Paradise takes a look at the law's loopholes and some reasons it probably won't work.

Suyderhoud: Cap won't cut prices | Fesharaki: Prices aren't too high

BACK TO TOP

|

IT'S JULY 2004. Your gas tank is almost empty. You search for a gas station -- the one you've patronized for 10 years has closed. When you finally find a station, there's no self-serve regular. Instead, you fill up at a "mini-serve" pump and pay 25 percent more per gallon than your cousin in California. Gasoline price cap

will not lower prices or

protect Hawaii consumersBy Jack Suyderhoud

What happened to the "consumer protection" promised in 2002 when Hawaii became the first state to establish gasoline price controls?

Traditional economics argues excessive market power creates super-normal profits, forcing consumers to pay non-competitive prices. To some, Hawaii's gasoline market fits this situation exactly.

In Hawaii, only two refineries, Chevron and Tesoro manufacture gasoline. Three brands account for 58 percent of the retail market; Chevron, Shell and Tesoro.

Price cap advocates (including the Star-Bulletin in an April 26 editorial) cited a lack of competitive prices and "obscene profits" as reasons to enact regulation. Claims that gasoline prices are not competitive and profits excessive are debatable (see the accompanying article). Regardless, the gas cap will definitely not protect consumers or lower prices.

The cap does not tie the price of self-serve regular to its cost of production or distribution but to an artificial benchmark: the West Coast price. According to a simulation by the respected Lundberg Letter (May 29), if it had been in place the last three years, it would have meant lower retail prices only 31 percent of the time, while creating greater price variability.The rest of the time, the formula would have capped prices an average of 10 cents per gallon above the prevailing Hawaii market price. If retailers had used this cap rather than competitive market forces as a pricing target, retail prices actually would have been higher the other 69 percent of the time.

THE CAP also creates market distortions. Since the price of regular is set by West Coast prices, not local product costs, the price formula could actually make the wholesale price of regular higher than higher-octane, premium grades.

How wholesalers and retailers respond could mean further unintended consequences. If the formula denies refiners an adequate return on investment, they might withhold regular gasoline from dealers. Instead, they could add octane enhancers and sell only premium fuel at prices that do yield adequate returns.

Because of the formula, a retailer who bought fuel last week at a high price might have to sell it for less this week. If dealers cannot make an adequate profit selling self-serve regular, they will convert those pumps to mini-serve or full-serve -- or perhaps require cash-only transactions. This will be especially true for dealers in high-cost locations since all dealers (regardless of their cost structures) are limited to a mark-up of 16 cents per gallon.

FOR BOTH refiners and retailers, the price cap increases uncertainty and thereby reduces incentives to invest in new production and sales capacity.

Gasoline retailing is highly competitive and maintaining profitability is already problematic. Accelerating industry trends, the cap will mean fewer stations, which will use higher volume to offset lower margins. Increasingly, gas will be a sideline to other businesses, such as convenience stores or large-box retailing.

Ultimately, the price cap will be a failure. It may increase the volatility of gas prices, but it will not lower them. Consumers will demand further action: Cap all gas prices or create a regulated gasoline monopoly like the electricity company. These are troubling prospects.

Rather than regulate prices, we should make the industry more competitive by reducing barriers to entry, making it easier for retailers to obtain refined product from outside the state. At the retail level, let's eliminate the rules that make opening new gas stations difficult.

More competition is the answer, not price regulation.

Jack Suyderhoud is a professor of business economics at the College of Business Admini-stration, University of Hawaii-Manoa. He uses self-serve regular gasoline in his 1997 Maxima and is price-sensitive.

Hawaii's gasoline price cap law is not what it appears. At the wholesale level, it caps only the price of regular unleaded gasoline while other grades are uncapped. The wholesale price of regular is capped at the previous week's prevailing price in Los Angeles, San Francisco and the Pacific Northwest, plus 22 cents per gallon on Oahu, 30 cents on neighbor islands. How the gas cap

would workThe retail price is capped only for self-serve regular at 16 cents per gallon above the wholesale price for all islands. Prices at mini- or full-serve pumps are not subject to the cap.

Because the bill's specifics were widely criticized, the Legislature deferred implementation until 2004 and included a provision that the cap can be suspended if the governor decides it will have adverse effects.

Jack Suyderhoud BACK TO TOP

|

IN THE United States cars are not just transportation but a way of life, and consumers monitor gasoline prices very carefully. In Hawaii, however, prices have become highly politicized and emotional. Contrary to popular

thought, drivers in Hawaii aren’t

paying too much for gasBy Fereidun Fesharaki

People think the big, bad oil companies are ripping off consumers and something must be done about it. If the state cannot prove conspiracy, then it should regulate.

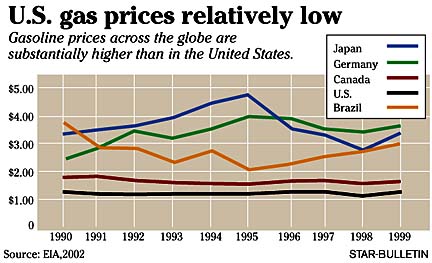

But examine the facts: U.S. gas prices today are the lowest of all industrialized countries, even financially strapped Mexico or Brazil. Adjusted for inflation, they are lower than in 1974.

Alternative energy sources cannot compete with oil prices, which are set by a combination of political and economic factors worldwide. Like it or not, OPEC nations greatly influence the price. However, whenever government tries to change such facts, consumers pay.Just because Hawaii has higher gasoline prices than the mainland, we cannot assume that we are getting ripped off. Some politicians will use any issue for popular gain, however, regardless of the facts. Outside legal counsel misled the state into believing it could win a conspiracy case and claim $2 billion in damages.

It is true Hawaii prices are higher. Excluding state taxes --some of the highest in the U.S. -- local prices have exceeded the national average by 32 cents a gallon and California prices by 23 cents on average. Why are local prices higher?

>> Hawaii is a small market that is not growing. People here use more efficient cars and cannot drive very far.MANY RESIDENTS have been misled to think Hawaii is an oil company's dream. If it's so lucrative, why have Exxon, Mobil (now merged as ExxonMobil) or BP never come to Hawaii? BHP sold its interests to Tesoro for below the purchase price. Why would it take a loss to exit a dream market?>> There are two refiners in Hawaii and, no matter which brand you buy, you'll likely get product from the same two refineries.

>> In general, local consumers are not price-sensitive and won't change driving patterns to save a few cents.

>> Hawaii is very expensive. Everything must be imported and whenever tanker transport prices go up, the cost of crude oil here rises dramatically.

>> Hawaii refiners produce a high component of jet fuel, which makes refining here more difficult and expensive than most places.

>> State divorcement laws do not allow oil companies to add service stations. Some estimate those laws alone add up to 3 cents per gallon.

When Texaco sold its assets after merging marketing operations with Shell, some insisted new competition would come to Hawaii and reduce prices. When ARCO entered the market, however, it just didn't happen. The reason is simple: Why drop prices when you cannot gain market share?

The truth is Hawaii is already a low-profit, competitive market -- and now COSTCO has opened two stations offering lower prices and there are plans for other low-price stations.

We cannot base Hawaii prices on West Coast prices; the markets are very different.

California's gasoline market is large and growing. The state produces about 740,000 barrels per day of local crude -- seven times Hawaii's entire oil consumption -- and pipes much of it directly to refineries, eliminating transport costs. California heavy crudes also are discounted because of quality, logistical and legal reasons.

Disregarding the facts, politicians seek to control prices with a gas cap. Hawaii residents should worry when we do something no other state or free market economy in the world has ever tried.

We're not alone because our politicians are smarter but because the gas cap is unworkable. Since it kills incentives for oil companies to make new investments or enter the market, it will actually curtail competition.

Caps cannot protect consumers when revolutions, wars, or terrorist attacks raise prices. In the end, consumers will pay higher prices, Hawaii will get a bad name and the world oil market will remain volatile. The gas cap should and will be repealed, or it will fall to legal challenges.

Making money is not illegal. That's why oil companies came to Hawaii. Conspiracy is illegal, but a state lawsuit failed to prove it exists. To many of us, this legal quest was obviously doomed, but no one listened.

Let's be realistic. We are not getting ripped off, except by those who have made this an emotional issue and a source of business for themselves.

We must be responsive to competitive prices and go out of our way to fill up with cheaper gasoline. History shows that when government interferes, consumers end up paying the price.

Fereidun Fesharaki, a senior fellow at the East-West Center, specializes in energy policy and planning, OPEC and the petroleum markets of Asia, the Pacific, Middle East, Latin America and the United States.