|

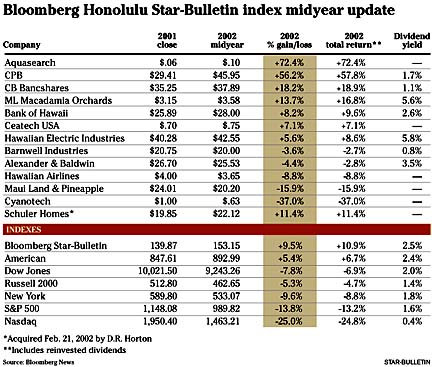

It's been a rocky six months for the stock market. But try telling that to Hawaii's publicly traded companies, which collectively rose 9.5 percent in the first half of the year.

By Dave Segal

dsegal@starbulletin.comStocks that had anything to do with banking were among the biggest winners, although financially troubled penny stock Aquasearch Inc. led the way in the Bloomberg Honolulu Star-Bulletin index with a 72.4 percent gain.

On the major indexes, the best performer was Central Pacific Bank parent CPB Inc., which soared 56.2 percent on the Nasdaq Stock Market to lead an entourage of financial-related stocks in the win column.

In all, seven of the 12 stocks in the index ended with green arrows.

Just like last year, the absence of technology stocks helped the Star-Bulletin index. By comparison, the Dow Jones industrial average fell 7.8 percent, the broad-based Standard & Poor's 500 index dropped 13.8 percent and the tech-heavy Nasdaq composite index lost 25 percent.

"One of the reasons (Hawaii stocks fared so well in the first six months) was their low base to start," said Richard Dole, chief executive of Dole Capital LLC. "They didn't do that well in the up market (in the late '90s). Alexander & Baldwin, for example, is selling at the same price it did 10 years ago. (Hawaii stocks) didn't benefit in the tech market but the local financial institutions are doing very well now."Meanwhile, Kona-based Aquasearch, which makes the dietary supplement AstaFactor out of microalgae, got a reprieve two weeks ago when U.S. Bankruptcy Judge Robert Faris approved the company's Chapter 11 reorganization plan. Aquasearch had been forced into bankruptcy last October by its creditors.

Aquasearch's over-the-counter-traded stock, which fell to 4.5 cents May 22, has surged 122 percent since that time to 10 cents -- most of the advance coming after its reorganization plan was approved.

The stock is one of three in the Star-Bulletin index that trades under $1 and one of five priced under $4.

"They have an infusion of cash so they have some time to put something together," Dole said. "But that cash can be used up very quickly so they're not out of the woods yet. It's dependent on the venture capitalists who decided to make a commitment. The company is going to have to have some breakthrough for that stock to do well."

The other high-flier, CPB, easily led the way among Hawaii's major stocks as it ended midyear at an all-time high of $45.95.

"We're an investment gem waiting to be discovered," said Clint Arnoldus, who was named chairman, president and chief executive of CPB earlier this year. "We're going to start a very aggressive investor relation program so the investment public knows about our stock."

Among CPB's banking brethren, City Bank parent CB Bancshares Inc. (up 18.2 percent), Bank of Hawaii Corp. (up 8.2 percent) and American Savings Bank parent Hawaiian Electric Industries Inc. (up 5.6 percent) were third, fifth and seventh, respectively, in price appreciation during the first six months.

Hawaiian Electric, whose 5.8 percent dividend yield is the highest of any stock in the index, posted a total return of 8.6 percent.

Dole said he wasn't sure how much more upside there was to the financial stocks.

"The financial sector already had a good run and probably the best is behind us now," he said.

ML Macadamia

Meanwhile, ML Macadamia Orchards LP probably is one of the front-runners for comeback stock of the year.The Big Island company, which was the index's second-worst performer last year with a 20 percent loss, is fourth this year with a 13.7 percent gain on top of a 5.6 percent dividend yield that gives it a total return of 16.8 percent.

ML Macadamia is in the process of collecting the remaining $1.2 million of $3.2 million in delinquent pay from purchaser and marketer Mauna Loa Macadamia Nut Corp.

Dole lauded ML Macadamia for the job it has been doing in maintaining its profit margins.

"They're getting less revenues because of the lower prices (for nuts) but they've also reduced their overhead," Dole said. "So they haven't had a proportional drop in margins. Even though their revenues have dropped, their profit margins have not."

The remaining Hawaii company to end midyear in the black was Kauai shrimp producer Ceatech USA Inc., whose thinly traded over-the-counter stock rose 7.1 percent.

Dole said the key for Hawaii stocks in the second half of the year likely will depend on whether the state is hit with a shipping strike.

"That would significantly affect many companies, including A&B," he said. "It probably would affect the financial institutions, too. With the local stocks, there's not that many moving parts, but they can be significant if something like that happens."

Negotiations began May 13 on the West Coast between the International Longshore and Warehouse Union and the Pacific Maritime Association on a new three-year contract. The current one expires tomorrow. Talks in Hawaii between the ILWU and the Stevedore Industry Council began Friday.

The company that would be most directly affected by a shipping strike is A&B, whose Matson Navigation Co. shipping subsidiary makes up the largest part of its business.

Alexander & Baldwin

A&B's stock, which hit a 52-week high of $29.15 on May 23, ended midyear off 4.4 percent at $25.53. Its stock started slipping after its May 29 announcement that Matson had signed an agreement with the Kvaerner Philadelphia Shipyard Inc. to purchase two container ships for a combined $220 million.A&B said that the ships, due to be delivered in late 2003 and sometime in 2004, respectively, would be dilutive to earnings upon delivery but beneficial in the long term. The prospect of a dockworkers strike probably also has put pressure on the stock.

Besides A&B, four other stocks in the index also fell during the first half of 2002.

Hawaiian Airlines

Hawaiian Airlines Inc., which was the index's top gainer in 2001 with a 120.7 percent gain, saw the air let out of its stock in March when it called off a proposed merger with rival Aloha Airlines.The stock, which started the year at $4, finished midyear at $3.65 for a loss of 8.8 percent. The drop comes despite the carrier's announcement last month that it would repurchase as much as 17.5 percent of its shares at $4.25.

Cyanotech

The worst index performer at midyear was Cyanotech Corp., which fell 73 percent to 63 cents and has seen its shares trade below $1 for 39 consecutive days.The company has received a warning from Nasdaq to get its stock bid price to $1 or greater for 10 consecutive days by Sept. 16 or face delisting

"Cyanotech is a seasoned company," Dole said. "It's close to making money . ... It's a much more substantial company than Aquasearch. Nevertheless, both of them are suffering."

Among the remaining companies, Barnwell Industries Inc. fell 3.6 percent and Maui Land & Pineapple dropped 15.9 percent.

Additionally, Schuler Homes Inc., whose acquisition by D.R. Horton Inc. was finalized on Feb. 21, rose 11.4 percent before being removed from the Nasdaq composite index.