Leasehold prices Areas of central Oahu, stretching from Halawa Heights to Mililani, are seeing a spurt of real estate sales and rising prices in recent months. Realtors report multiple offers are common and, in some cases, buyers are bidding above the asking price on particularly desirable properties.

still struggle

CENTRAL OAHU / INVENTORY DIMINISHING

During the 1980s, property values on Oahu and parts of the neighbor islands shot sky high as wealthy speculators from Japan bought up real estate. As the decade closed, the Japanese bubble burst and property prices started to slide. Hawaii residents who bought homes as prices soared were trapped with real estate worth less than they had paid. But many neighborhoods are beginning to make a comeback. This is part three of a seven-day look at home prices and sales volume in the state of Hawaii.

By Lyn Danninger

ldanninger@starbulletin.comDiminishing inventory, they say, is pushing up prices for choice properties.

Asking prices are also edging up, said John Riggins of John Riggins Realty, who specializes in properties located in central and leeward Oahu.

"If someone brings a property on the market priced slightly above previous sales that is in good condition and easy to show, it's selling immediately with multiple offers," he said.

The events of Sept. 11 not withstanding, Riggins claims the fourth quarter of 2001 and the first quarter of 2002 have been the strongest sales periods ever for his firm.

Moreover, Riggins said he doesn't see any letup, given the decrease of available housing island-wide.

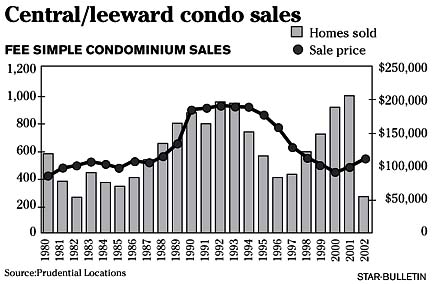

"In April, we had a 4.1-month supply of inventory for single-family homes on Oahu. For condominiums, we had a four-month supply," he said. "When we compare that to the Japanese bubble period, the lowest inventory in 1989 was 6.1 months for single-family homes and 4.4 months for condominiums, so you can see we have tremendous demand right now."But in spite of demand, prices in most cases have yet to reach the levels of the late 1980s and 1990s. And in some cases, they won't, Riggins believes.

"I think it's going to be extremely tough, especially for those people who bought leasehold around 1990," he said. "For example in the Wailuna townhouse subdivision in Aiea, properties are selling at record prices, but not the prices of 1990 because they are leasehold."

At that time, a three-bedroom leasehold townhouse could have sold for around $340,000. Today, the asking price for the same unit runs around $185,000.

For fee-simple single family homes, prices have not returned to where they were in the early 1990s, but they are still moving up, Riggins said.

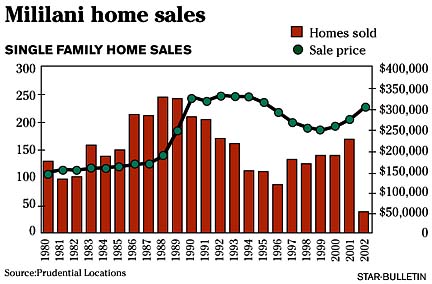

Currently, Riggins has a single-family Mililani home in escrow for $350,000. In 1990 the same property would have sold for around $400,000, he said. But Riggins notes he continued to receive offers on the property after the initial offer was already accepted.

Another issue for real estate agents is when appraisals lag behind the pace of sales. When a home is appraised for less than the asking price, many potential home buyers can be priced out of the market. They often have difficulty qualifying for a mortgage or paying the difference on top of the required downpayment.

That changes the way sellers are looking at prospective buyers, said Larry Arinaga, broker-in-charge of Coldwell Banker Pacific Properties Leeward office."Sellers aren't necessarily looking at the best price. It's the terms, especially if the downpayments are strong so if the appraisal doesn't come out they can still buy the property," he said.

In some areas like Mililani, the shortage of inventory has started to make an impression on median sales prices realized so far this year.

"On a monthly basis this year in January, the median sales price in Mililani for a single-family home was $321,000. In February, it was $315,000, in March it was $305,000 and in April it was $295,000, so in Mililani, the inventory is basically nil," Arinaga said.

But while prices may appear to have taken a dip in the last month in Mililani, the median price so far this year is $305,000, compared with $265,000 last year, Arinaga said.

The rapid, mostly local sales activity seen in central Oahu's real estate market indicates just how many people were stuck in less-than-desirable housing situations over the past 10 years, said Ricky Cassiday, research consultant to Prudential Locations realty firm.

"People have been sitting in their homes since prices started to go down," Cassiday said. "Normally, people move around."

It's also an indicator of how much economic conditions have improved for many local families over the decade.

"Basically you had a bunch of people in town, in some cases families doubling up, so this is an opportunity to thin out households," he said.