Sales volume jumps, As has been the case in the rapidly recovering real estate markets of East and Windward Oahu, the neighborhoods comprising Honolulu's metropolitan core have seen plenty of activity in recent months.

prices don’t

METRO HONOLULU / CONDO PRICES LAG

During the 1980s, property values on Oahu and parts of the neighbor islands shot sky high as wealthy speculators from Japan bought up real estate. As the decade closed, the Japanese bubble burst and property prices started to slide. Hawaii residents who bought homes as prices soared were trapped with real estate worth less than they had paid. But many neighborhoods are beginning to make a comeback. This is part two of a seven-day look at home prices and sales volume in the state of Hawaii

By Lyn Danninger

ldanninger@starbulletin.comSingle-family home resale prices have steadily increased over the past couple of years. The median price paid for a single-family home in metro Honolulu in 2000 was $325,000. At the end of 2001, that number had risen to $332,350. So far this year, the median price for a single family home is up to $360,000.

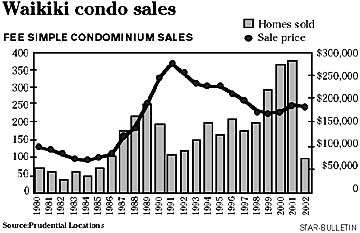

Conversely, while the number of condominium resales broke records in April, median prices have not shown dramatic jumps, real estate professionals said.

For example, in both 2000 and 2001, the median price paid for a condominium resale in metro Honolulu stood at $150,000, according to the Honolulu Board of Realtors. Year-to-date, the number has risen slightly, to $155,000. Moreover, much of the most desirable inventory is fast disappearing.

Real estate professionals say they are surprised condominium prices have not climbed higher given the high level of activity.Some of the price lag in condominium resales may be explained by high maintenance fees, said Gordon Au of Century 21 All-Island's.

Because a state law passed some years ago no longer allows special assessments for repairs, all potential maintenance and repairs must be budgeted in advance and assessed to condo owners through regular maintenance fees, Au said.

"That's a big reason why maintenance fees have gone up," Au said.

Some prospective homeowners are turned off at the thought of paying huge maintenance fees, Au said. In addition, with bargain interest rates, many prospective buyers now stand a better chance of qualifying for a single-family home, he said.

Maintenance fees in many downtown and metro Honolulu area condominiums now average $300 to $400 per month, said Nancy Metcalf, real estate agent with Coldwell Banker Pacific Properties.

For example, in downtown's Honolulu Tower, maintenance fees for a typical a two-bedroom condominium now run around $350 per month. But sales prices on such units still have a way to go before reaching prices paid at the height of the market, when maintenance fees were lower. Reaching those levels may not happen in the current market, Metcalf said.

During that period, sales prices in Honolulu Tower for a two-bedroom unit ran above $300,000, she said. Today, such a unit may range between $250,000 and $270,000, depending on condition and location, she said.

In the Nuuanu area as a whole, median prices topped out in 1992 at $283,000 for a fee-simple condominium. Year-to-date, the median price has reached $232,000. The median price for a leasehold condominium in the Nuuanu area reached a dizzying $291,000 in 1991. Today, the median price for a leasehold condominium in Nuuanu has fallen to $175,000 -- still a big improvement since the market bottomed out in 1999 at $135,000.

"The important thing for sellers to understand is that in some cases, it may never be at that level again," Metcalf said.

Prudential Locations research consultant Ricky Cassiday agreed, especially in relation to prices of leasehold property.

But Cassiday believes most fee-simple condominium resales should eventually approach what they were at the height of the market.In Waikiki, the fee-simple condominium market is feeling the squeeze, said Century 21 All Islands sales agent and Waikiki specialist Amanda Keckin.

"There are more buyers chasing fewer listings," Keckin said. Prices for the most sought-after units -- two-bedroom, 1.5 bath -- in the area are already edging up slightly, perhaps up to 5 percent more, said Keckin.

Keckin estimates the average buyer is looking at paying anywhere from $180,000 to $250,00 for such a unit. For a one-bedroom, the range would likely be $150,000 to $175,000 she said.

However, prices for Waikiki condominiums are still a long way from the levels seen at the height of the Japanese bubble, Keckin said.

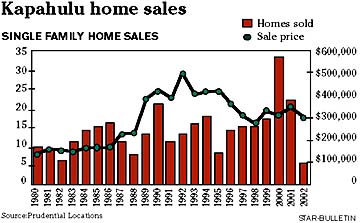

In older neighborhoods, predominately of single-family homes, such as Kapahulu, the median price so far this year for a fee-simple single-family home sits at $300,000. Last year it reached $350,000.

The difference in price can be explained by fewer premium housing choices as much as anything else, said Prudential Locations' Cassiday. In 1992, the Kapahulu fee-simple home market topped out at $495,000. But in 2000, a record 33 single family homes were sold in the neighborhood.

Last year, that number had dropped to 22. So far this year, five homes have sold in the area.

While good prices can be found in many urban Oahu neighborhoods and low interest rates mean lots of potential home buyers, real estate agents say the biggest challenge they face is locating remaining quality inventory.