Property values on Oahu and parts of the neighbor islands shot sky high as wealthy speculators from Japan bought up real estate. As the decade closed, the bubble burst and property prices started to slide. Hawaii residents who bought homes as prices soared were trapped with real estate worth less than they had paid. But many neighborhoods are beginning to make a comeback. This is part one of a seven-day look at home prices and sales in the state of Hawaii.

|

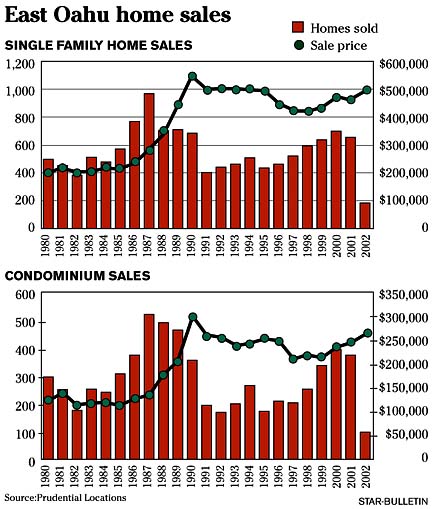

Suburbs East Oahu, often a harbinger of things to come, has been one of the first areas to recover from deflated property prices. Resales prices are now at or above the levels of a decade ago, said Ricky Cassiday, research consultant to Prudential Locations.

lead the pack

EAST OAHU / The Harbinger

WINDWARD / Short Supply

Back from the bust?

By Lyn Danninger

ldanninger@starbulletin.comIn Hawaii Kai, for example, Dan Madden has witnessed some spectacular recoveries.

With housing options ranging from waterfront mansions to high-rise condominiums, and despite new inventory coming on line, single-family homeowners continue to sell properties in record time, said the principal broker with East Oahu Realty.

"There was a home that went on the market two weeks ago and at its first open house, they had 11 offers. It went for $15,000 over asking price," Madden said.

Similarly, some houses that could not reach their asking price just a few months ago are back on the market and now selling for the original asking price or above, Madden said.

Such was the case for one of Madden's clients, who had been trying to sell his Mariner's Ridge home since 2000.

"We put the house on the market from December 2000 to December 2001," said physician John McCarthy.

In that time McCarthy said he received a lone offer for around $400,000 -- significantly less than he hoped for."We started slightly above the appraisal at $525,000. By fall 2001 it was down to $490,000," recalled McCarthy. "Many people came through to look, we had open houses. It just didn't seem like people were in a buying mood."

After taking the property off the market, McCarthy said he heard the market was improving so he recently listed the house again -- this time at $499,000.

"The very first day we had it on (the market) was May 2 and we had an offer. We were planning on an open house this weekend but never got to do it," he said.

McCarthy said he accepted a full-price offer. But he has received other offers since the property went into escrow -- one over the asking price and another on the way.

McCarthy said he is delighted with the outcome, but after such a long wait will be relieved when the closing takes place.

Even among leasehold properties, especially waterfront condominiums in Hawaii Kai, movement is occurring despite high lease rents and pricey lease-to-fee conversion options.

Fee-simple condominium and townhome resale prices, while strong in general in the Hawaii Kai area, still lag single-family homes with about 17.7 percent to go until prices reach previous top of the market levels, said Prudential's Cassiday.

Because of newly constructed multifamily inventory now on the market, it may take some time for existing condominiums and townhomes in the area to reach the previous peak, Cassiday said.

"What drives prices up is scarcity; so if you have a bunch of new townhomes coming up -- which you do there -- don't expect a big price appreciation in the next couple of years," he said.

Similarly, the strong appreciation seen so far in Hawaii Kai's single-family properties also may begin to level out as new housing projects slated to come online over the next few years roll out, Cassiday said.

Overall, East Oahu in general has recovered well in the last couple of years and the prospects continue to look good, Cassiday said.

"Single-family homes have recovered and I don't see them going down, having gone up 10 percent in the last two years. Will they go up again 10 in next two years? I doubt it, for reasons of new inventory," he said.

Jim Wright, president of Century 21 All Islands, agreed.

"Anytime you bring a new product on, there's only so much absorption in a given market at any time so the resale market will soften," he said. "It's just an inevitable part of it."

Like East Oahu Realty's Madden, Wright said his agents have seen bids above the asking price on a regular basis, but no huge jumps in pricing.

"This cycle has been so different," said Herb Conley, managing partner with Century 21 All Islands. "We've had a nice uptick in unit sales but nothing that would cause you to believe everything is going to drop. Some neighborhoods have gone up more than others, but this type of cycle is much better for our economy because it's not creating an unreal ending where prices become so unaffordable."

BACK TO TOP

|

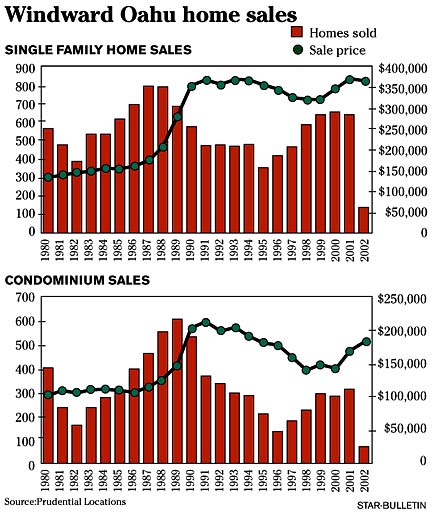

Windward Oahu, like its neighbor, has enjoyed robust resales activity. But unlike East Oahu, no substantial new housing development is slated in the near future. WINDWARD / Short Supply

By Lyn Danninger

ldanninger@starbulletin.comThe impact of short supply is already being felt, said Jim Mazzola, principal broker with Coldwell Banker's Windward office.

With tight inventory, the number of sales has dropped slightly this year so far, even though total dollar volume of sales continues to increase, he said.

"If you take a look at the number of sales year-to-date for single-family homes in Windward Oahu, we are actually down 1.9 percent. For condos, it's 3 percent. But it you look at total dollar volume of sales for single-family, it's up 2.2 percent and for condos up 11 percent," he said.

Homes now coming on the market are usually snapped up in record time, he said.

"The new inventory that comes on the market, if it's in pretty good shape, goes right away, has multiple offers and sells for over the asking price," he said.

Bids range between 5 percent and 8 percent above the listing price, he said.In neighborhoods such as Aikahi Park, prices for single-family homes are now in the $500,000 range. When the market bottomed out, Aikahi's highest sales were in the high $300,000s to low $400,000s, Mazzola said.

For Kailua, median sales prices for single-family homes since April 2001 are up by 12.9 percent, Mazzola said. In Kaneohe for the same time period, median prices improved by 10.4 percent.

Mazzola believes the windward side's popularity has also been helped in recent years by the addition of H3. People who previously would not consider the area because of the lengthy commute are taking a second look, he said.

"We now have some of the best commutes, especially with three major arteries," Mazzola said.

Further up the Windward coastline, appreciation is even higher, mostly because prices had sunk so far during the downturn, according to Mazzola.

Overall, median prices on the windward side in April for single-family homes hit $370,000 and $177,500 for condominiums.

In the Kailua neighborhood of Enchanted Lake, single-family housing prices are running in the $450,000 range, Mazzola said.

For Kaneohe, it's a similar story. Even with a wide variety of neighborhoods and some areas moving faster than others, most are coming up in price.

"Basically it's a function of supply," Mazzola said.